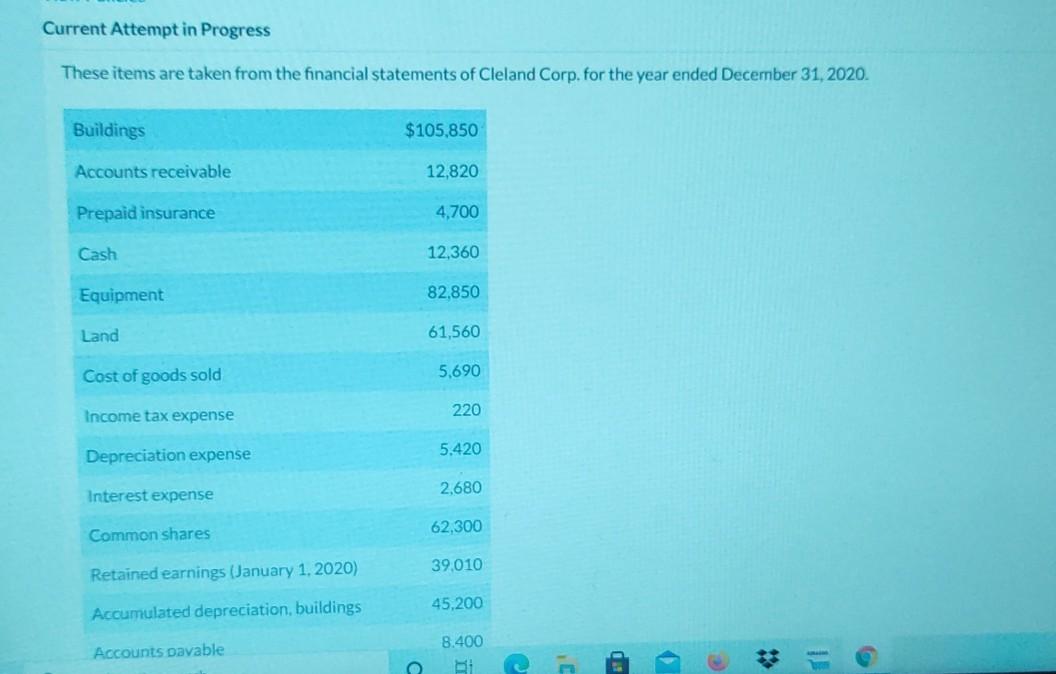

Question: Current Attempt in Progress These items are taken from the financial statements of Cleland Corp. for the year ended December 31, 2020 Buildings $105,850 Accounts

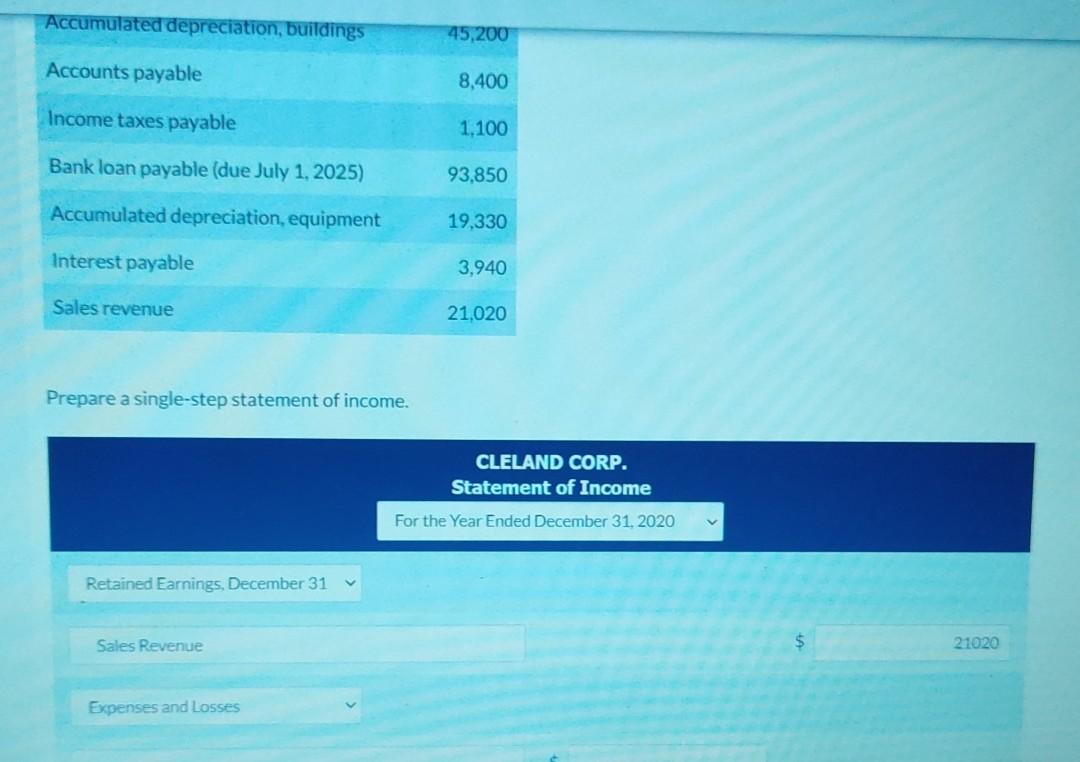

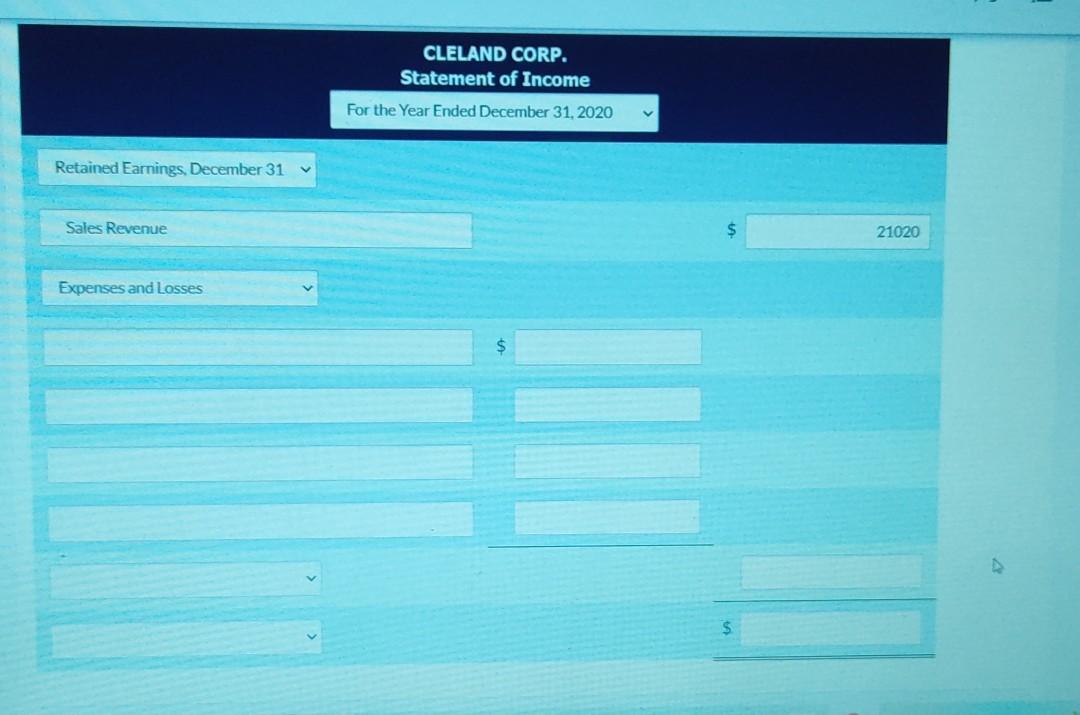

Current Attempt in Progress These items are taken from the financial statements of Cleland Corp. for the year ended December 31, 2020 Buildings $105,850 Accounts receivable 12,820 Prepaid insurance 4,700 Cash 12,360 Equipment 82.850 Land 61,560 Cost of goods sold 5,690 220 Income tax expense Depreciation expense 5.420 2.680 Interest expense Common shares 62,300 39.010 Retained earnings (January 1, 2020) Accumulated depreciation, buildings 45,200 Accounts payable 8.400 Di 2 Accumulated depreciation, buildings 45,200 Accounts payable 8,400 Income taxes payable 1,100 Bank loan payable (due July 1, 2025) 93,850 Accumulated depreciation, equipment 19,330 Interest payable 3,940 Sales revenue 21,020 Prepare a single-step statement of income. CLELAND COR Statement of Income For the Year Ended December 31, 2020 Retained Earnings, December 31 Sales Revenue $ 21020 Expenses and Losses CLELAND CORP. Statement of Income For the Year Ended December 31, 2020 Retained Earnings, December 31 V Sales Revenue 21020 Expenses and Losses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts