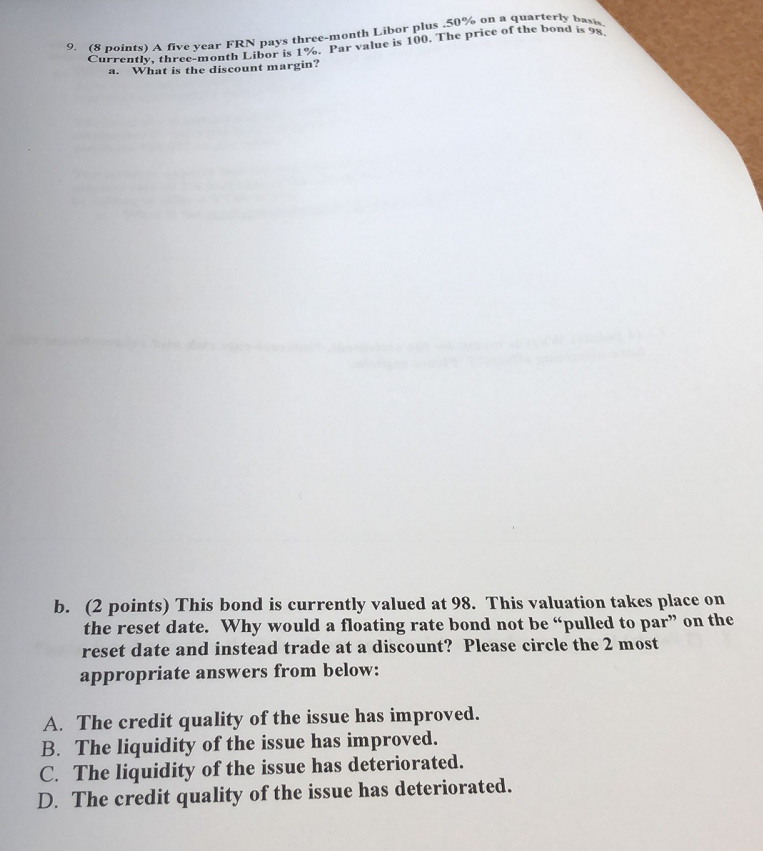

Question: Currents) A five year FRN pays three-month Libor plus .50% on Currently, three- quarterly month Libor is i%. Par value is 100. The price of

Currents) A five year FRN pays three-month Libor plus .50% on Currently, three- quarterly month Libor is i%. Par value is 100. The price of the bond is a. What is the discount margin? b. (2 points) This bond is currently valued at 98. This valuation takes place on the reset date. Why would a floating rate bond not be "pulled to par" on the reset date and instead trade at a discount? Please circle the 2 most appropriate answers from below: A. The credit quality of the issue has improved. B. The liquidity of the issue has improved. C. The liquidity of the issue has deteriorated. D. The credit quality of the issue has deteriorated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts