Question: Current Liabilities: 1. Obligations due within one year 2. Will be paid with assets or through the creation of other liabilities Examples include: Accounts payable

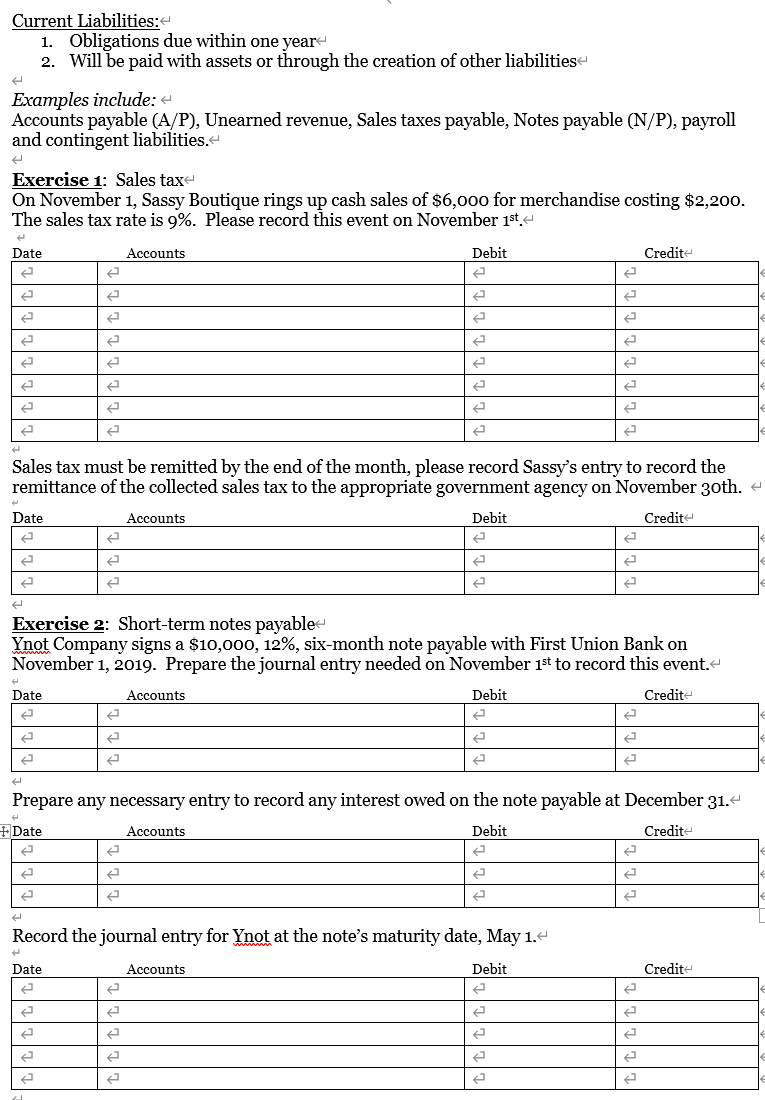

Current Liabilities: 1. Obligations due within one year 2. Will be paid with assets or through the creation of other liabilities Examples include: Accounts payable (A/P), Unearned revenue, Sales taxes payable, Notes payable (N/P), payroll and contingent liabilities. Exercise 1: Sales tax On November 1, Sassy Boutique rings up cash sales of $6,000 for merchandise costing $2,200. The sales tax rate is 9%. Please record this event on November 1st Date Accounts Debit Credit LLLLLLLL Sales tax must be remitted by the end of the month, please record Sassy's entry to record the remittance of the collected sales tax to the appropriate government agency on November 30th. + Date Accounts Debit Credit Exercise 2: Short-term notes payable Ynot Company signs a $10,000, 12%, six-month note payable with First Union Bank on November 1, 2019. Prepare the journal entry needed on November 1st to record this event. Date Accounts Debit Credit Prepare any necessary entry to record any interest owed on the note payable at December 31. Date Accounts Debit Credit ttt Record the journal entry for Ynot at the note's maturity date, May 1. Date Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts