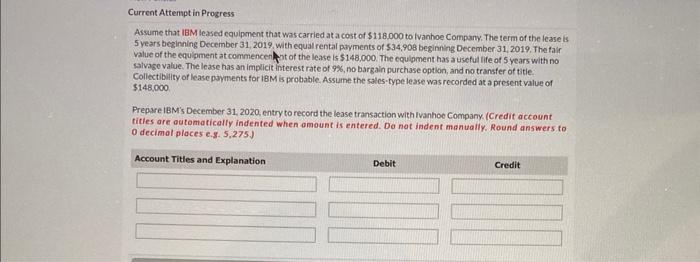

Question: Current Attenmpt in Progress Assume that IBM leased equipment that was carried at a cost of $118.000 to fuanhoe Company. The term of the lease

Current Attenmpt in Progress Assume that IBM leased equipment that was carried at a cost of $118.000 to fuanhoe Company. The term of the lease is 5 years beginning December 31,2019 , wi thequal rental payments of $34,908 beginning December 31,2019, The taif value of the cquigment atcommencenl hit of the lease is 5148,000 . The equigment has a tseful fife of 5 years with no kalvage value. The lease has an implicit interest rate of 9%, no bargain purchase option, and no transfer of titie. Collectibulty of lease payments for 18M is probable. Assume the sales-type lease was recorded at a present value of 5148,000 Prepare IBM's December 31, 2020, entry to record the lease transaction with Ivanhoe Company. (Credif account tities are atomaticalfy indented when amount is entered. Do not indent manually. Round answers to 0 decimel places c.8. 5,275.J

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts