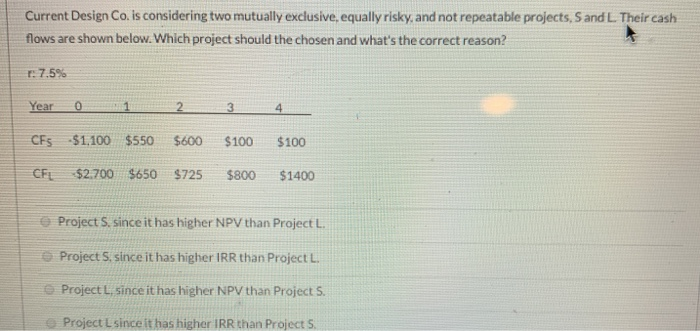

Question: Current Design Co. is considering two mutually exclusive, equally risky, and not repeatable projects, Sand L. Their cash flows are shown below. Which project should

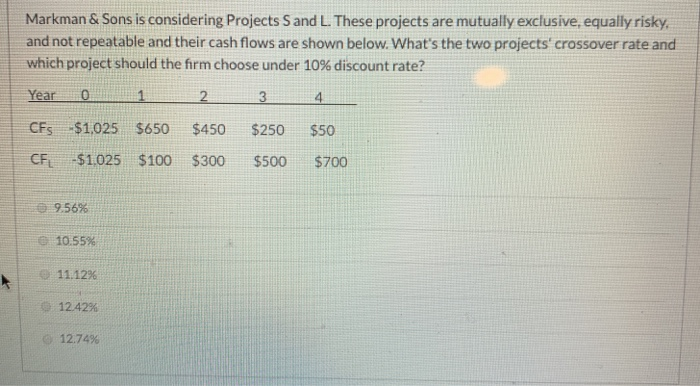

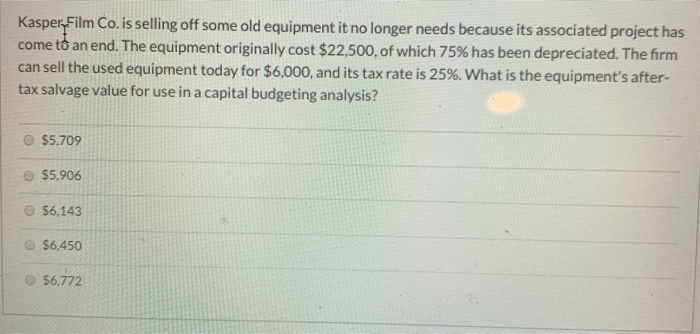

Current Design Co. is considering two mutually exclusive, equally risky, and not repeatable projects, Sand L. Their cash flows are shown below. Which project should the chosen and what's the correct reason? r:7.5% Year 0 1 2 3 4 CES $1,100 $550 $600 $100 $100 CFL $2.700 $650 $725 $800 $1400 Project 5. since it has higher NPV than Project L. Project 5. since it has higher IRR than Project L. Project L since it has higher NPV than Project 5 Project L since it has higher IRR than Projects Markman & Sons is considering Projects S and L. These projects are mutually exclusive, equally risky, and not repeatable and their cash flows are shown below. What's the two projects' crossover rate and which project should the firm choose under 10% discount rate? Year 0 CFS-$1,025 $650 CF -$1.025 $100 $450 $300 $250 $500 $50 $700 9.56% 10.55% 11.12% 1242% 12.74% Kasper Film Co. is selling off some old equipment it no longer needs because its associated project has come to an end. The equipment originally cost $22,500, of which 75% has been depreciated. The firm can sell the used equipment today for $6,000, and its tax rate is 25%. What is the equipment's after- tax salvage value for use in a capital budgeting analysis? $5,709 $5,906 $6,143 $6,450 $6,772

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts