Question: Current Attempt in Progress Your answer is partially correct. Hypothetical comparative condensed balance sheets of Nike, Inc. are presented here. table [ [

Current Attempt in Progress

Your answer is partially correct.

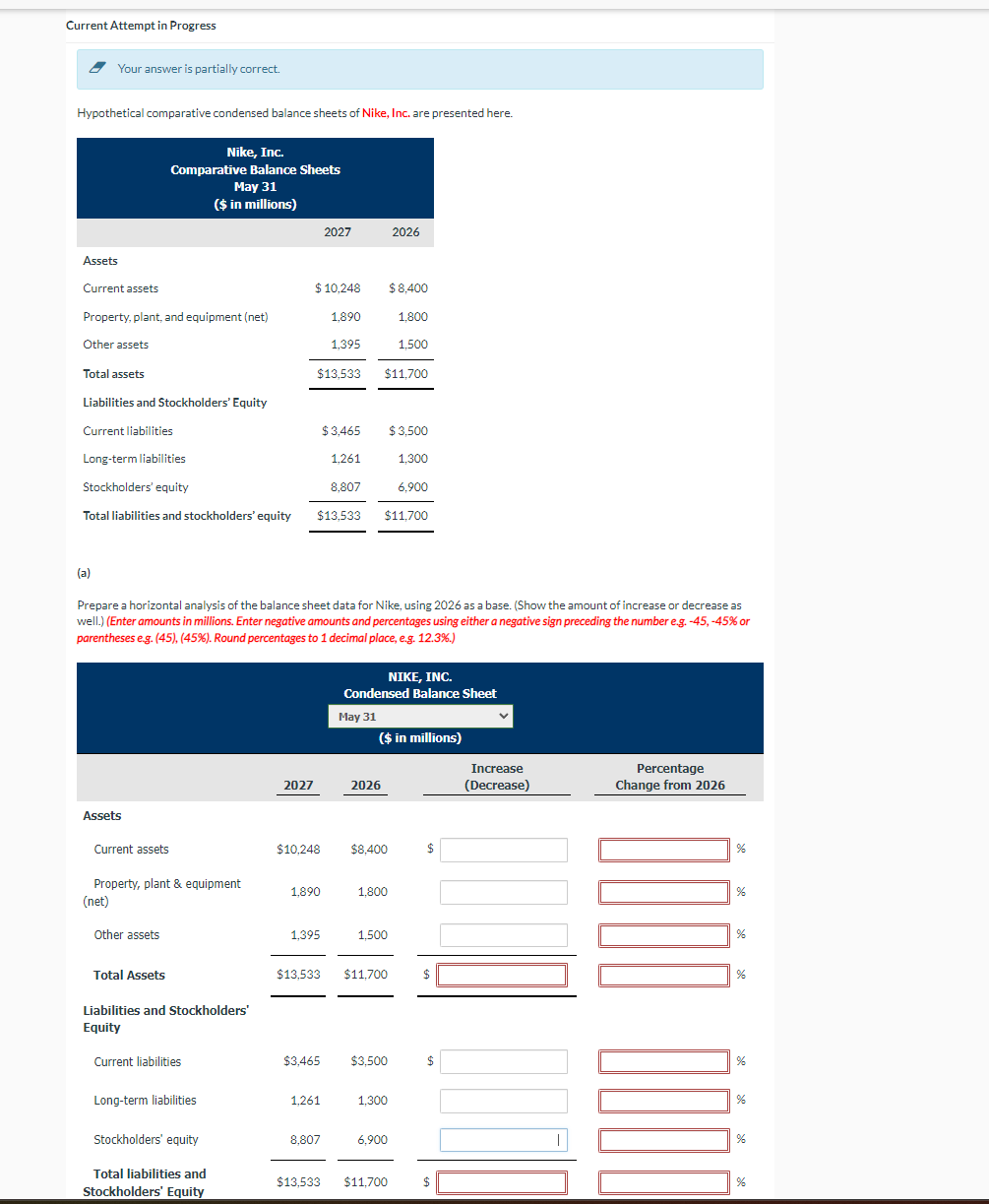

Hypothetical comparative condensed balance sheets of Nike, Inc. are presented here.

tabletableNike Inc.Comparative Balance SheetsMay $ in millionsAssetsCurrent assets,$ $Property plant, and equipment netOther assets,Total assets,$$Liabilities and Stockholders' EquityCurrent liabilities,$$Longterm liabilities,Stockholders equity,Total liabilities and stockholders' equity,$$

a

Prepare a horizontal analysis of the balance sheet data for Nike, using as a base. Show the amount of increase or decrease as well.Enter amounts in millions. Enter negative amounts and percentages using either a negative sign preceding the number eg or parentheses eg Round percentages to decimal place, eg

tabletableNIKE INC.Condensed Balance SheetMay $ in millionstableIncreaseDecreasetablePercentageChange from AssetsCurrent assets,$$$tableProperty plant & equipmentnetOther assets,Total Assets,$$$tableLiabilities and Stockholders'EquityCurrent liabilities,$$$Longterm liabilities,tableTotal liabilities andStockholders Equity$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock