Question: Current Attempt in Progress Veronica Strand's regular hourly wage rate is $18, and she receives an hourly rate of $20 for work in excess of

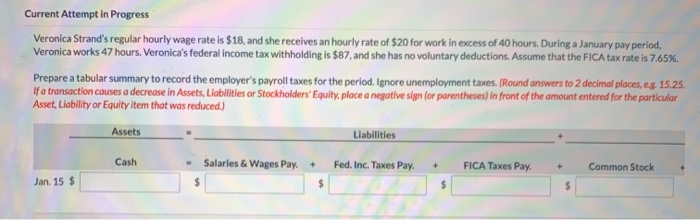

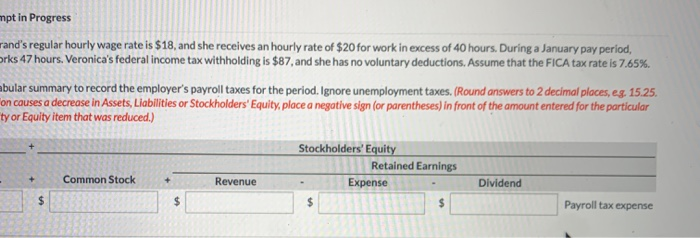

Current Attempt in Progress Veronica Strand's regular hourly wage rate is $18, and she receives an hourly rate of $20 for work in excess of 40 hours. During a January pay period, Veronica works 47 hours. Veronica's federal income tax withholding is $87, and she has no voluntary deductions. Assume that the FICA tax rate is 7.65 %. Prepare a tabular summary to record the employer's payroll taxes for the period. Ignore unemployment taxes. (Round answers to 2 decimal places, eg. 15.25. Ifa transaction causes a decrease in Assets, Liablities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liobility or Equity item that was reduced.) Assets Liabilities Cash Salarles & Wages Pay. Fed. Inc. Taxes Pay FICA Taxes Pay. + Common Stock + + Jan. 15 $ $ $ $ mpt in Progress and's regular hourly wage rate is $18, and she receives an hourly rate of $20 for work in excess of 40 hours. During a January pay period, rks 47 hours. Veronica's federal income tax withholding is $87, and she has no voluntary deductions. Assume that the FICA tax rate is 7.65 % bular summary to record the employer's payroll taxes for the period. Ignore unemployment taxes. (Round answers to 2 decimal places, es 15.25 on causes a decrease in Assets, Liabilities or Stockholders Equity, place a negative sign (or parentheses) in front of the amount entered for the particular ty or Equity item that was reduced.) Stockholders' Equity Retained Earnings Common Stock + Revenue Expense Dividend $ $ $ $ Payroll tax expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts