Question: Current Attempt in Progress Your answer is partially correct. Balance sheets for Salt Company and Pepper Company on December 3 1 , 2 0 1

Current Attempt in Progress

Your answer is partially correct.

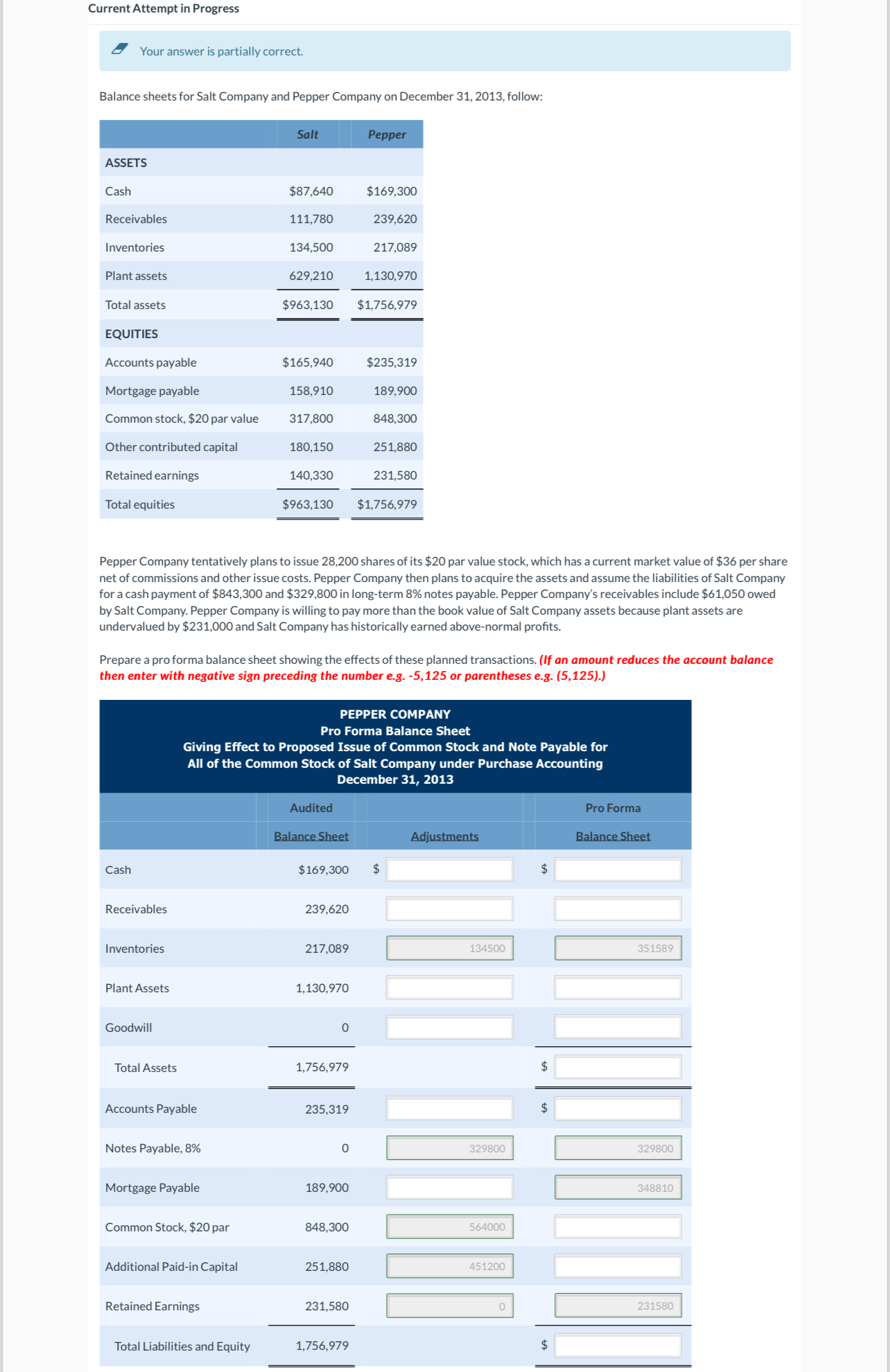

Balance sheets for Salt Company and Pepper Company on December follow:

begintabularccc

hline & Salt & Pepper

hline multicolumnlASSETS

hline Cash & $ & $

hline Receivables & &

hline Inventories & &

hline Plant assets & &

hline Total assets & $ & $

hline multicolumnlEQUITIES

hline Accounts payable & $ & $

hline Mortgage payable & &

hline Common stock, $ par value & &

hline Other contributed capital & &

hline Retained earnings & &

hline Total equities & $ & $

hline

endtabular

Pepper Company tentatively plans to issue shares of its $ par value stock, which has a current market value of $ per share net of commissions and other issue costs. Pepper Company then plans to acquire the assets and assume the liabilities of Salt Company for a cash payment of $ and $ in longterm notes payable. Pepper Company's receivables include $ owed by Salt Company. Pepper Company is willing to pay more than the book value of Salt Company assets because plant assets are undervalued by $ and Salt Company has historically earned abovenormal profits.

Prepare a pro forma balance sheet showing the effects of these planned transactions. If an amount reduces the account balance then enter with negative sign preceding the number eg or parentheses eg

begintabularcccccc

hline multicolumncbegintabularl

PEPPER COMPANY

Pro Forma Balance Sheet

Giving Effect to Proposed Issue of Common Stock and Note Payable for All of the Common Stock of Salt Company under Purchase Accounting December

endtabular

hline & Audited & & & &

hline & Balance Sheet & & Adjustments & & heet

hline Cash & $ & $ & & $ &

hline Receivables & & & & &

hline Inventories & & & & &

hline Plant Assets & & & & &

hline Goodwill & & & & &

hline Total Assets & & & & $ &

hline Accounts Payable & & & & $ &

hline Notes Payable, & & & & &

hline Mortgage Payable & & & & &

hline Common Stock, $ par & & & & &

hline Additional Paidin Capital & & & & &

hline Retained Earnings & & & & &

hline Total Liabilities and Equity & & & & $ &

hline

endtabular look at picture and show steps

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock