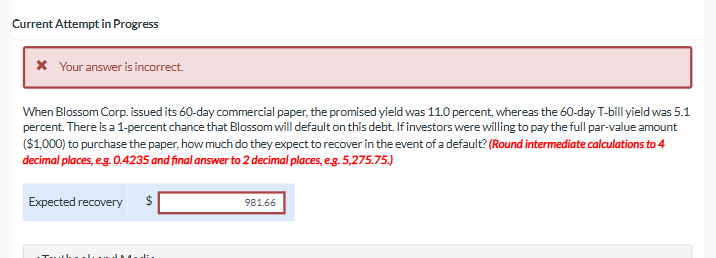

Question: Current Attempt in Progress X Your answer is incorrect. When Blossom Corp. issued its 6 0 - day commercial paper, the promised yield was 1

Current Attempt in Progress X Your answer is incorrect. When Blossom Corp. issued its day commercial paper, the promised yield was percent, whereas the day T bill yield was percent. There is a percent chance that Blossom will default on this debt. If investors were willing to pay the full parvalue amount $ to purchase the paper, how much do they expect to recover in the event of a default? Round intermediate calculations to decimal places, eg and final answer to decimal places, eg

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock