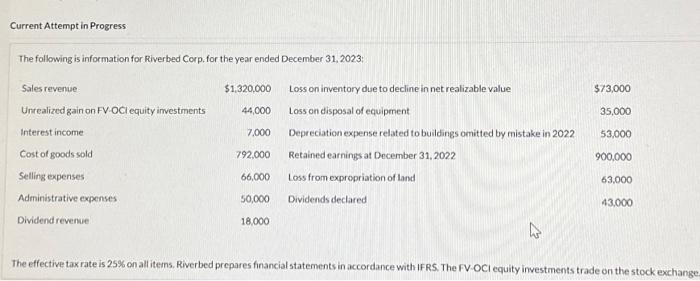

Question: Current Attempt in Progress The following is information for Riverbed Corp. for the year ended December 31, 2023: Sales revenue Unrealized gain on FV-OCI equity

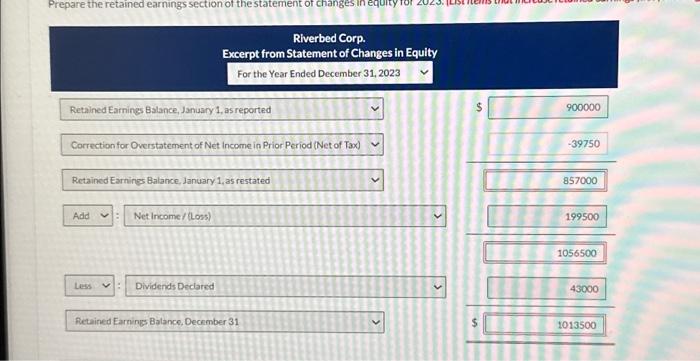

Current Attempt in Progress The following is information for Riverbed Corp, for the year ended December 31, 2023: The effective tax rate is 25% on all iterns. Riverbed prepares financial statements in accordance with IFR5. The FV OCI equity investments trade on the stock exchango Riverbed Corp. Excerpt from Statement of Changes in Equity For the Year Ended December 31, 2023 Retained Earnings Balance, January 1, as reported Correction for Overstatement of Net income in Prior Period (Net of Tax) Retained Earnines Balance, January 1 , as restated Retained Earnings Balance, December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts