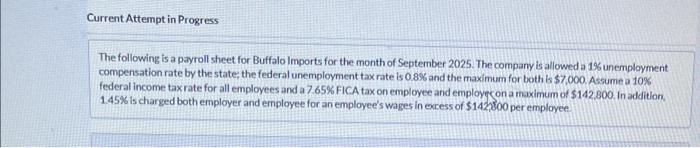

Question: Current Attempt in Progress The following is a payroll sheet for Buffalo lmports for the month of Septernber 2025 . The company is allowed a

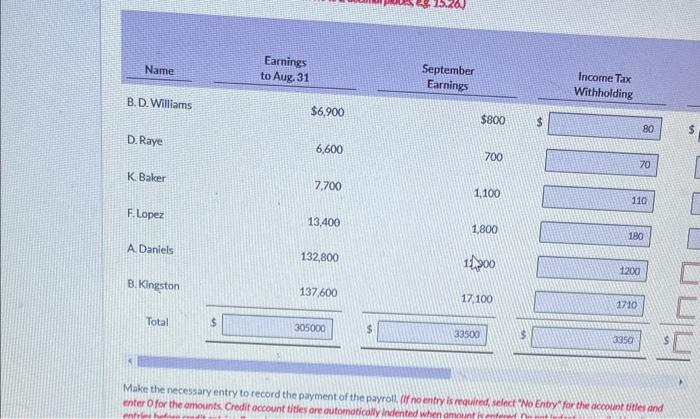

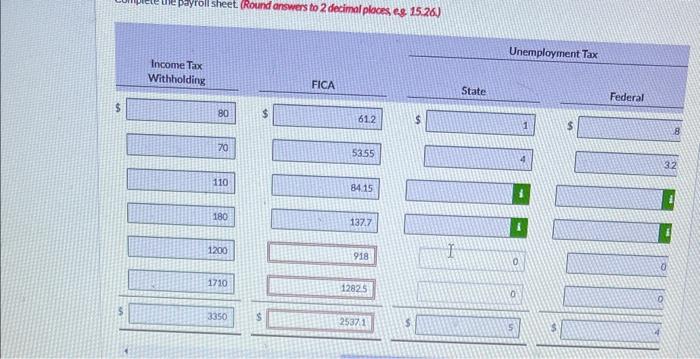

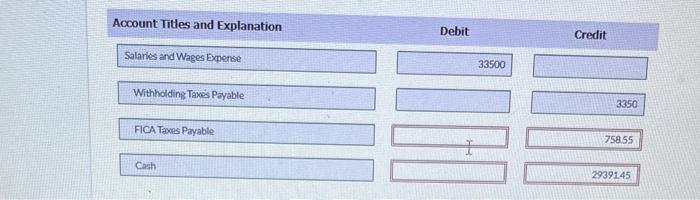

Current Attempt in Progress The following is a payroll sheet for Buffalo lmports for the month of Septernber 2025 . The company is allowed a 1% unemployment compensation rate by the state; the federal unemployment tax rate is 0.8% and the maximum for both is $7,000. Assume a 10% federal income tax rate for all employees and a 7.65% FICA tax on employee and employe on a maximum of $142.800. In addition. 1.45% is charged both employer and employee for an employee's wages in excess of $142,000 per employee Make the necessary entry to record the payment of the payrols (if no entry is cavired selecr No enty for the pcoovent titler and enter of for the amounts Credit account titles are outomotically indented when amotint is entenw. payroll sheet (Round answers to 2 decimal places eg 15.26) Account Titles and Explanation Withholding Taxos Payable The parts of this question must be completed in order. This part will be available when you complete the part above (c) The parts of this question must be completed in order. This part will be avallable when you complete the partabove

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts