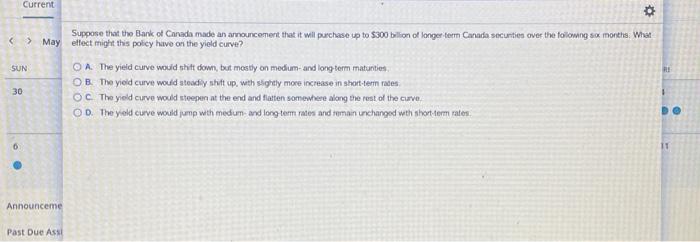

Question: Current SUN > May effect might this policy have on the yield curve? Suppose that the Bank of Canada made an announcement that it wil

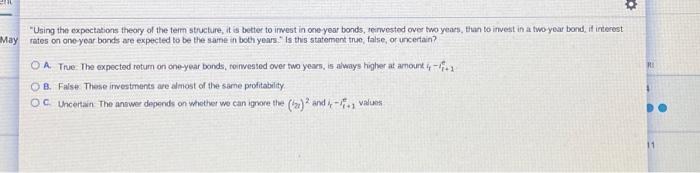

Current SUN > May effect might this policy have on the yield curve? Suppose that the Bank of Canada made an announcement that it wil purchase up to $300 billion of longer term Canada secunties over the following so months. What O A The yield Curve would shift down, but mostly on medium- and long term maturties OB. The yield Curve would steadiy shift up with slightly more increase in short-term rades OC. The yield Curve would steeper at the end and flatten somewhere along the rest of the cuve OD. The yeld curve would jump with medium and long term rates and remain unchanged with short-term rates 30 0 11 Announceme Past Due Assi . R: "Using the expectations theory of the term structure, it is better to invest in one year bonds, reinvested over two years, than to invest in a two year bond, if interest May rates on one year bands are expected to be the same in both years. Is this statement true false or uncertain? O A True. The expected return on one-year bonds, roinvested over two years, is always higher at amourkey - Tina OB. False. These investments are almost of the same profitability OC Uncertain. The answer depends on whether we can grove the (fa) and , - - Values 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts