Question: Current Attempt in Progress Whispering Winds Corp. uses the straight-line method of depreciation. The company's fiscal year end is December 31. The following transactions occurred

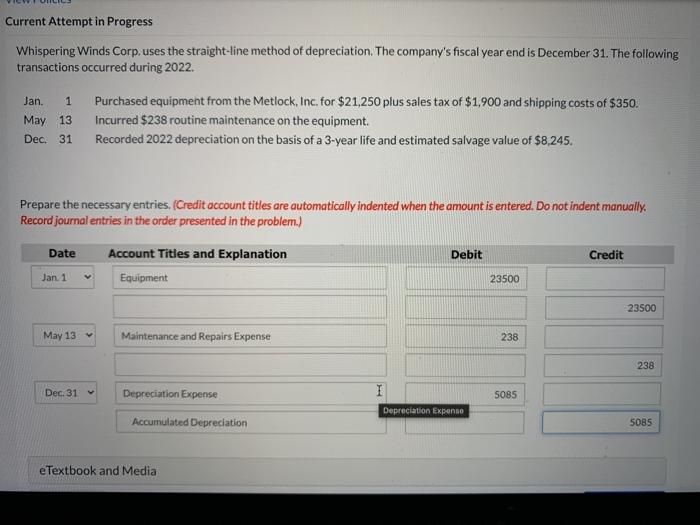

Current Attempt in Progress Whispering Winds Corp. uses the straight-line method of depreciation. The company's fiscal year end is December 31. The following transactions occurred during 2022. Jan. Purchased equipment from the Metlock, Inc. for $21,250 plus sales tax of $1,900 and shipping costs of $350. May 13 Incurred $238 routine maintenance on the equipment Dec. 31 Recorded 2022 depreciation on the basis of a 3-year life and estimated salvage value of $8.245. 1 Prepare the necessary entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually Record journal entries in the order presented in the problem.) Date Debit Credit Account Titles and Explanation Equipment Jan 1 23500 23500 May 13 Maintenance and Repairs Expense 238 238 Dec. 31 Depreciation Expense 5085 Depreciation Expenso Accumulated Depreciation 5085 e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts