Question: Current Position Analysis The bond indenture for the 10-year, 9% debenture bonds Issued January 2, 20YS, required working capital of $100,000, a current ratio

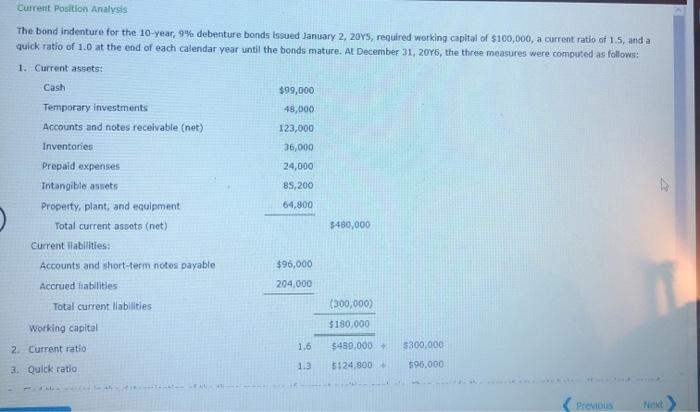

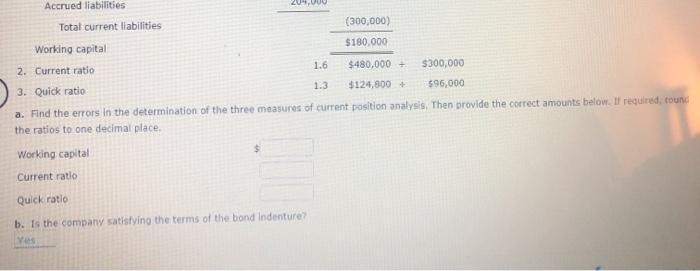

Current Position Analysis The bond indenture for the 10-year, 9% debenture bonds Issued January 2, 20YS, required working capital of $100,000, a current ratio of 1.5, and a quick ratio of 1.0 at the end of each calendar year until the bonds mature. At December 31, 2016, the three measures were computed as follows: 1. Current assets: Cash Temporary investments $99,000 48,000 Accounts and notes receivable (net) 123,000 Inventories 36,000 Prepaid expenses 24,000 Intangible assets 85,200 Property, plant, and equipment 64,800 Total current assets (net) $480,000 Current liabilities: Accounts and short-term notes payable $96,000 Accrued liabilities: 204,000 Total current liabilities (300,000) Working capital $180,000 2. Current ration 1.6 $480,000+ $300,000 3. Quick ratio 1.3 $124,800+ $96,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts