Question: Current Attempt in Progress Two investments involving a virtual mold apparatus for producing dental crowns qualify for different property classes, Investment A has a cost

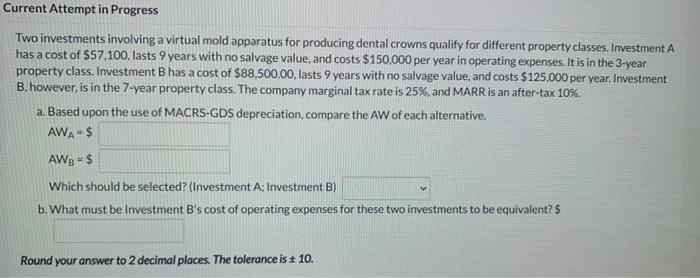

Current Attempt in Progress Two investments involving a virtual mold apparatus for producing dental crowns qualify for different property classes, Investment A has a cost of $57.100, lasts 9 years with no salvage value, and costs $150,000 per year in operating expenses. It is in the 3-year property class. Investment B has a cost of $88,500.00, lasts 9 years with no salvage value, and costs $125,000 per year. Investment B. however, is in the 7-year property class. The company marginal tax rate is 25%, and MARR is an after-tax 10%. a. Based upon the use of MACRS-GDS depreciation, compare the AW of each alternative. AWA-$ AW, - $ Which should be selected? (Investment A: Investment B) b. What must be Investment B's cost of operating expenses for these two investments to be equivalent? $ Round your answer to 2 decimal places. The tolerance is + 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts