Question: Custom Training recently started a business providing training events for corporations. In crder to better understand the profitability of the business, the owners asked you

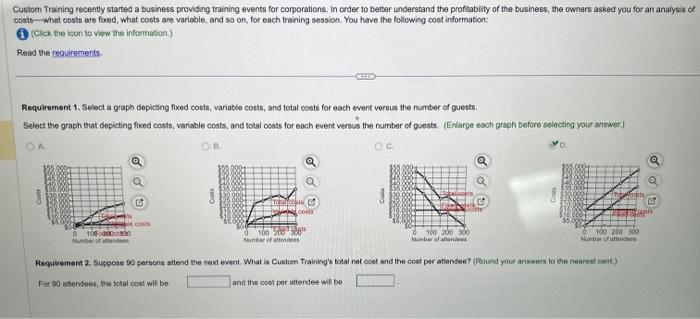

Custom Training recently started a business providing training events for corporations. In crder to better understand the profitability of the business, the owners asked you for an analysis of oosts - What costs are foxod, what costs are variable, and so on, for each trahing session. You have the following cost information: (i) (Click the icon to view the information.) Read the requirements. Requirement 1. Select a graph depicting flixed costs, variable costs, and total costs for each ewent versus the number of guests. Select the graph that dopicting foxed costs, variable costs, and total costs for each event versus the number of guosts. (Erlarge each graph before selecting your answec) For 90 intemfees, the total cost wil bo and the cost per attendes wil be Custom Training recently started a business providing training events for corporations. In crder to better understand the profitability of the business, the owners asked you for an analysis of oosts - What costs are foxod, what costs are variable, and so on, for each trahing session. You have the following cost information: (i) (Click the icon to view the information.) Read the requirements. Requirement 1. Select a graph depicting flixed costs, variable costs, and total costs for each ewent versus the number of guests. Select the graph that dopicting foxed costs, variable costs, and total costs for each event versus the number of guosts. (Erlarge each graph before selecting your answec) For 90 intemfees, the total cost wil bo and the cost per attendes wil be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts