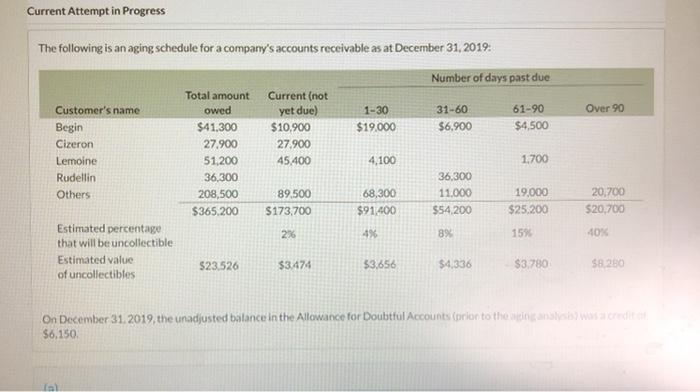

Question: Current Attempt in Progress The following is an aging schedule for a company's accounts receivable as at December 31, 2019: Number of days past due

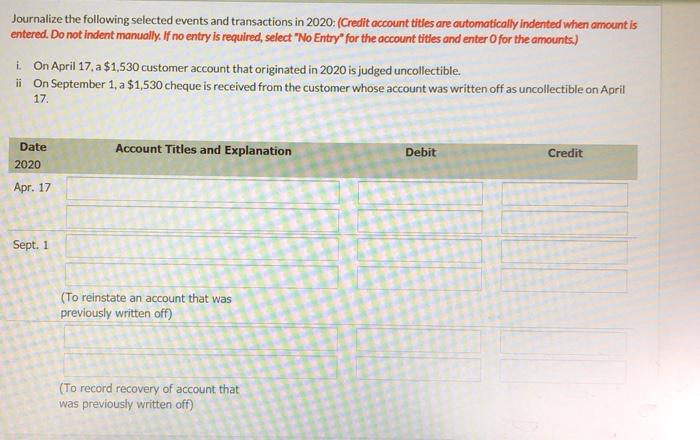

Current Attempt in Progress The following is an aging schedule for a company's accounts receivable as at December 31, 2019: Number of days past due Over 90 1-30 $19.000 31-60 $6,900 61-90 $4,500 Customer's name Begin Cizeron Lemoine Rudellin Others Total amount Current (not owed yet due) $41.300 $10,900 27.900 27.900 51,200 45400 36.300 208,500 89.500 $365.200 $173,700 2% 4,100 1.700 68,300 $91,400 36,300 11.000 $54,200 19,000 $25.200 20,700 $20,700 49 89% 15% 40% Estimated percentage that will be uncollectible Estimated value of uncollectibles 523.526 $3.474 $3,656 $4,336 $3.780 $8280 On December 31, 2019, the unadjusted balance in the Allowance for Doubtful Accounts (conto the Word $6,150 Journalize the following selected events and transactions in 2020: (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter O for the amounts.) i. On April 17. a $1,530 customer account that originated in 2020 is judged uncollectible. ii on September 1, a $1,530 cheque is received from the customer whose account was written off as uncollectible on April 17. Date 2020 Account Titles and Explanation Debit Credit Apr. 17 Sept. 1 (To reinstate an account that was previously written off) (To record recovery of account that was previously written off)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts