Question: current ratio I need help on Problem 21, 1;a-d, 2; a-e. My numbers came out really low so I want to make sure I am

current ratio

I need help on Problem 21, 1;a-d, 2; a-e. My numbers came out really low so I want to make sure I am doing them correctly

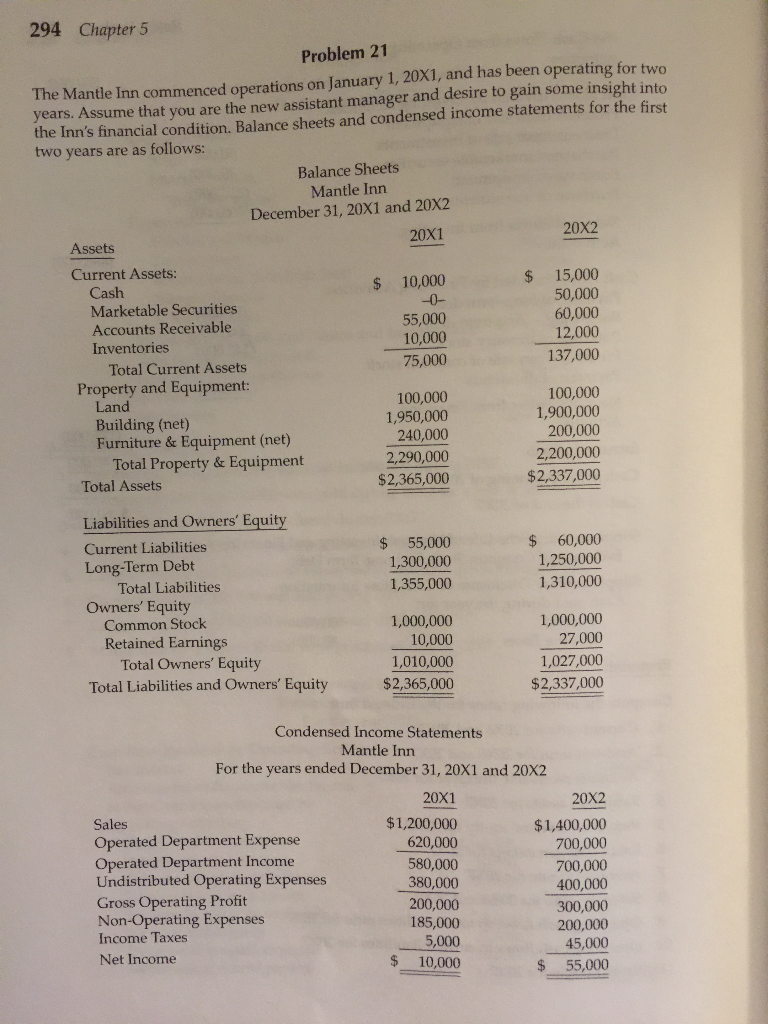

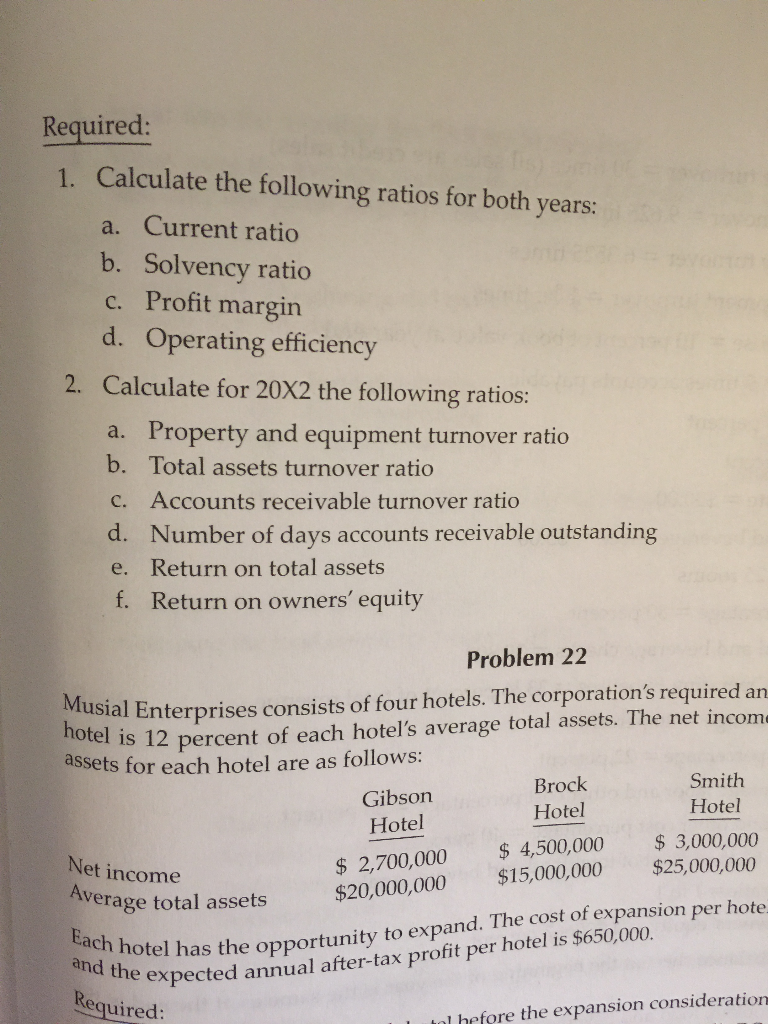

294 Chapter 5 Problem 21 The Mantle Inn commenced operations on January 1, 20X1, and has been operating for two years. Assume that you are the new assistant manager and desire to gain some insight into the Inn's financial condition. Balance sheets and condensed income statements for the first two years are as follows: Balance Sheets Mantle Inn December 31, 20X1 and 20X2 20X2 20X1 Assets Current Assets: 15,000 10,000 -0- $ Cash Marketable Securities Accounts Receivable Inventories 50,000 60,000 12,000 55,000 10,000 137,000 75,000 Total Current Assets Property and Equipment: Land 100,000 1,900,000 200,000 100,000 1,950,000 240,000 Building (net) Furniture & Equipment (net) Total Property & Equipment 2,200,000 $2,337,000 2,290,000 $2,365,000 Total Assets Liabilities and Owners' Equity 60,000 1,250,000 55,000 1,300,000 Current Liabilities $ $ Long-Term Debt Total Liabilities Owners' Equity 1,355,000 1,310,000 Common Stock Retained Earnings Total Owners' Equity Total Liabilities and Owners' Equity 1,000,000 10,000 1,000,000 27,000 1,010,000 1,027,000 $2,365,000 $2,337,000 Condensed Income Statements Mantle Inn For the years ended December 31, 20X1 and 20X2 20X1 20X2 Sales $1,200,000 $1,400,000 700,000 Operated Department Expense Operated Department Income Undistributed COperating Expenses Gross Operating Profit Non-Operating Expenses Income Taxes 620,000 580,000 700,000 380,000 400,000 200,000 185,000 5,000 300,000 200,000 45,000 Net Income 10,000 55,000 Required: Calculate the following ratios for both years: 1. Current ratio a. b. Solvency ratio c. Profit margin d. Operating efficiency 2. Calculate for 20X2 the following ratios: Property and equipment turnover ratio a. b. Total assets turnover ratio Accounts receivable turnover ratio C. d. Number of days accounts receivable outstanding Return on total assets e. f. Return on owners' equity Problem 22 Musial Enterprises consists of four hotels. The corporation's required an hotel is 12 percent of each hotel's average total assets. The net incom ssets for each hotel are as follows: Smith Brock Gibson Hotel Hotel Hotel $ 3,000,000 $25,000,000 $ 4,500,000 $15,000,000 $ 2,700,000 Net income $20,000,000 Average total assets Each hotel has the opportunity to expand. The cost of expansion per hote and the expected annual after-tax profit per hotel is $650,000. Required: hal hefore the expansion consideration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts