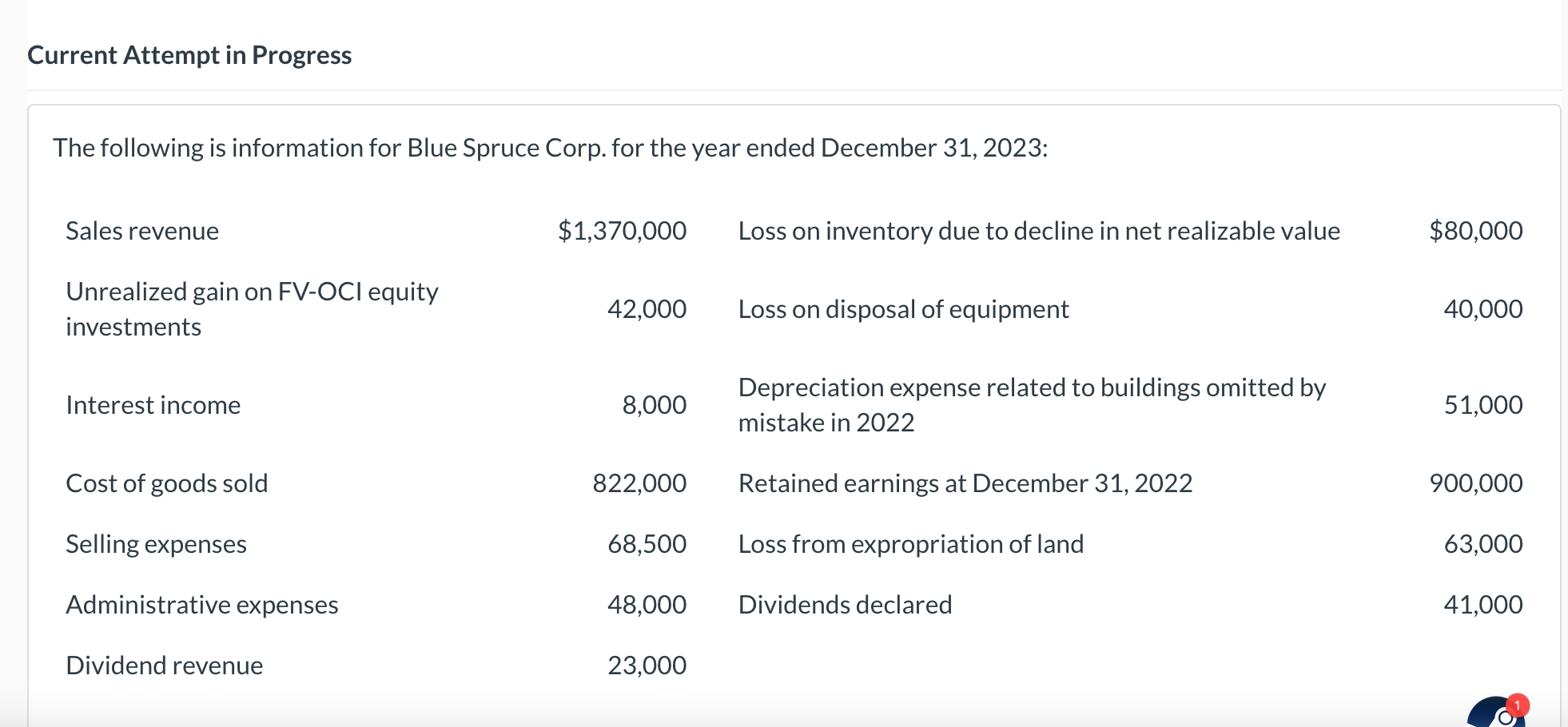

Question: Current Attempt in Progress The following is information for Blue Spruce Corp. for the year ended December 31, 2023: The effective tax rate is 20%

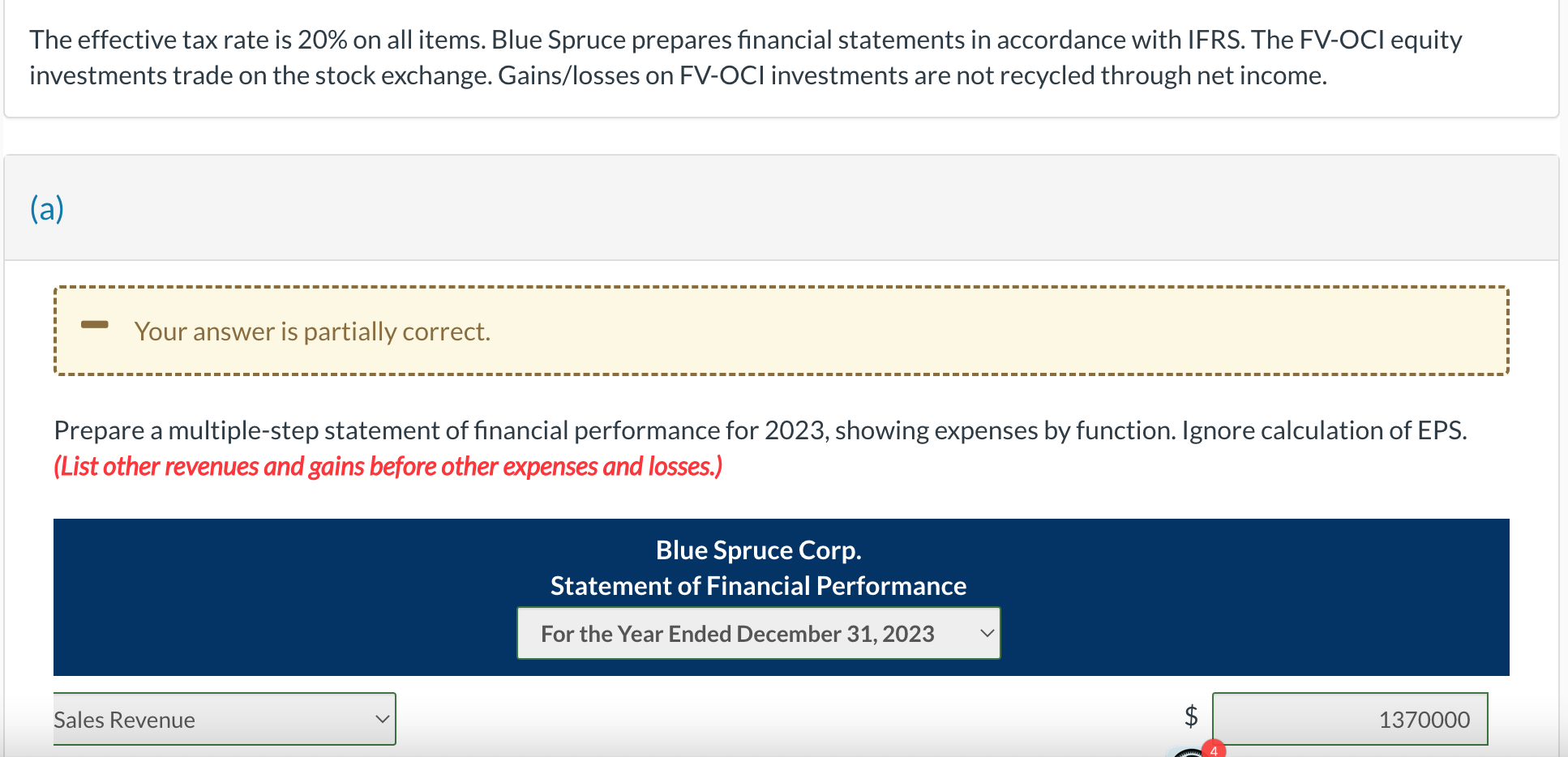

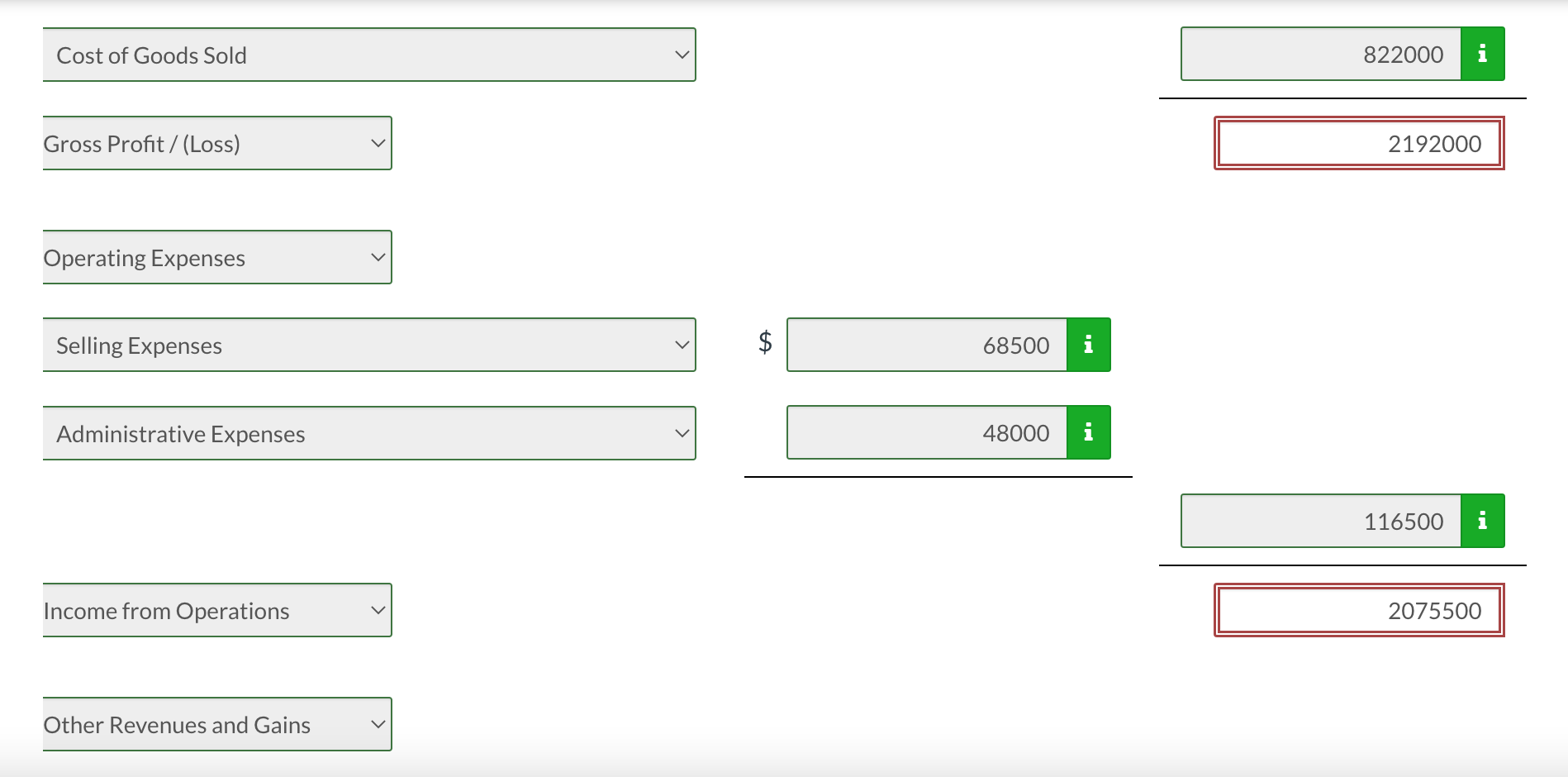

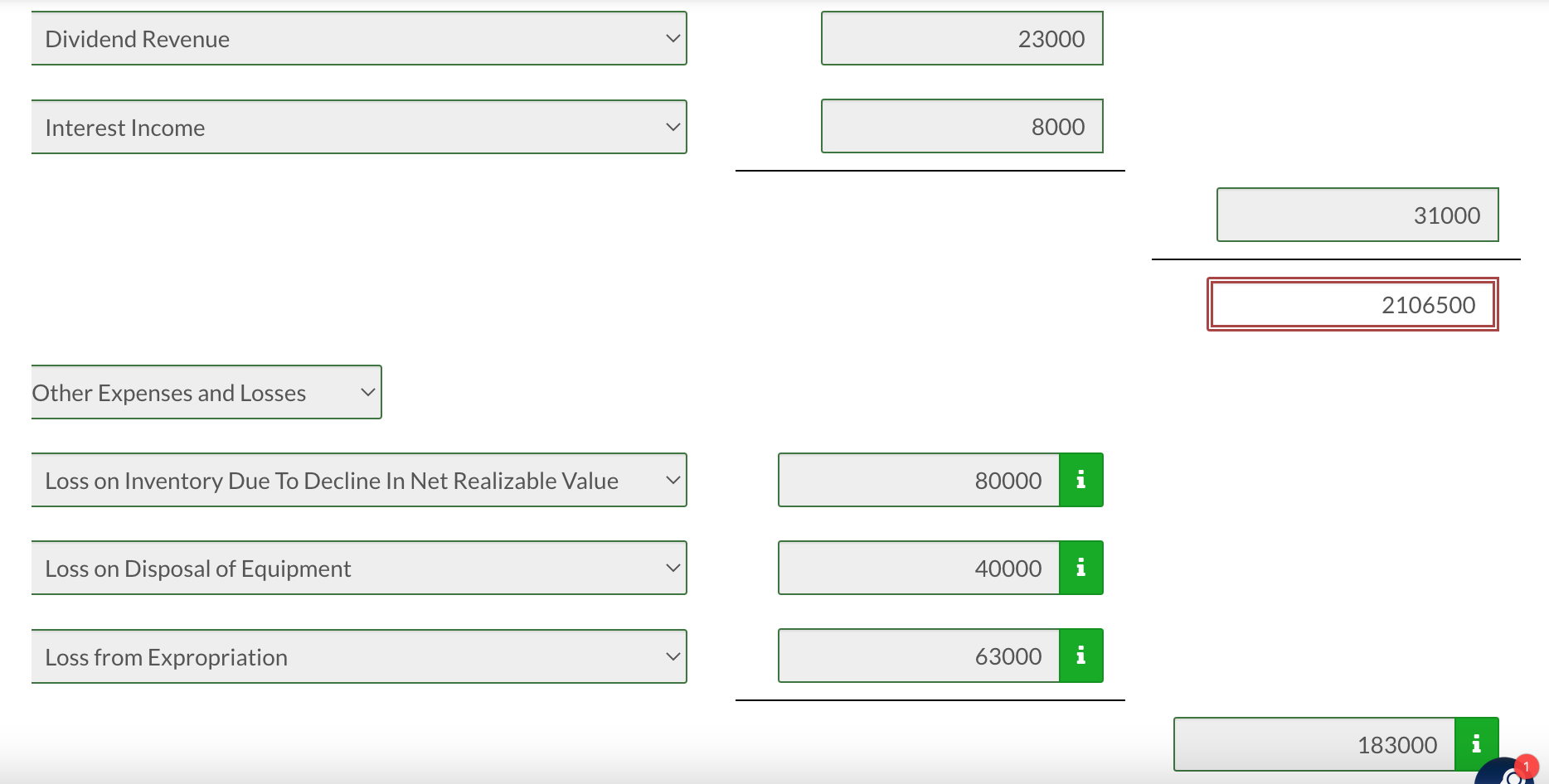

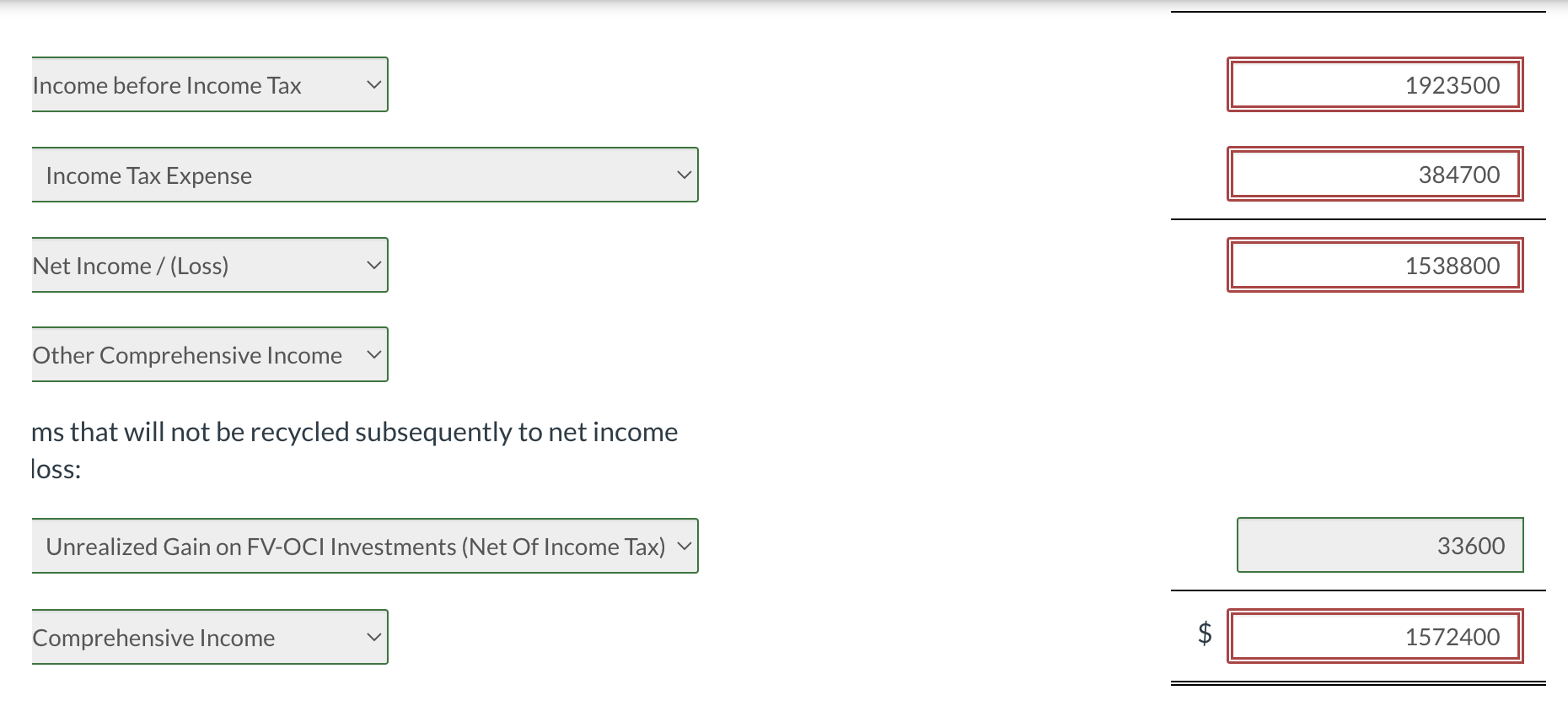

Current Attempt in Progress The following is information for Blue Spruce Corp. for the year ended December 31, 2023: The effective tax rate is 20% on all items. Blue Spruce prepares financial statements in accordance with IFRS. The FV-OCI equity investments trade on the stock exchange. Gains/losses on FV-OCI investments are not recycled through net income. (a) Prepare a multiple-step statement of financial performance for 2023 , showing expenses by function. Ignore calculation of EPS. (List other revenues and gains before other expenses and losses.) Cost of Goods Sold Gross Profit / (Loss) Operating Expenses Selling Expenses \begin{tabular}{|l|l|} \hline$8500 & i \\ \hline \end{tabular} Administrative Expenses \begin{tabular}{|r|r|} \hline 48000 \\ \hline \end{tabular} Other Revenues and Gains Dividend Revenue 23000 Interest Income 8000 Loss on Inventory Due To Decline In Net Realizable Value \begin{tabular}{|l|l|} \hline 80000 & i \\ \hline \end{tabular} Loss on Disposal of Equipment \begin{tabular}{|l|l|} \hline 40000 & i \\ \hline \end{tabular} Loss from Expropriation \begin{tabular}{|l|} \hline 63000 \\ \hline \end{tabular} ms that will not be recycled subsequently to net income loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts