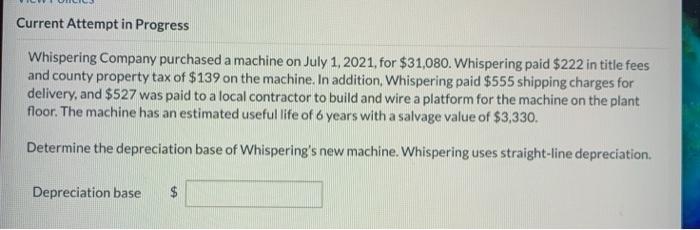

Question: Current Attempt in Progress Whispering Company purchased a machine on July 1, 2021, for $31,080. Whispering paid $222 in title fees and county property tax

Current Attempt in Progress Whispering Company purchased a machine on July 1, 2021, for $31,080. Whispering paid $222 in title fees and county property tax of $139 on the machine. In addition, Whispering paid $555 shipping charges for delivery, and $527 was paid to a local contractor to build and wire a platform for the machine on the plant floor. The machine has an estimated useful life of 6 years with a salvage value of $3,330. Determine the depreciation base of Whispering's new machine. Whispering uses straight-line depreciation. Depreciation base $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts