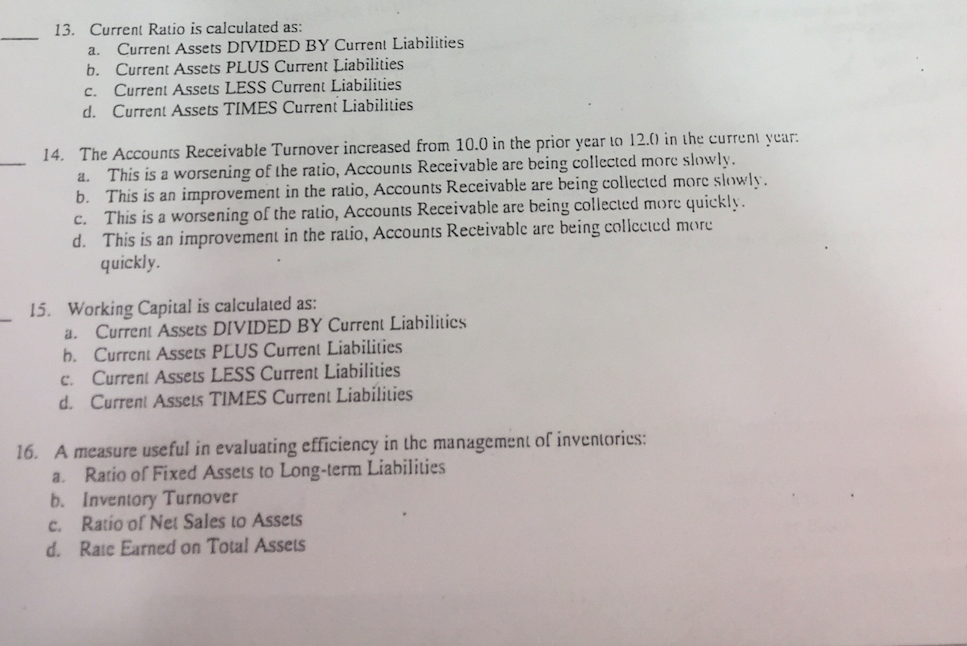

Question: Current Ratio is calculated as: Cure Assets DIVIDED BY Current Liabilities Current Assets PLUS Current Liabilities Current Assets LESS Current Liabilities Current Assets TIMES Current

Current Ratio is calculated as: Cure Assets DIVIDED BY Current Liabilities Current Assets PLUS Current Liabilities Current Assets LESS Current Liabilities Current Assets TIMES Current Liabilities The Accounts Receivable Turnover increased from 10.0 in the prior year to 12.0 in the cure year. This is a worsening of the ratio, Accounts Receivable are being collected more slowly. This is an improvement in the ratio. Accounts Receivable are being collected more slowly. This is a worsening of the ratio, Accounts Receivable are being collected more quickly. This is an improvement in the ratio. Accounts Receivable arc being collected more quickly. Working Capital is calculated as: Current Assets DIVIDED BY Current Liabilities Current Assets PLUS Current Liabilities Current Assets LESS Current Liabilities Current Assets TIMES Current Liabilities A measure useful in evaluating efficiency in the management of inventories: Ratio of Fixed Assets to Long-term Liabilities Inventory Turnover Ratio of Net Sales to Assets Rate Earned on Total Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts