Question: Current Attempt in Progress Your answer is partially correct. Metlock Co. has one temporary difference at the beginning of 2025 of $490,000. The deferred tax

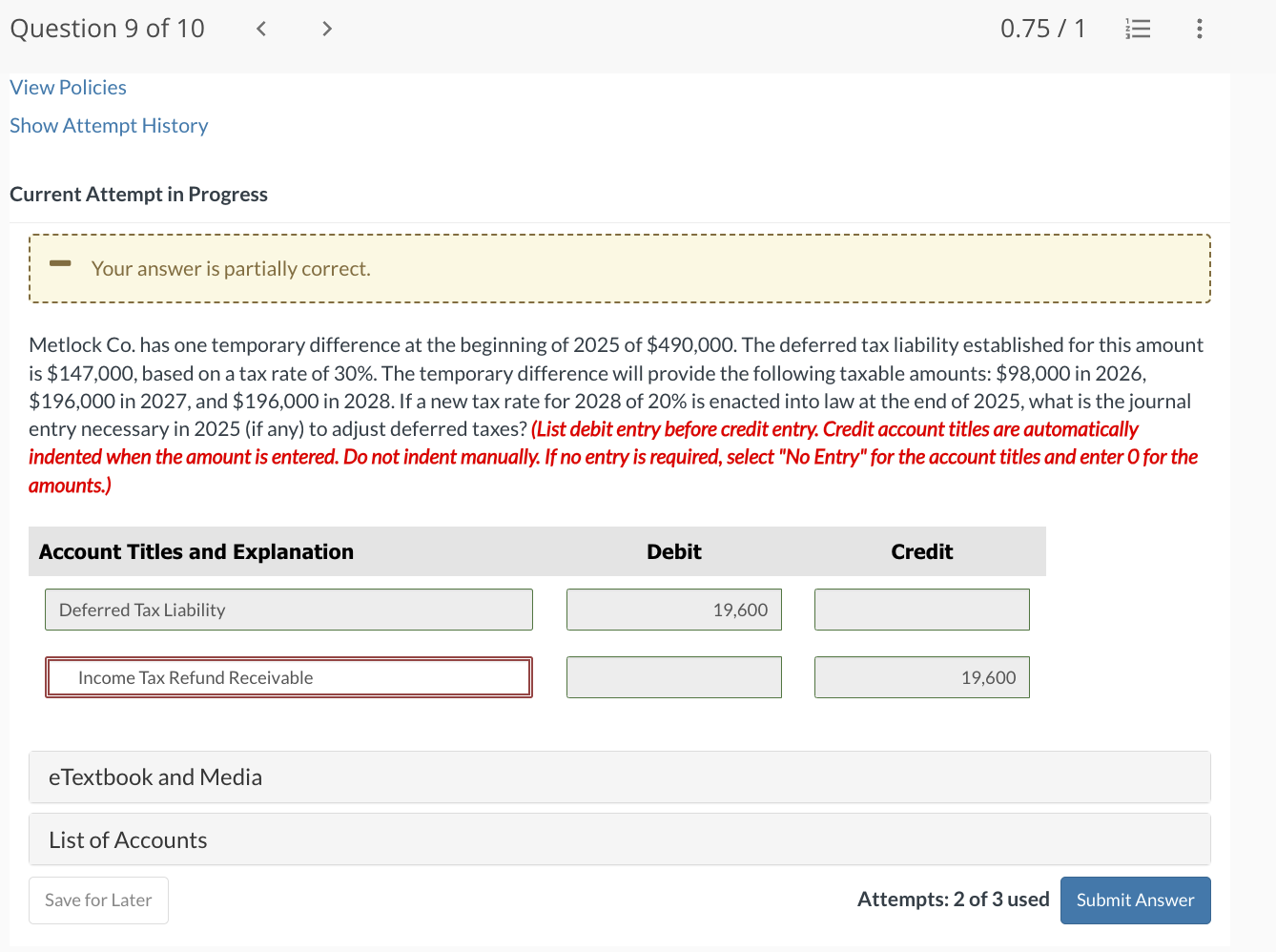

Current Attempt in Progress Your answer is partially correct. Metlock Co. has one temporary difference at the beginning of 2025 of $490,000. The deferred tax liability established for this amount is $147,000, based on a tax rate of 30%. The temporary difference will provide the following taxable amounts: $98,000 in 2026 , $196,000 in 2027 , and $196,000 in 2028 . If a new tax rate for 2028 of 20% is enacted into law at the end of 2025 , what is the journal entry necessary in 2025 (if any) to adjust deferred taxes? (List debit entry before credit entry. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) eTextbook and Media List of Accounts Attempts: 2 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts