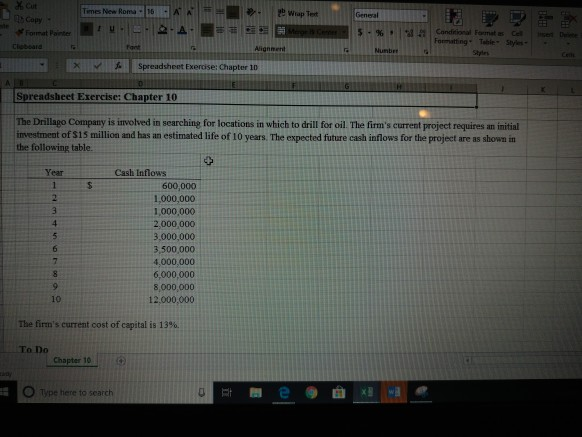

Question: Cut Copy Format Panter | $-% , l.al2 | canditioal Fatmatas Cel Formatting Table Styles Stytes Clobeard Font lignment Numbre '/ ), Spreadsheet Exercise: Chapter

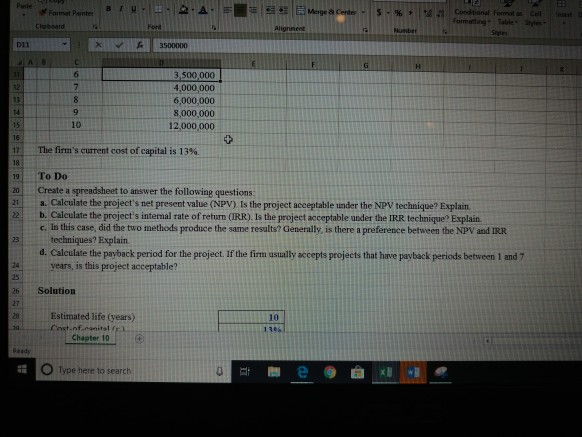

Cut Copy Format Panter | $-% , l.al2 | canditioal Fatmatas Cel Formatting Table Styles Stytes Clobeard Font lignment Numbre '/ ), Spreadsheet Exercise: Chapter 10 Spreadsheet Exercise: Chapter 10 The Drillago Company is involved in searching for locations in which to drill for oil. The firm's current project requires an initial investment of $15 million and has an estimated life of 10 years. The expected future cash inflows for the project are as shown in the following table. Year Cash Inflows 600,000 1,000,000 1,000,000 2.000,000 3,000,000 3,500,000 4.000,000 6,000,000 8,000,000 12,000,000 10 The firm's current cost of capital is 13%. To Do Chapter 10 O Type here to search Paste Conditional Foat Cell t atgTabl Claboard Alignnent D11 3,500,000 4,000,000 6,000,000 8,000,000 12,000,000 12 14 10 The firm's current cost ofcapital is 13%. To Do 20 Create a spreadsheet to answer the following questions: 21a. Calculate the project's net present value (NPV) Is the project acceptable under the NPV technique? Explain 22 b. Caleulate the project's internal rate of return (IRR). Is the project acceptable under the IRR technique? Explain c. In this case, did the two methods produce the same results? Generally, is there a preference between the NPV and IRR 23 techniques? Explain d. Calculate the payback period for the project If the firm usually accepts projets that have payback periods between 1 and 7 24years, is this project acceptable? 25 26 Solution 27 20 Estimated life (years) 10 Chapter 10 Baady O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts