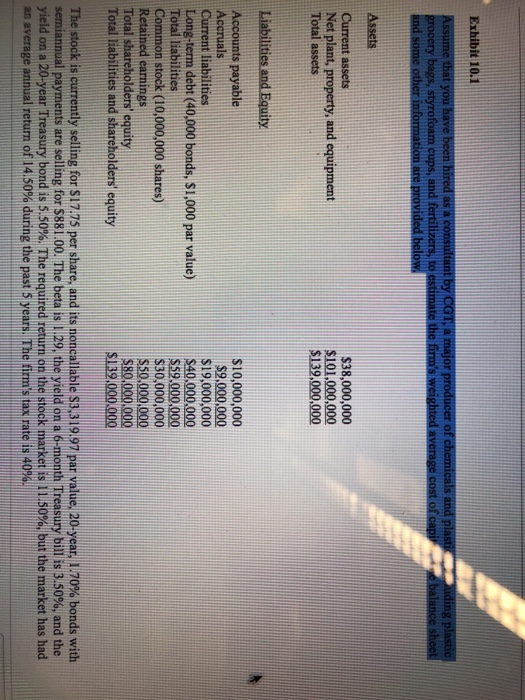

Question: Current liabilities Long-term debr (40,000 bonds, $1,000 par value $19,000,000 $40,000,000 $59,000,000 $30,000,000 $50,000,000 $80,000,000 $139,000,000 Total liabilities Common stock (10,000,000 shares Total shareholders equity

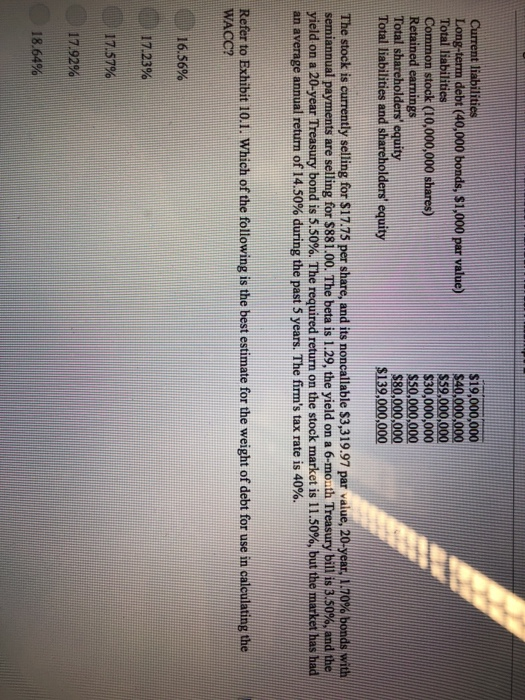

Current liabilities Long-term debr (40,000 bonds, $1,000 par value $19,000,000 $40,000,000 $59,000,000 $30,000,000 $50,000,000 $80,000,000 $139,000,000 Total liabilities Common stock (10,000,000 shares Total shareholders equity Total liabilities and shareholders' equity The stock is currently selling for $17.75 per share, and its noncallable $3,319.97 par value, 20-year, 1.70% bonds with semiannual payments are selling for S881.00. The beta is 1.29, the yield on a 6-moth Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%. Refer to Exhibit 10.1. Which of the following is the best estimate for the weight of debt for use in calculating the WACC? 16.56% I 17.23% 7.57% 18.64%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts