Question: current (t = 0) yield curve. That is, unless stated otherwise, use the information below for calculating any values or yields needed in any of

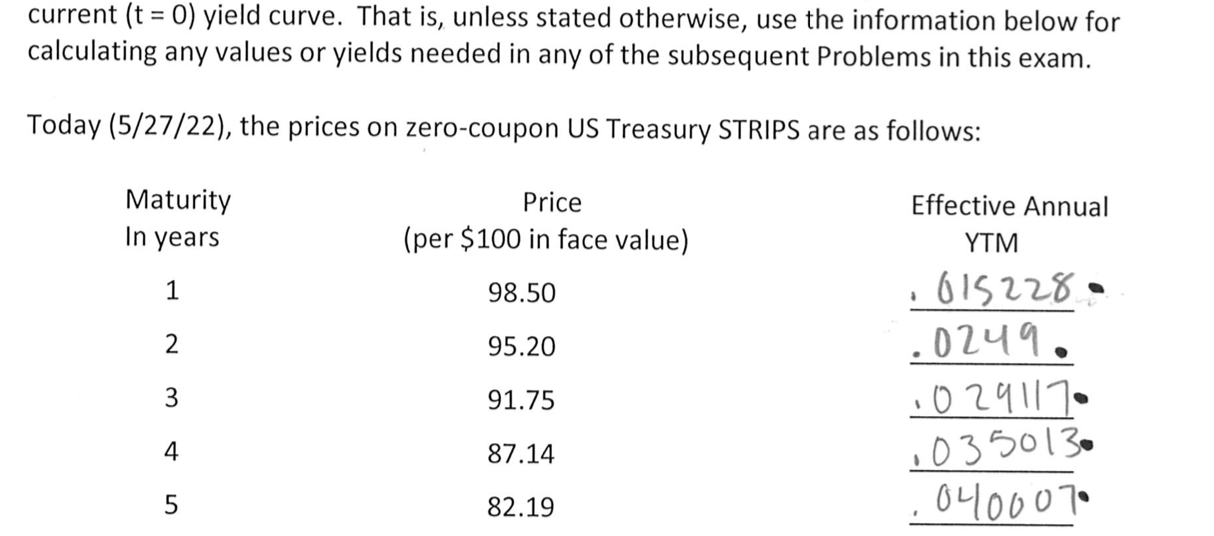

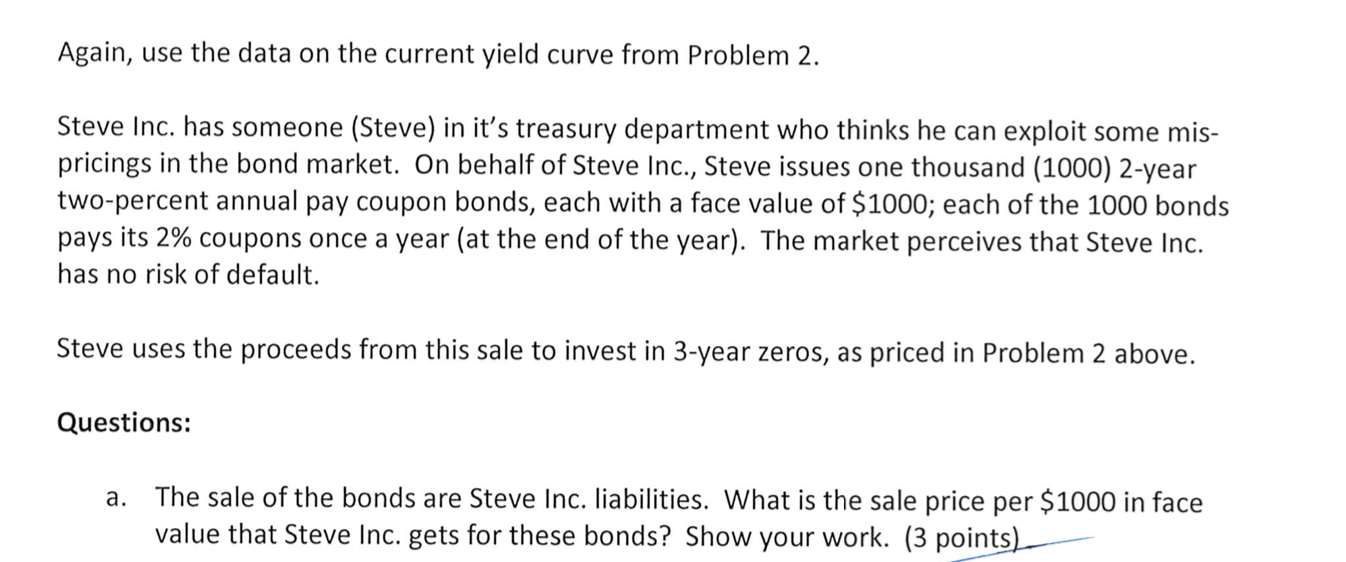

current (t = 0) yield curve. That is, unless stated otherwise, use the information below for calculating any values or yields needed in any of the subsequent Problems in this exam. Today (5/27/22), the prices on zero-coupon US Treasury STRIPS are as follows: Maturity Price Effective Annual YTM In years (per $100 in face value) 1 98.50 015228. 2 95.20 .0249. 3 91.75 0291170 4 87.14 1035013. 0400070 5 82.19 Again, use the data on the current yield curve from Problem 2. Steve Inc. has someone (Steve) in it's treasury department who thinks he can exploit some mis- pricings in the bond market. On behalf of Steve Inc., Steve issues one thousand (1000) 2-year two-percent annual pay coupon bonds, each with a face value of $1000; each of the 1000 bonds pays its 2% coupons once a year (at the end of the year). The market perceives that Steve Inc. has no risk of default. Steve uses the proceeds from this sale to invest in 3-year zeros, as priced in Problem 2 above. Questions: a. The sale of the bonds are Steve Inc. liabilities. What is the sale price per $1000 in face value that Steve Inc. gets for these bonds? Show your work. (3 points) b. How much money does Steve Inc. get from selling 1000 of these bonds? (2 points) current (t = 0) yield curve. That is, unless stated otherwise, use the information below for calculating any values or yields needed in any of the subsequent Problems in this exam. Today (5/27/22), the prices on zero-coupon US Treasury STRIPS are as follows: Maturity Price Effective Annual YTM In years (per $100 in face value) 1 98.50 015228. 2 95.20 .0249. 3 91.75 0291170 4 87.14 1035013. 0400070 5 82.19 Again, use the data on the current yield curve from Problem 2. Steve Inc. has someone (Steve) in it's treasury department who thinks he can exploit some mis- pricings in the bond market. On behalf of Steve Inc., Steve issues one thousand (1000) 2-year two-percent annual pay coupon bonds, each with a face value of $1000; each of the 1000 bonds pays its 2% coupons once a year (at the end of the year). The market perceives that Steve Inc. has no risk of default. Steve uses the proceeds from this sale to invest in 3-year zeros, as priced in Problem 2 above. Questions: a. The sale of the bonds are Steve Inc. liabilities. What is the sale price per $1000 in face value that Steve Inc. gets for these bonds? Show your work. (3 points) b. How much money does Steve Inc. get from selling 1000 of these bonds? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts