Question: Cuu= Select one: 1. 309 2. 234 3. 335 4. 293 5. 207 2. Cud= Select one: 23 8 15 12 0 3. Cdd= Select

- Cuu=

Select one:

1.

309

2.

234

3.

335

4.

293

5.

207

2. Cud=

Select one:

- 23

- 8

- 15

- 12

- 0

3. Cdd=

Select one:

- 1

- 2

- 0

- 5

- 12

4. To calculate Cu, the hedge ratio is

Select one:

- 0.3

- 0.4

- 0.5

- 1

- 1.2

5. Cu=

Select one:

1.

103.344

2.

106.981

3.

111.224

4.

112.343

5.

123.456

6. To calculate Cd, the hedge ratio is

Select one:

- 0.4

- 0.7

- 0.1

- 0.3

- 0

7. Cd=

Select one:

1.

5.887

2.

2.387

3.

3.444

4.

1.398

5.

4.554

8. To calcuate C0, the hedge ratio is

Select one:

1.

0.223

2.

0.345

3.

0.983

4.

0.674

5.

0.783

9. C0=

Select one:

- 23

- 12

- 55

- 34

- 45

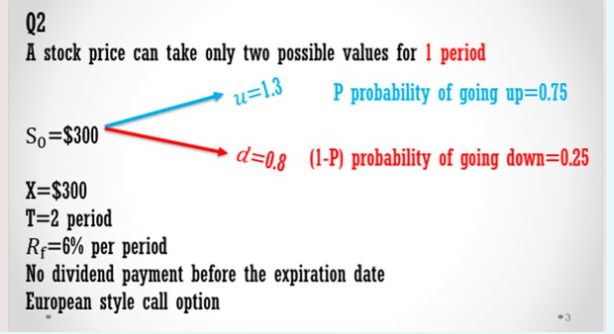

Q2 A stock price can take only two possible values for 1 period S0=$300d=1.3 P probability of going up =0.75 X=$300 T=2 period Rf=6% per period No dividend payment before the expiration date European style call option Q2 A stock price can take only two possible values for 1 period S0=$300d=1.3 P probability of going up =0.75 X=$300 T=2 period Rf=6% per period No dividend payment before the expiration date European style call option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts