Question: Current Attempt in Progress Your answer is incorrect. During the past year, Serena McGill planted a new vineyard on 1 5 0 acres of land

Current Attempt in Progress

Your answer is incorrect.

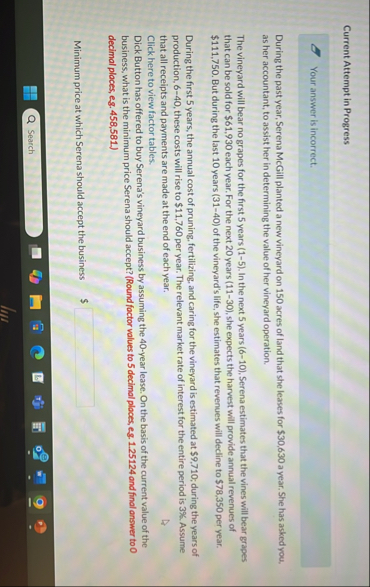

During the past year, Serena McGill planted a new vineyard on acres of land that she leases for $ a year. She has asked you, as her accountant, to assist her in determining the value of her vineyard operation.

The vineyard will bear no grapes for the first years In the next years Serena estimates that the vines will bear grapes that can be sold for $ each year. For the next years she expects the harvest will provide annual revenues of $ But during the last years of the vineyard's life, she estimates that revenues will decline to $ per year.

During the first years, the annual cost of pruning, fertilizing, and caring for the vineyard is estimated at $; during the years of production, these costs will rise to $ per year. The relevant market rate of interest for the entire period is Assume that all receipts and payments are made at the end of each year.

Click here to view factor tables.

Dick Button has offered to buy Serena's vineyard business by assuming the year lease. On the basis of the current value of the business, what is the minimum price Serena should accept? Round factor values to decimal places, eg and final answer to decimal places, eg

Minimum price at which Serena should accept the business $

Search

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock