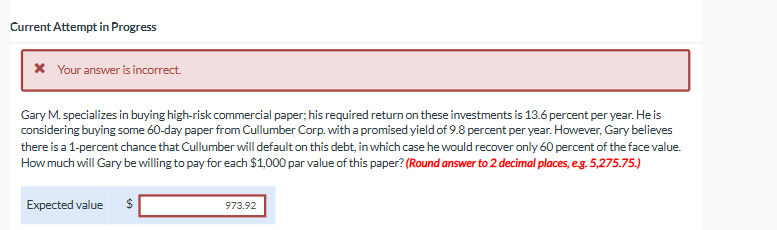

Question: Current Attempt in Progress Your answer is incorrect. Gary M . specializes in buying high - risk commercial paper; his required return on these investments

Current Attempt in Progress Your answer is incorrect. Gary M specializes in buying highrisk commercial paper; his required return on these investments is percent per year. He is considering buying some day paper from Cullumber Corp. with a promised yield of percent per year. However, Gary believes there is a percent chance that Cullumber will default on this debt, in which case he would recover only percent of the face value. How much will Gary be willing to pay for each $ par value of this paper? Round answer to decimal places, eg

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock