Question: Current yield, capital gains yield, and yield to maturity Hooper Printing Inc. has bonds outstanding with 19 years left to maturity. The bonds have an

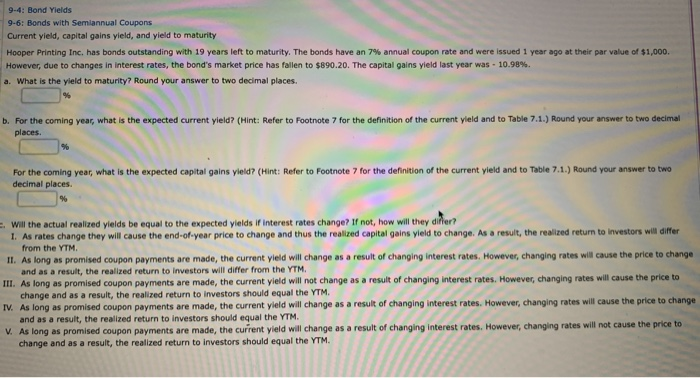

9-4: Bond Yields 9-6: Bonds with Semiannual Coupons Current yield, capital gains yield, and yield to maturity Hooper Printing Inc, has bonds outstanding with 19 years left to maturity. The bonds have an 7% annual coupon rate and were issued 1 year ago at their par value of $1,000. However, due to changes in interest rates, the bond's market price has fallen to $890.20. The capital gains yield last year was. 10.98%. . What is the yield to maturity? Round your answer to two decimal places. . For the coming year, what is the expected current yield (Hint: Refer to Footnote 7 for the definition of the current yield and to Table 7.1.) Round your answer to two decimal places For the coming year, what is the expected capital gains yield? (Hint: Refer to Footnote 7 for the definition of the current yield and to Table 7.1.) Round your answer to two decimal places. will the actual realized yields be equal to the expected yields of interest rates change? If not, how will they difer? 1. As rates change they will cause the end-of-year price to change and thus the realized capital gains yield to change. As a result, the realized return to investors will differ from the YTM 11. As long as promised coupon payments are made, the current yield will change as a result of changing interest rates. However, changing rates will cause the price to change and as a result, the realized return to investors will differ from the YTM III. As long as promised coupon payments are made, the current yield will not change as a result of changing interest rates. However, changing rates will cause the price to change and as a result, the realized return to investors should equal the YTM IV. As long as promised coupon payments are made, the current yield will change as a result of changing interest rates. However, changing rates will cause the price to change and as a result, the realized return to investors should equal the YTM V. As long as promised coupon payments are made, the current yield will change as a result of changing interest rates. However, changing rates will not cause the price to change and as a result, the realized return to investors should equal the YTM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts