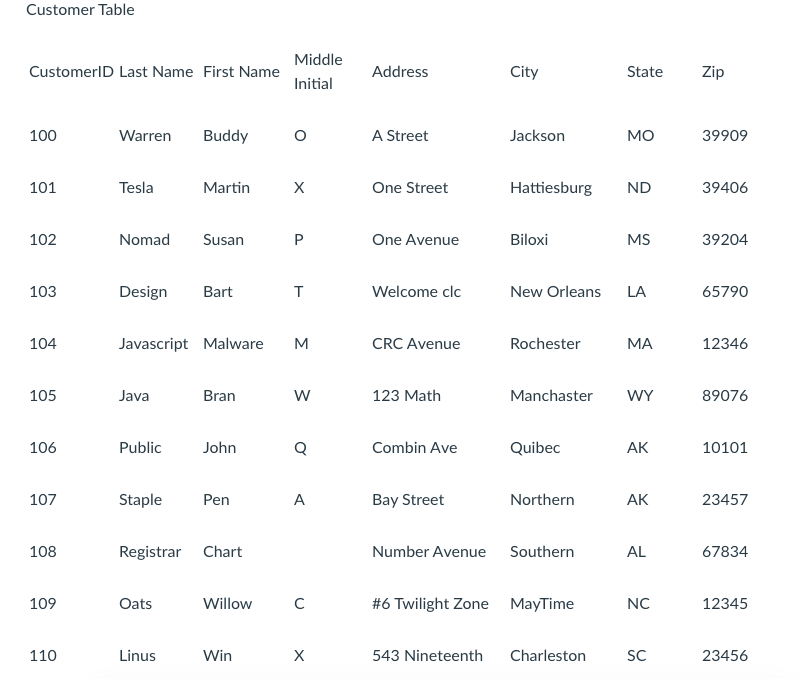

Question: Customer ID relates the two tables.For example, if I wanted to know what accounts Buddy Warren has, I would use the following process: Find Buddy

Customer ID relates the two tables.For example, if I wanted to know what accounts Buddy Warren has, I would use the following process:

- Find Buddy Warren in the Customer Table. Note his CustomerID.The number is 100 in this case.

- Go to the Account table.

- Match the CustomerId (100) with the CustomerID in the Account table.

- Doing this indicates that the customer has a Checking account with $900 in the account.

Doing the above steps has related the two tables together and given information on a customer.

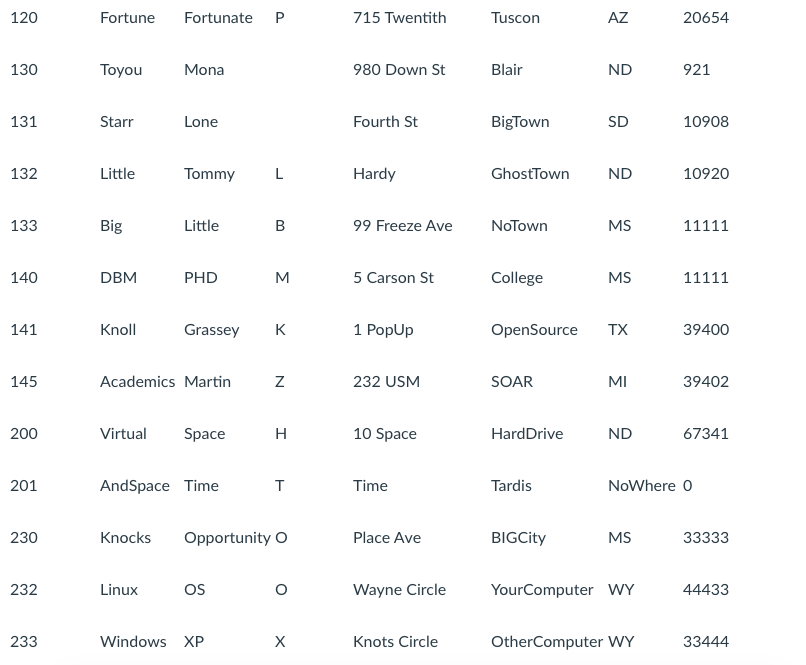

Given this data, answer the questions.

- Who lives in Mississippi?

- A. What accounts does Buddy Warren have?

- What day did he open the account?

- A. Who has a Savings Account?

- B. Who has a Checking balance greater than $10,000?

- Who has a Middle Initial of "O" and lives in "MO"?

- Who has a credit card?

- What accounts does Martin Academics have?

- What account and how much is in the account for the person with a zip code of 0 (zero)?

- Who is the person who has a checking account with $1,200.00 in the account?

Who has a Credit Card and a Savings account?

Customer Table CustomerID Last Name First Name Middle Initial Address City State Zip 100 Warren Buddy O A Street Jackson MO 39909 101 Tesla Martin X One Street Hattiesburg ND 39406 102 Nomad Susan P One Avenue Biloxi MS 39204 103 Design Bart T Welcome clc New Orleans LA 65790 104 Javascript Malware M CRC Avenue Rochester MA 12346 105 Java Bran W 123 Math Manchaster WY 89076 106 Public John Q Combin Ave Quibec AK 10101 107 Staple Pen A Bay Street Northern AK 23457 108 Registrar Chart Number Avenue Southern AL 67834 109 Oats Willow C #6 Twilight Zone MayTime NC 12345 110 Linus Win X 543 Nineteenth Charleston SC 23456\fAccount Table AccountID OpeningDate TypeOfAccount Balance CustomerID 90001 1/20/1999 Checking $1,200.00 233 90002 1/20/1999 Checking $900.00 100 90003 1/20/1999 Checking $100,000.00 145 90004 1/20/1999 Savings $20,000.00 145 90005 3/1/2000 Credit Card $200.00 145 90006 8/10/2001 Checking $400.00 101 90007 7/23/2002 Savings $200.00 103 90008 8/23/2003 Credit Card $0.00 103 90010 9/10/2005 Savings $4,000.00 102 90011 9/10/2006 Checking $100.00 103 90012 10/10/2010 Checking $934.00 132 90014 10/12/2008 Checking $123.00 12090015 9/9/2009 Checking $9,875.00 131 90020 1/5/2009 Checking $10,001.00 130 90021 3/3/2010 Checking $1.00 110 90022 5/5/2005 Checking $456.00 140 90023 1/1/2010 Checking $347.00 109 90025 1/2/2010 Checking $2,098.00 133 90100 10/5/2007 Checking $123.51 108 90111 4/4/2010 Checking $90.99 107 90112 4/4/2009 Checking $999.00 106 90113 8/23/2003 Checking $590.10 105 90114 8/23/2003 Checking $812.00 104 90115 3/1/2000 Checking $945.00 120 90116 3/1/2000 Checking $821.00 232 90117 3/1/2000 Checking $909.00 230\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts