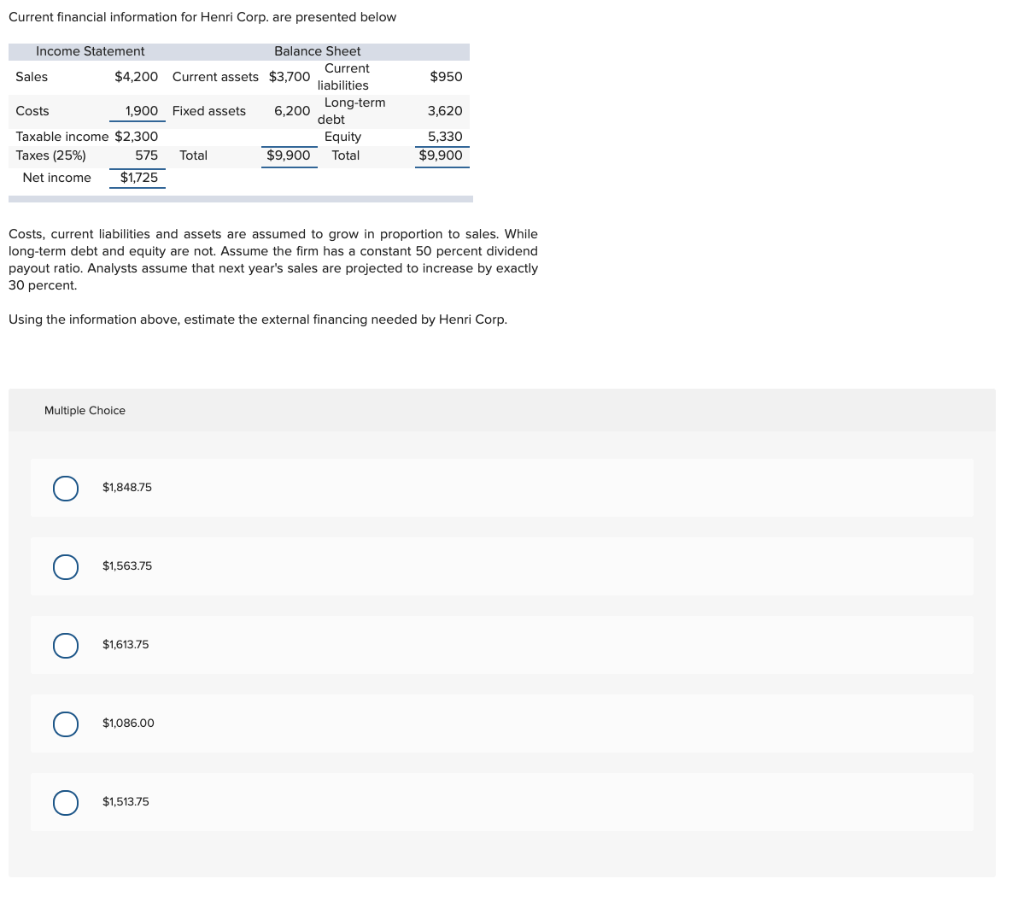

Question: Current financial information for Henri Corp. are presented below $950 Income Statement Balance Sheet Sales $4,200 Current assets $3,700 Current liabilities Costs 1,900 Long-term Fixed

Current financial information for Henri Corp. are presented below $950 Income Statement Balance Sheet Sales $4,200 Current assets $3,700 Current liabilities Costs 1,900 Long-term Fixed assets 6,200 debt Taxable income $2,300 Equity Taxes (25%) 575 Total $9,900 Total Net income $1,725 3,620 5,330 $9.900 Costs, current liabilities and assets are assumed to grow in proportion to sales. While long-term debt and equity are not. Assume the firm has a constant 50 percent dividend payout ratio. Analysts assume that next year's sales are projected to increase by exactly 30 percent Using the information above, estimate the external financing needed by Henri Corp. Multiple Choice O $1,848.75 O $1,563.75 O $1,613.75 $1,086.00 O $1,513.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts