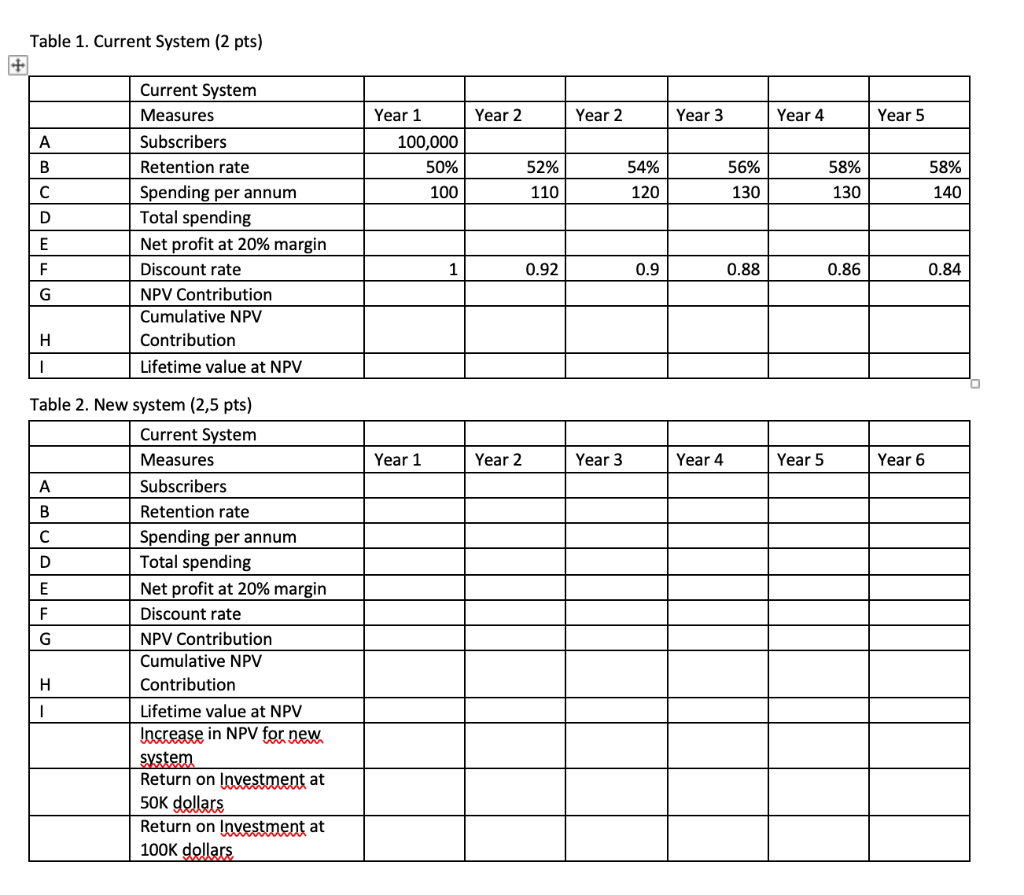

Question: Current System- Please first fill the first table based on the numbers and assumptions indicated above. If the company switches to the new system, based

Current System- Please first fill the first table based on the numbers and assumptions indicated above.

If the company switches to the new system, based on preliminary tests with improved targeting, it is estimated that with the new system, retention rates will increase from 50 to 52 per cent in the first year, increasing by five per cent per year. It is estimated that in year 1 spending per annum will increase from 100 dollars per annum to 110 per annum, increasing by the same percentages as the current example. The discount is expected to follow the same inflation trend. Then, use the information to fill the second table.

Table 1. Current System (2 pts) Year 2 Year 2 Year 3 Year 4 Year 5 A Year 1 100,000 50% 100 B 56% 52% 110 54% 120 58% 130 58% 140 130 C D Current System Measures Subscribers Retention rate Spending per annum Total spending Net profit at 20% margin Discount rate NPV Contribution Cumulative NPV Contribution Lifetime value at NPV E F 1 0.92 0.9 0.88 0.86 0.84 G H Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Table 2. New system (2,5 pts) Current System Measures A Subscribers B Retention rate Spending per annum D Total spending E Net profit at 20% margin F Discount rate G NPV Contribution Cumulative NPV H Contribution Lifetime value at NPV Increase in NPV for new system Return on Investment at 50K dellars Return on Investment at 100K dollars 1-1 Table 1. Current System (2 pts) Year 2 Year 2 Year 3 Year 4 Year 5 A Year 1 100,000 50% 100 B 56% 52% 110 54% 120 58% 130 58% 140 130 C D Current System Measures Subscribers Retention rate Spending per annum Total spending Net profit at 20% margin Discount rate NPV Contribution Cumulative NPV Contribution Lifetime value at NPV E F 1 0.92 0.9 0.88 0.86 0.84 G H Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Table 2. New system (2,5 pts) Current System Measures A Subscribers B Retention rate Spending per annum D Total spending E Net profit at 20% margin F Discount rate G NPV Contribution Cumulative NPV H Contribution Lifetime value at NPV Increase in NPV for new system Return on Investment at 50K dellars Return on Investment at 100K dollars 1-1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts