Question: Current Attempt in Progress Waterways puts much emphasis on cash flow when it plans for capital investments. The company chose its discount rate of 88

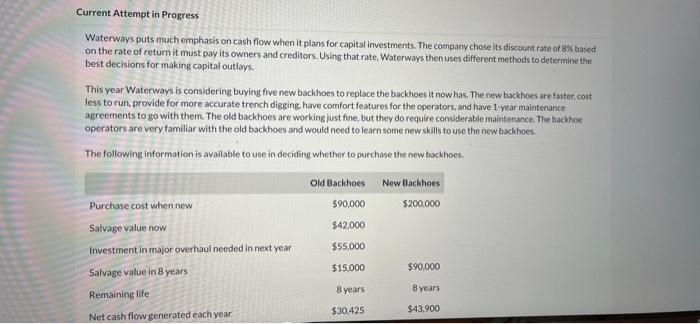

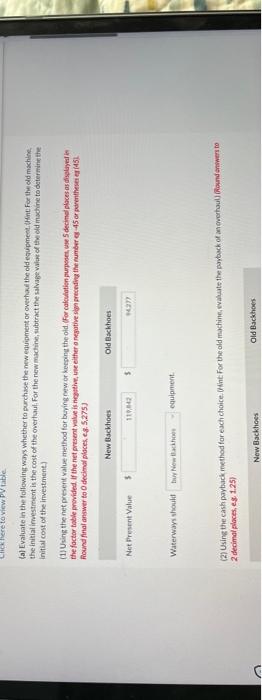

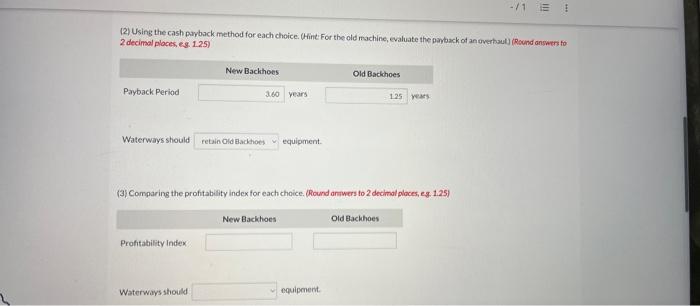

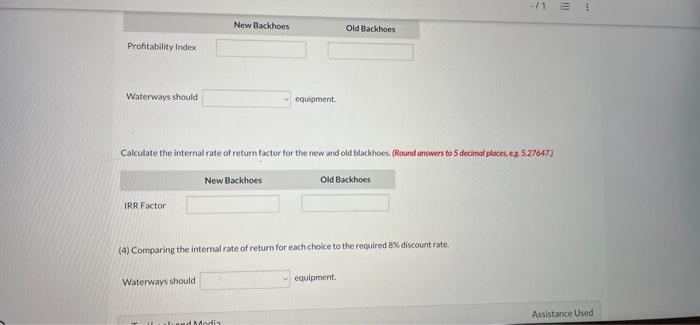

Current Attempt in Progress Waterways puts much emphasis on cash flow when it plans for capital investments. The company chose its discount rate of 88 based on the rate of return it must pay its owners and creditors. Using that rate. Waterways then uses different methods to defermine the best decisions for making capital outlays. This year Waterways is considering buying five new backhoes to replace the backhoes it now has. The new backhoes are faster, cost less to run, provide for more accurate trench digging. have comfort features for the operators, and have 1-year maintenance agreements to go with them. The old backhoes are working just fine, but they do require considerable maintenance. The backhoe operators are very familiar with the old backhoes and would need to learn some new skills to use the new backhoes. The following information is available to use in deciding whether to purchase the new backhoes. (a) Eyaluate in the following ways whether to purchase the new equipment or ovechad the old equipmede thine For the old machine. the initial imestment is the cost of the overtuul. For the new machine, subtract the salvage walos of the old machine to determine the initial cost of the irvestment. (1) Using the net present value method for bering netw or kecpint the old. (For caloulation pupsoth, wse 5 decimel ploces as displayel in the foctor toble provided, if the net present value is nogithe, tive either a negotive stas preceding the number ef 45 or porntheser er 455 . found final answer to 0 decimal ploces, es.5.275) \begin{tabular}{l} New Backhoes \\ Net Fresent Value old Backhoes \\ \hline \$ \end{tabular} Waterways should equipment. (2) Usine the cash payback method far each choice. OAlit: For the old machine, Evaluate the payback of ameworhaul] (hound anowers to 2 decimal ploces eg. 1.25) (2) Using the cash piryback method for each choice. (Hint. For the old machine, evaluate the panback of an overtoul] (Round answers to 2 decimal places eg. 1.25 Waterways should equipment. (3) Comparing the profitability index for each choice. (Round antwers to 2 decimal places, eg. 1.25) Cakulate the internal rate of return factor for the new and old blackhoes. (Round answers fo 5 decimal ploces, es. 5.27647 ) (4) Comparing the internal rate of return for each choice to the required B\% discount rate. Waterwaysshould equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts