Question: Current Attempt in Progress Your answer is partially correct. Blossom Rental Company provided the following information to its auditors. For the year ended March 31,

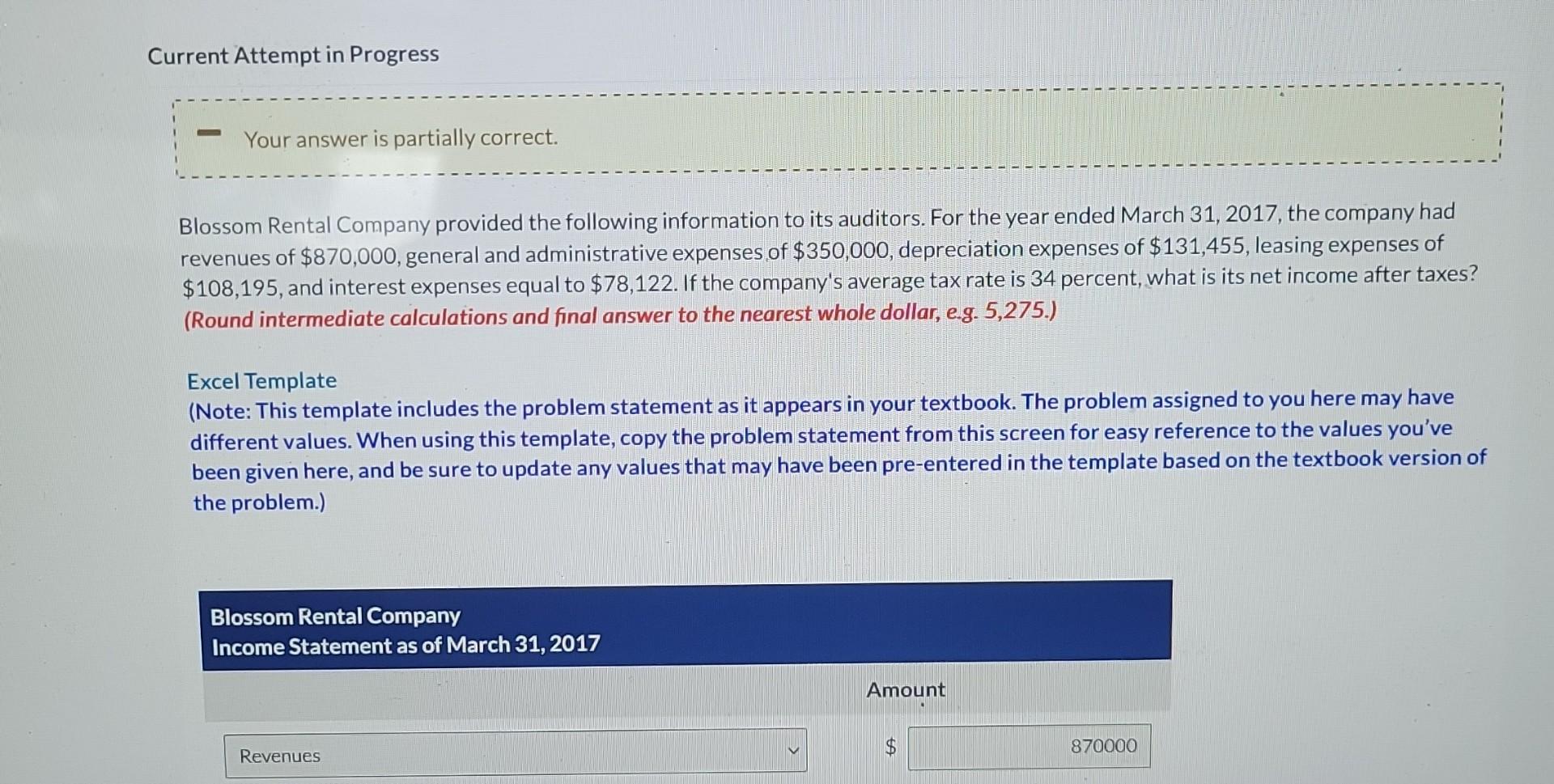

Current Attempt in Progress Your answer is partially correct. Blossom Rental Company provided the following information to its auditors. For the year ended March 31, 2017, the company had revenues of $870,000, general and administrative expenses of $350,000, depreciation expenses of $131,455, leasing expenses of $108,195, and interest expenses equal to $78,122. If the company's average tax rate is 34 percent, what is its net income after taxes? (Round intermediate calculations and final answer to the nearest whole dollar, e.g. 5,275.) Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts