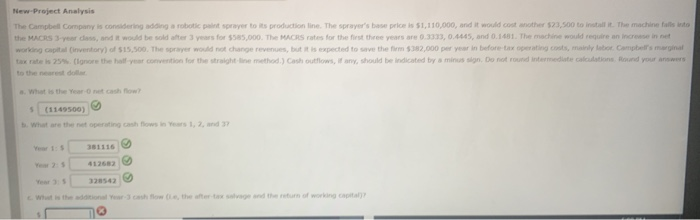

Question: c.)what is the additional year 3 cash flow d) if the project's cost of capital is 15%, what is the NPV of the project New-Project

New-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is 51,110,000, and it would cost another 523,500 to install the machine foto the MACRS 3-year class, and it would be sold after 3 years for $585,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital inventory of $15,500. The prayer would not change revenues, but it is expected to save the firm $382,000 per year in before-tex operating costs, mainly lobor. Campbell's marginal tax rates 25 Cignore the half year convention for the straight line method.) Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate actions and your answers to the nearest dollar With Yeah 5 (1149500) 381116 320542 New-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is 51,110,000, and it would cost another 523,500 to install the machine foto the MACRS 3-year class, and it would be sold after 3 years for $585,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital inventory of $15,500. The prayer would not change revenues, but it is expected to save the firm $382,000 per year in before-tex operating costs, mainly lobor. Campbell's marginal tax rates 25 Cignore the half year convention for the straight line method.) Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate actions and your answers to the nearest dollar With Yeah 5 (1149500) 381116 320542

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts