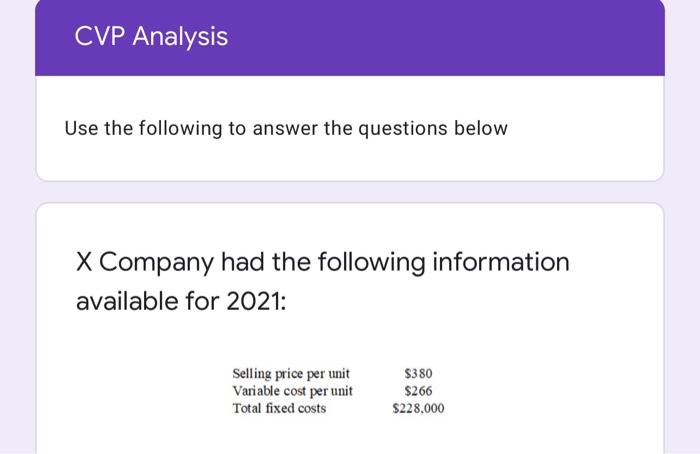

Question: CVP Analysis Use the following to answer the questions below X Company had the following information available for 2021: Selling price per unit Variable cost

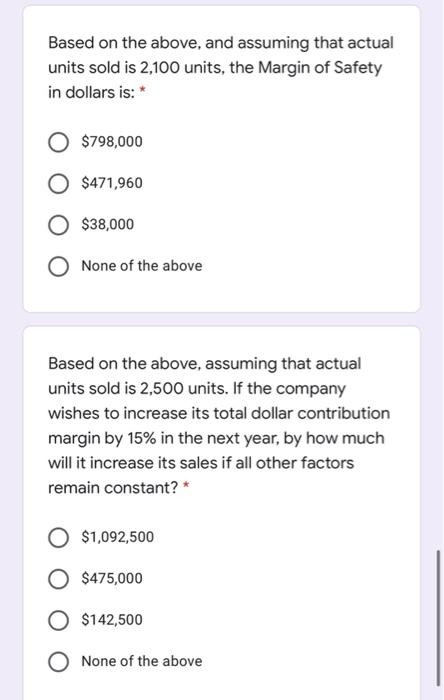

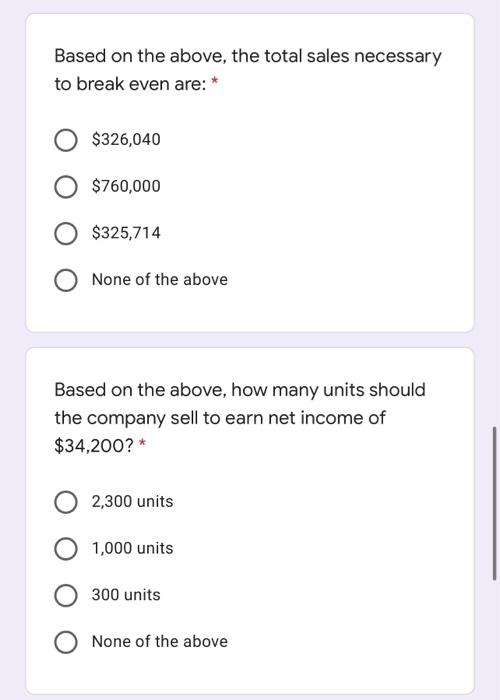

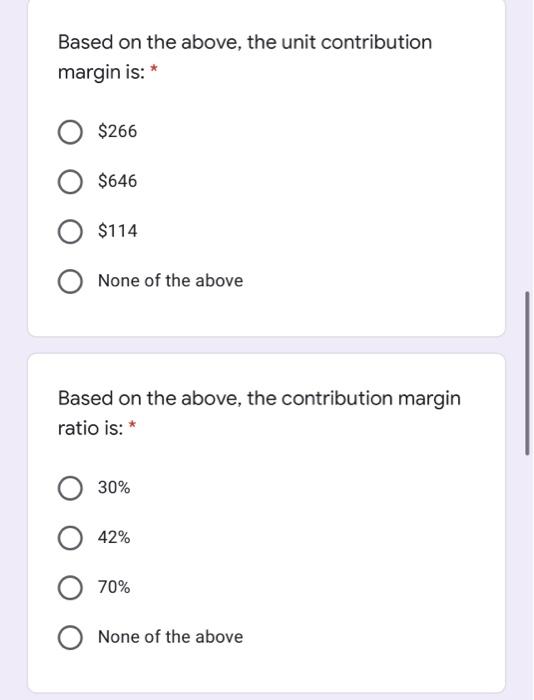

CVP Analysis Use the following to answer the questions below X Company had the following information available for 2021: Selling price per unit Variable cost per unit Total fixed costs $380 $266 $228.000 Based on the above, and assuming that actual units sold is 2,100 units, the Margin of Safety in dollars is: * $798,000 $471,960 $38,000 None of the above Based on the above, assuming that actual units sold is 2,500 units. If the company wishes to increase its total dollar contribution margin by 15% in the next year, by how much will it increase its sales if all other factors remain constant?* $1,092,500 $475,000 $142,500 O None of the above Based on the above, the total sales necessary to break even are: * $326,040 $760,000 $325,714 None of the above Based on the above, how many units should the company sell to earn net income of $34,200?* 2,300 units 1,000 units 300 units O None of the above Based on the above, the unit contribution margin is: * $266 $646 $114 None of the above Based on the above, the contribution margin ratio is: * 30% 42% 70% None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts