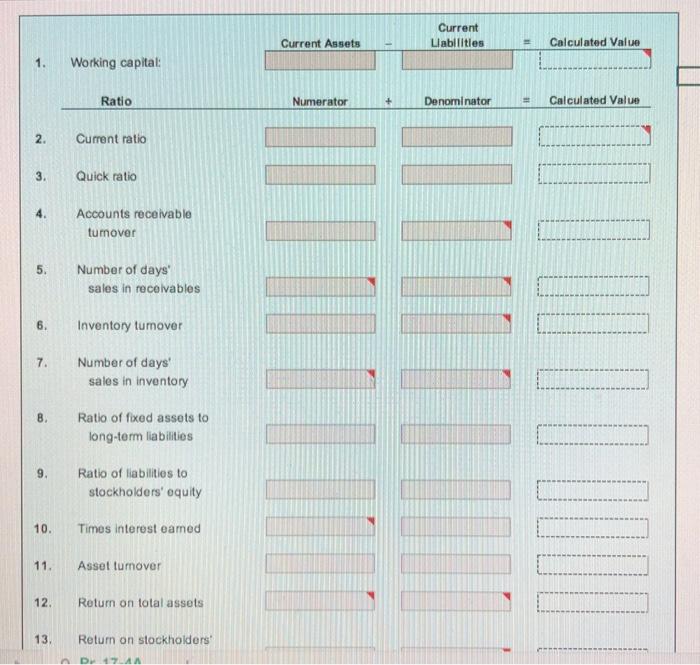

Question: Current Current Assets Llablitles Calculated Value !! 1. Working capital: Ratio Numerator Denominator Calculated Value 2. Current ratio 3. Quick ratio 4. Accounts receivable

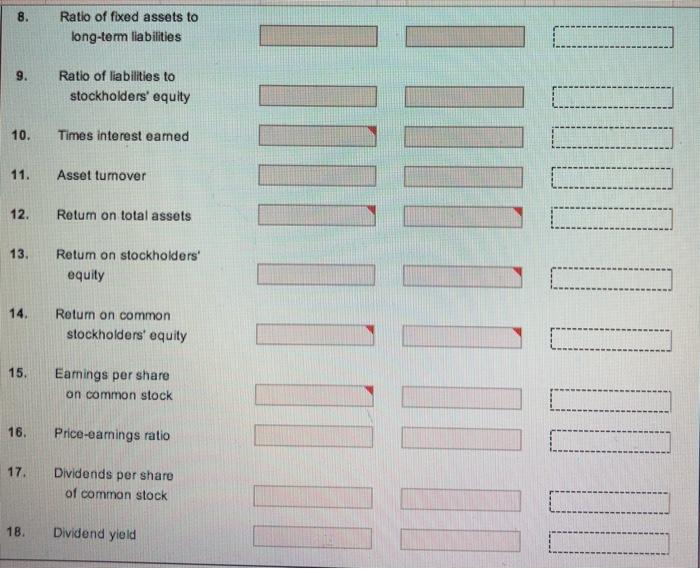

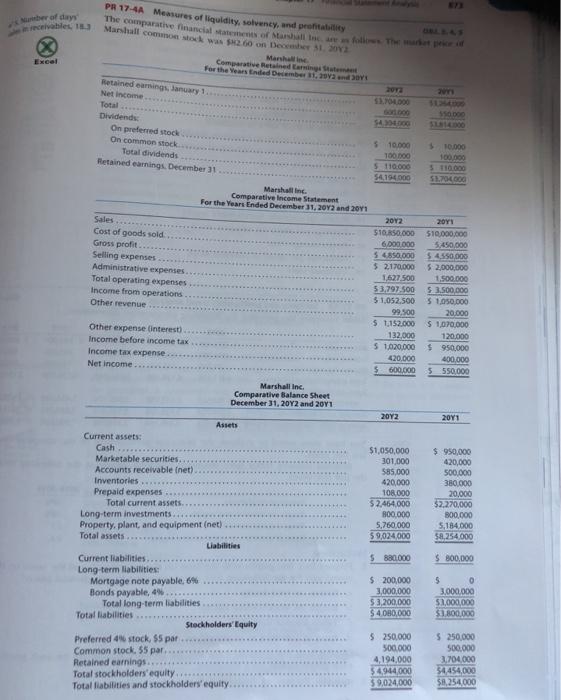

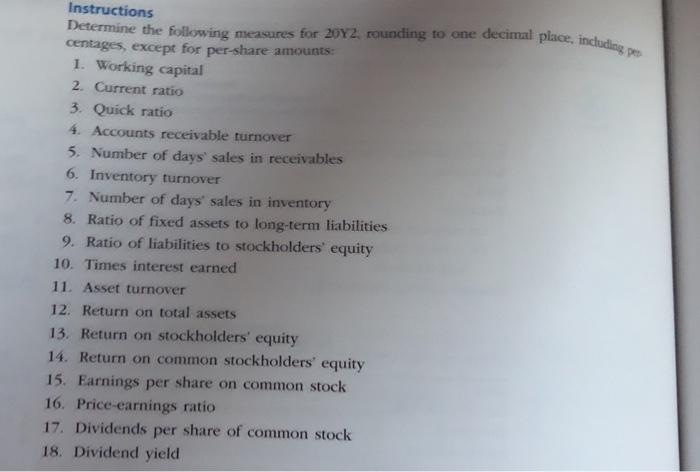

Current Current Assets Llablitles Calculated Value !! 1. Working capital: Ratio Numerator Denominator Calculated Value 2. Current ratio 3. Quick ratio 4. Accounts receivable tumover 5. Number of days sales in recelvables 6. Inventory tumover 7. Number of days' sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders' equity 10. Times interest eaned 11. Asset tumover 12. Return on total assets 13. Retum on stockholders O Pr 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders' equity 10. Times interest eamed 11. Asset turnover 12. Retum on total assets 13. Retum on stockholders' equity 14. Return on common stockholders' equity 15. Eamings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yield ber of days eceivables, 183 PR 17-4A Measures of liquldity, solvency, and profitaliity N73 The comparative financial statetents of Mardull bn are s folows The wmarket pri Manshall common stock was S2 60 on Deoemher 31. 20V2 OBL A.S Marshall inc. Comparative Retained Earning Statemt For the Years Ended December 1, 202nd 30 Excel Retained eamings, January 1 Net income Total Dividends On preferred stock On common stock Total dividends Retained earnings. December 31 2012 SANE $3.704.000 6o.000 $4.34000 550.000 S3814.000 $ 10.000 F0.000 100000 S 110.000 $4,194000 100,000 S 110.000 $3.704000 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 Sales 2012 20Y1 Cost of goods sold Gross profit Selling expenses Administrative expenses. Total operating expenses Income from operations Other revenue $10.R50.000 $10,000,000 6.000.000 5,450,000 $4.850.000 $4.550,000 $2,000,000 1,500.000 5 3.500,000 $1.050.000 $2170,000 1,627,500 53,797.500 $1,052.500 99.500 $1,152.000 20.000 $ 1,070.000 Other expense (interest) Income before income tax Income tax expense 132,000 S 1,020,000 420,000 600,000 120.000 $950,000 400,000 5 550,000 Net income Marshall Inc. Comparative Balance Sheet December 31, 20Y2 and 20Y1 20Y2 20Y1 Assets Current assets: Cash Marketable securities. Accounts receivable (net) $1,050,000 $ 950,000 420,000 301,000 585,000 420,000 108.000 $2.464,000 S00,000 380,000 Inventories. Prepaid expenses Total current assets.. Long-term investments. Property, plant, and equipment (net) Total assets.... 20,000 $2.270,000 B00,000 5,184.000 $8,254.000 BO0.000 5,760,000 $9,024,000 Liabilities 5 880.000 S 800,000 Current liabilities.. Long-term liabilities: Mortgage note payable, 6% Bonds payable, 4%. Total long-term liabilities. Total liabilities $ 200,000 3,000,000 $3.200.000 $4.080,000 3,000,000 $3,000,000 $1.800,000 Stockholders' Equity $ 250,000 500.000 $ 250,000 500,000 Preferred 4% stock, $5 par Common stock, 55 par.. Retained earnings.. Total stockholders'equity. Total liabilities and stockholders' equity. 4,194,000 3.704.000 $4.944,000 $9.024,000 54,454,000 S8,254.000 Determine the following measures for 20Y2, rounding to one decimal place, including pe Instructions centages, except for per-share amounts: 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days' sales in receivables 6. Inventory turnover 7. Number of days' sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders' equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders' equity 14. Return on common stockholders' equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yield

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Solution 1 Working Capital Current Assets Current Liabilities Current Assets 2464000 Current Liabilities 880000 Working Capital 2464000 880000 1584000 2 Current Ratio Current Assets Current Liabilitie... View full answer

Get step-by-step solutions from verified subject matter experts