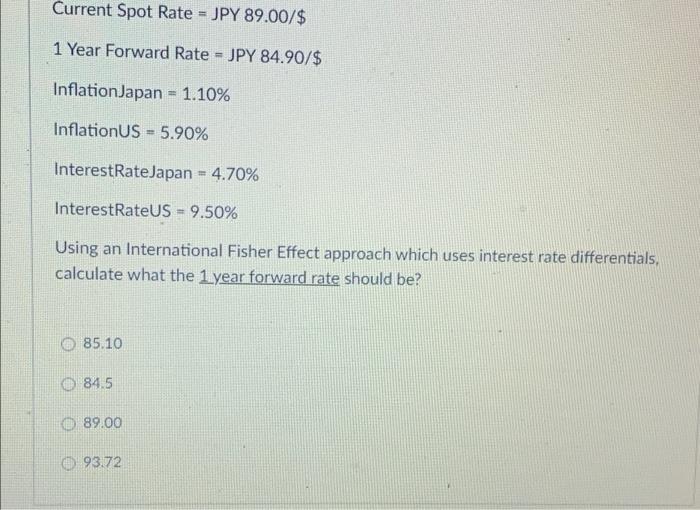

Question: Current Spot Rate = JPY 89.00/$ 1 Year Forward Rate = JPY 84.90/$ InflationJapan = 1.10% InflationUS = 5.90% InterestRateJapan = 4.70% InterestRateUS = 9.50%

Current Spot Rate = JPY 89.00/$ 1 Year Forward Rate = JPY 84.90/$ InflationJapan = 1.10% InflationUS = 5.90% InterestRateJapan = 4.70% InterestRateUS = 9.50% Using an International Fisher Effect approach which uses interest rate differentials, calculate what the 1year forward rate should be? 85.10 84.5 89.00 93.72

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts