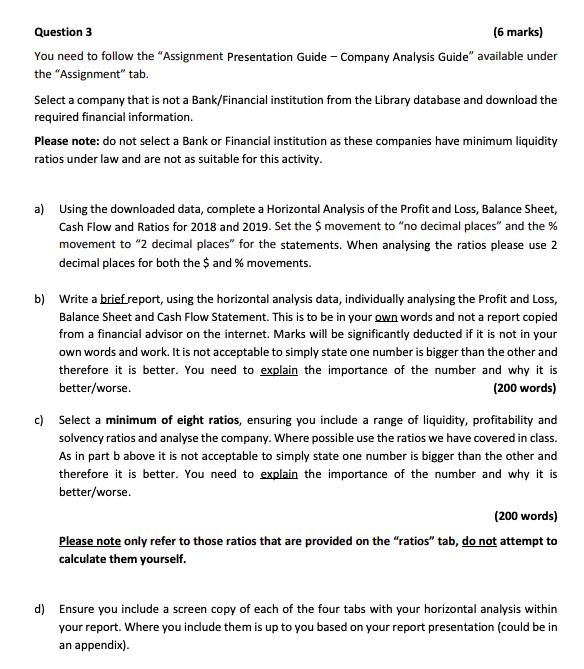

Question: D 0.00 ASX Code WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES

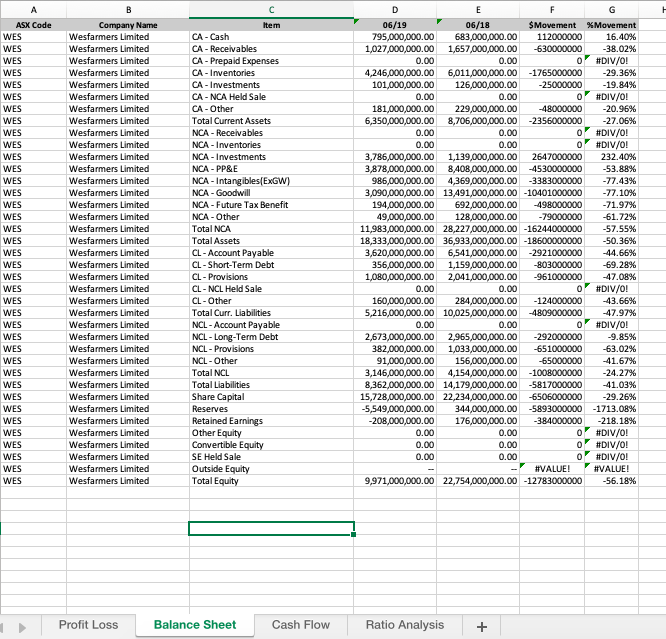

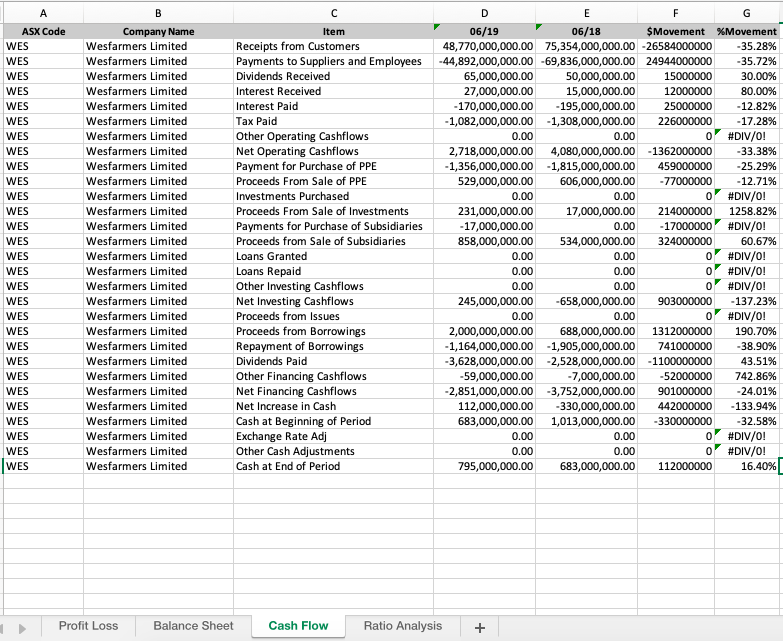

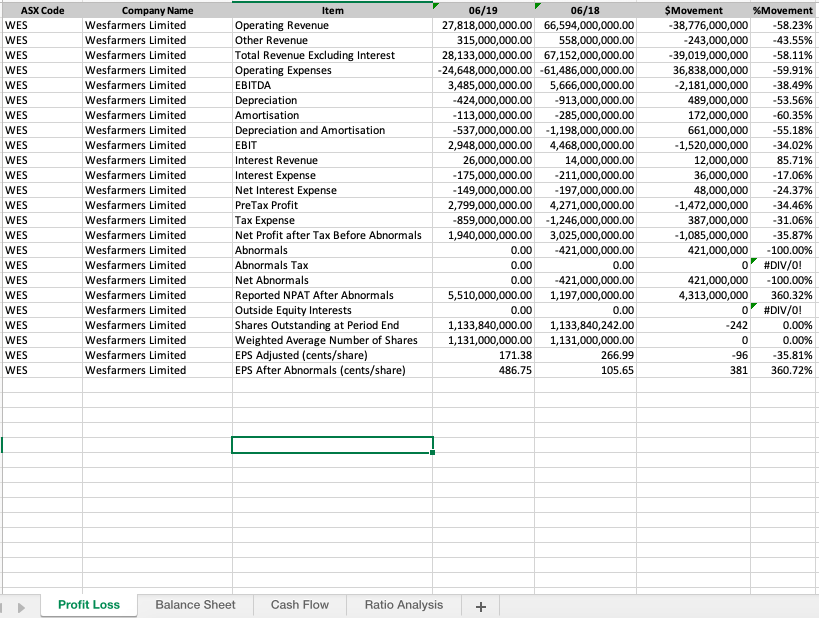

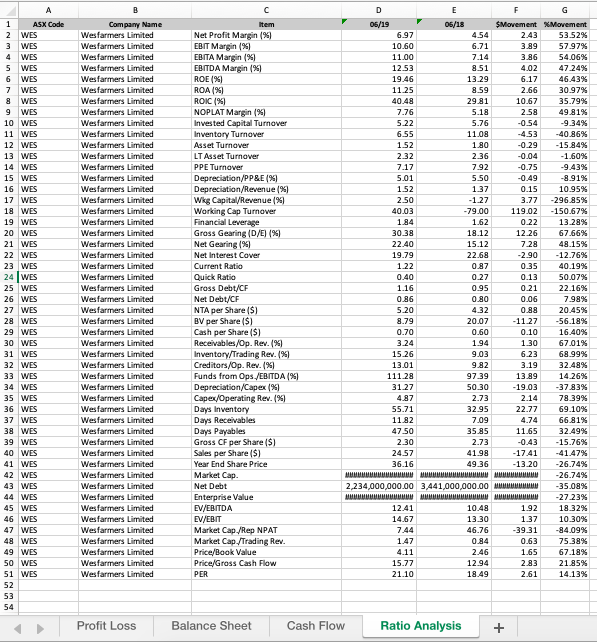

D 0.00 ASX Code WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES Company Name Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited CA-Cash CA - Receivables CA - Prepaid Expenses CA - Inventories CA - Investments CA-NCA Held Sale CA - Other Total Current Assets NCA-Receivables NCA - Inventories NCA - Investments NCA - PP&E NCA - Intangibles[ExGW) NCA - Goodwill NCA - Future Tax Benefit NCA- Other Total NCA Total Assets CL-Account Payable CL-Short-Term Debt CL - Provisions CL - NCL Held Sale CL- Other Total Curr. Liabilities NCL-Account Payable NCL-Long-Term Debt NCL-Provisions NCL-Other Total NCL Total Liabilities Share Capital Reserves Retained Earnings Other Equity Convertible Equity SE Held Sale Outside Equity Total Equity 06/19 - 06/18 $Movement 795,000,000.00 6 83,000,000.00 112000000 1,027,000,000.00 1,657,000,000.00 -630000000 0.00 0.00 0 4,246,000,000.00 6,011,000,000.00 -1765000000 101,000,000.00 126,000,000.00 -25000000 0.00 0 181,000,000.00 2 29,000,000.00 48000000 6,350,000,000.00 8,706,000,000.00 -2356000000 0.00 0.00 0 0.00 0.00 0 3,786,000,000.00 1,139,000,000.00 2647000000 3,878,000,000.00 8,408,000,000.00 4530000000 986,000,000.00 4,369,000,000.00 -3383000000 3,090,000,000.00 13,491,000,000.00 -10401000000 194,000,000.00 692,000,000.00 498000000 49,000,000.00 128,000,000.00 -79000000 11,983,000,000.00 28,227,000,000.00 -16244000000 18,333,000,000.00 36,933,000,000.00 -18600000000 3,620,000,000.00 6,541,000,000.00 -2921000000 356,000,000.00 1,159,000,000.00 -803000000 1,080,000,000.00 2,041,000,000.00 -961000000 0. 000 . 000 160,000,000.00 284,000,000.00 -124000000 5,216,000,000.00 10,025,000,000.00 -4809000000 0.00 0.00 0 2,673,000,000.00 2,965,000,000.00 -292000000 382,000,000.00 1,033,000,000.00 -651000000 91,000,000.00 156,000,000.00 65000000 3,146,000,000.00 4,154,000,000.00 -1008000000 8,362,000,000.00 14,179,000,000.00 -5817000000 15,728,000,000.00 22,234,000,000.00 -6506000000 -5,549,000,000.00 344,000,000.00 -5893000000 -208,000,000.00 176,000,000.00 -384000000 0.00 0.00 O 0.00 0.00 0 0.00 0.00 0 - #VALUE! 9,971,000,000.00 22,754,000,000.00 -12783000000 Movement 16.40% -38.02% #DIV/0! -29.36% -19.84% #DIV/0! -20.96% -27.06% #DIV/0! #DIV/0! 232.40% -53.88% -77.43% -77.10% -71.97% -61.72% -57.55% -50.36% 44.66% -69.28% -47.08% #DIV/0! 43.66% 47.97% #DIV/0! -9.85% -63.02% 41.67% -24.27% 41.03% -29.26% -1713.08% -218.18% #DIV/0! #DIV/0! #DIV/0! #VALUE! -56.18% Profit Loss Balance Sheet Cash Flow Ratio Analysis + 0.00 ASX Code WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES B Company Name Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Item Receipts from Customers Payments to Suppliers and Employees Dividends Received Interest Received Interest Paid Tax Paid Other Operating Cashflows Net Operating Cashflows Payment for Purchase of PPE Proceeds From Sale of PPE Investments Purchased Proceeds From Sale of Investments Payments for Purchase of Subsidiaries Proceeds from Sale of Subsidiaries Loans Granted Loans Repaid Other Investing Cashflows Net Investing Cashflows Proceeds from Issues Proceeds from Borrowings Repayment of Borrowings Dividends Paid Other Financing Cashflows Net Financing Cashflows Net Increase in Cash Cash at Beginning of Period Exchange Rate Adj Other Cash Adjustments Cash at End of Period F G 06/19 06/18 $Movement %Movement 48,770,000,000.00 75,354,000,000.00 -26584000000 -35.28% -44,892,000,000.00 -69,836,000,000.00 24944000000 -35.72% 65,000,000.00 50,000,000.00 15000000 30.00% 27,000,000.00 15,000,000.00 12000000 80.00% -170,000,000.00 -195,000,000.00 25000000 -12.82% -1,082,000,000.00 -1,308,000,000.00 226000000 -17.28% 0.00 0 #DIV/0! 2,718,000,000.00 4,080,000,000.00 -1362000000 -33.38% -1,356,000,000.00 1,815,000,000.00 459000000 -25.29% 529,000,000.00 606,000,000.00 -77000000 -12.71% 0.00 0.00 0 #DIV/0! 231,000,000.00 17,000,000.00 214000000 1258.82% -17,000,000.00 0.00 -17000000 #DIV/0! 858,000,000.00 534,000,000.00 324000000 60.67% 0.00 0.00 0 #DIV/0! 0.00 0.00 0 #DIV/0! 0.00 0.00 0 #DIV/0! 245,000,000.00 -658,000,000.00 903000000 - 137.23% 0.00 0.00 0 #DIV/0! 2,000,000,000.00 688,000,000.00 1312000000 190.70% -1,164,000,000.00 1,905,000,000.00 741000000 -38.90% -3,628,000,000.00 2,528,000,000.00 -1100000000 43.51% -59,000,000.00 -7,000,000.00 -52000000 742.86% -2,851,000,000.00 -3,752,000,000.00 901000000 -24.01% 112,000,000.00 -330,000,000.00 442000000 -133.94% 683,000,000.00 1,013,000,000.00 -330000000 -32.58% 0.00 0.00 0 #DIV/0! 0.00 0.00 0 #DIV/0! 795,000,000.00 683,000,000.00 112000000 16.40% Profit Loss Balance Sheet Cash Flow Ratio Analysis + 06/19 ASX Code WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES Company Name Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Item Operating Revenue Other Revenue Total Revenue Excluding Interest Operating Expenses EBITDA Depreciation Amortisation Depreciation and Amortisation EBIT Interest Revenue Interest Expense Net Interest Expense PreTax Profit Tax Expense Net Profit after Tax Before Abnormals Abnormals Abnormals Tax Net Abnormals Reported NPAT After Abnormals Outside Equity Interests Shares Outstanding at Period End Weighted Average Number of Shares EPS Adjusted (cents/share) EPS After Abnormals (cents/share) 06/18 27,818,000,000.00 66,594,000,000.00 315,000,000.00 558,000,000.00 28,133,000,000.00 67,152,000,000.00 -24,648,000,000.00 -61,486,000,000.00 3,485,000,000.00 5,666,000,000.00 -424,000,000.00 -913,000,000.00 -113,000,000.00 -285,000,000.00 -537,000,000.00 -1,198,000,000.00 2,948,000,000.00 4,468,000,000.00 26,000,000.00 14,000,000.00 -175,000,000.00 -211,000,000.00 -149,000,000.00 197,000,000.00 2,799,000,000.00 4,271,000,000.00 -859,000,000.00 -1,246,000,000.00 1,940,000,000.00 3,025,000,000.00 0.00 -421,000,000.00 0.00 0.00 0.00 -421,000,000.00 5,510,000,000.00 1,197,000,000.00 0.00 0.00 1,133,840,000.00 1,133,840,242.00 1,131,000,000.00 1,131,000,000.00 171.38 266.99 486.75 105.65 $Movement -38,776,000,000 -243,000,000 -39,019,000,000 36,838,000,000 -2,181,000,000 489,000,000 172,000,000 661,000,000 -1,520,000,000 12,000,000 36,000,000 48,000,000 -1,472,000,000 387,000,000 -1,085,000,000 421,000,000 0 421,000,000 4,313,000,000 0 -242 0 -96 381 %Movement -58.23% -43.55% -58.11% -59.91% -38.49% -53.56% -60.35% -55.18% -34.02% 85.71% -17.06% -24.37% -34.46% -31.06% -35.87% -100.00% #DIV/0! -100.00% 360.32% #DIV/0! 0.00% 0.00% -35.81% 360.72% Profit Loss Balance Sheet Cash Flow Ratio Analysis + A Item 06/18 05/19 6.97 10.60 1100 12.53 19.46 11 25 40.48 4.54 6.71 7.14 8.51 13.29 9.59 2981 Movement 2.43 3.99 3.86 4.02 6.17 2.66 10.67 7.76 2.58 5.18 5.76 5.22 6.55 152 -15 2.32 7.17 5.01 -0.54 -4.53 -0.29 -0.04 -0.75 -0.49 0.15 3.77 119.02 0.22 12.26 1.52 250 40.03 1.84 30.39 22.40 19.79 1.22 -2.90 0.35 1.80 2.36 7.92 5.50 1.37 -1.27 -79.00 1.62 19.12 15.12 22.68 0.87 0.27 0.95 0.30 4.32 20.07 0.60 1.94 9.03 9.82 9739 50.30 0.40 1 ASX Code 2 WES 3 WES 4 WES 5 WES 6 WES 7 WES WES 9 WES 10 WES 11 WES 12 WES 13 WES 14 WES 15 WES 16 WES 17 WES 18 WES 19 WES 20 WES 21 WES 22 WES 23 WES 24 WES 25 WES 26 WES 27 WES 28 WES 29 WES 30 WES 31 WES 32 WES 33 WES 34 WES 35 WES 36 WES 37 WES 38 WES 39 WES 40 WES 41 WES 42 WES 43 WES 44 WES 45 WES 46 WES 47 WES 48 WES 49 WES 50 WES 51 WES 013 Company Name Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Movement 53 52% 57.97% 54.06% 47 24% 46.43% 30.97% 35.79% 49 81% .9 34% -40 86% -15.84% -1.60% -9.43% -8.91% 10.95% 296.85% - 150.67% 13 28% 67.66% 48.15% -12.76% 40.19% 50.07% 22.16% 7.99% 20.45% -56.18% 16.40% 67.01% 68 99% 32 48% 14 26% -37 83% 78 39% 69.10% 66.31% 32 49% -15.76% -41.47% -26.74% -26.74% -35.09% -27 23% 18.32% 10.30% 0.21 Net Profit Margin (%) EBIT Margin (9) EBITA Margin % EBITDA Margin (% ROE (9 ROA1% ROK 191 NOPLAT Margin (%) Invested Capital Turnover Inventory Turnover Asset Turnover LT Asset Turnover PPE Turnover Depreciation/PP&E % Depreciation/Revenue (% Wig Capital Revenue (9) Working Cap Turnover Financial Leverage Gross Gearing (D/E) (9) Net Gearing (%) Net Interest Cover Current Ratio Quick Ratio Gross Debt/CF Net Debt/CF NTA per Share ($) BV per Share ($) Cash per Share ($) Receivables/Op. Rev. (%) Inventory/Trading Rev. (%) Creditors/Op. Rev. (%) Funds from Ops./EBITDA%) Depreciation/Capex (%) Caped/Operating Rev. (9) Days Inventory Days Receivables Days Payables Gross CF per Share ($) Sales per Share ($) Year End Share Price Market Cap. Net Debt Enterprise Value EV/EBITDA EV/EBIT Market Cap./Rep NPAT Market Cap./Trading Rev. Price/Book Value Price/Gross Cash Flow 1 16 0.86 5.20 9.79 0.70 3.24 15.26 13.01 111.28 31.27 487 55.71 1182 47.50 2.30 24.57 36.16 0.06 0.83 -11 27 0.10 1 30 6.23 3.19 13.89 -19.03 2.14 22.77 4.74 11.65 2.73 32.95 7.09 35.85 2.73 41 98 49.36 -17.41 13.20 2,234,000,000.00 3.441.000.000.00 MMMMMMMMMMM 192 14.09% 12.41 14.67 7.44 147 4.11 15.77 21.10 10.43 13.30 46.76 0.84 2.46 12.94 1849 -3931 0.63 1.65 2.83 2.61 75.38% 67.18% 21 85% 14.13% Profit Loss Balance Sheet Cash Flow Ratio Analysis +. Question 3 (6 marks) You need to follow the "Assignment Presentation Guide - Company Analysis Guide" available under the "Assignment" tab. Select a company that is not a Bank/Financial institution from the Library database and download the required financial information. Please note: do not select a Bank or Financial institution as these companies have minimum liquidity ratios under law and are not as suitable for this activity. a) Using the downloaded data, complete a Horizontal Analysis of the Profit and Loss, Balance Sheet, Cash Flow and Ratios for 2018 and 2019. Set the $ movement to "no decimal places" and the % movement to "2 decimal places for the statements. When analysing the ratios please use 2 decimal places for both the $ and % movements. b) Write a brief report, using the horizontal analysis data, individually analysing the Profit and Loss, Balance Sheet and Cash Flow Statement. This is to be in your own words and not a report copied from a financial advisor on the internet. Marks will be significantly deducted if it is not in your own words and work. It is not acceptable to simply state one number is bigger than the other and therefore it is better. You need to explain the importance of the number and why it is better/worse. (200 words) Select a minimum of eight ratios, ensuring you include a range of liquidity, profitability and solvency ratios and analyse the company. Where possible use the ratios we have covered in class. As in part b above it is not acceptable to simply state one number is bigger than the other and therefore it is better. You need to explain the importance of the number and why it is better/worse. (200 words) Please note only refer to those ratios that are provided on the "ratios" tab, do not attempt to calculate them yourself. d) Ensure you include a screen copy of each of the four tabs with your horizontal analysis within your report. Where you include them is up to you based on your report presentation (could be in an appendix). D 0.00 ASX Code WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES Company Name Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited CA-Cash CA - Receivables CA - Prepaid Expenses CA - Inventories CA - Investments CA-NCA Held Sale CA - Other Total Current Assets NCA-Receivables NCA - Inventories NCA - Investments NCA - PP&E NCA - Intangibles[ExGW) NCA - Goodwill NCA - Future Tax Benefit NCA- Other Total NCA Total Assets CL-Account Payable CL-Short-Term Debt CL - Provisions CL - NCL Held Sale CL- Other Total Curr. Liabilities NCL-Account Payable NCL-Long-Term Debt NCL-Provisions NCL-Other Total NCL Total Liabilities Share Capital Reserves Retained Earnings Other Equity Convertible Equity SE Held Sale Outside Equity Total Equity 06/19 - 06/18 $Movement 795,000,000.00 6 83,000,000.00 112000000 1,027,000,000.00 1,657,000,000.00 -630000000 0.00 0.00 0 4,246,000,000.00 6,011,000,000.00 -1765000000 101,000,000.00 126,000,000.00 -25000000 0.00 0 181,000,000.00 2 29,000,000.00 48000000 6,350,000,000.00 8,706,000,000.00 -2356000000 0.00 0.00 0 0.00 0.00 0 3,786,000,000.00 1,139,000,000.00 2647000000 3,878,000,000.00 8,408,000,000.00 4530000000 986,000,000.00 4,369,000,000.00 -3383000000 3,090,000,000.00 13,491,000,000.00 -10401000000 194,000,000.00 692,000,000.00 498000000 49,000,000.00 128,000,000.00 -79000000 11,983,000,000.00 28,227,000,000.00 -16244000000 18,333,000,000.00 36,933,000,000.00 -18600000000 3,620,000,000.00 6,541,000,000.00 -2921000000 356,000,000.00 1,159,000,000.00 -803000000 1,080,000,000.00 2,041,000,000.00 -961000000 0. 000 . 000 160,000,000.00 284,000,000.00 -124000000 5,216,000,000.00 10,025,000,000.00 -4809000000 0.00 0.00 0 2,673,000,000.00 2,965,000,000.00 -292000000 382,000,000.00 1,033,000,000.00 -651000000 91,000,000.00 156,000,000.00 65000000 3,146,000,000.00 4,154,000,000.00 -1008000000 8,362,000,000.00 14,179,000,000.00 -5817000000 15,728,000,000.00 22,234,000,000.00 -6506000000 -5,549,000,000.00 344,000,000.00 -5893000000 -208,000,000.00 176,000,000.00 -384000000 0.00 0.00 O 0.00 0.00 0 0.00 0.00 0 - #VALUE! 9,971,000,000.00 22,754,000,000.00 -12783000000 Movement 16.40% -38.02% #DIV/0! -29.36% -19.84% #DIV/0! -20.96% -27.06% #DIV/0! #DIV/0! 232.40% -53.88% -77.43% -77.10% -71.97% -61.72% -57.55% -50.36% 44.66% -69.28% -47.08% #DIV/0! 43.66% 47.97% #DIV/0! -9.85% -63.02% 41.67% -24.27% 41.03% -29.26% -1713.08% -218.18% #DIV/0! #DIV/0! #DIV/0! #VALUE! -56.18% Profit Loss Balance Sheet Cash Flow Ratio Analysis + 0.00 ASX Code WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES B Company Name Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Item Receipts from Customers Payments to Suppliers and Employees Dividends Received Interest Received Interest Paid Tax Paid Other Operating Cashflows Net Operating Cashflows Payment for Purchase of PPE Proceeds From Sale of PPE Investments Purchased Proceeds From Sale of Investments Payments for Purchase of Subsidiaries Proceeds from Sale of Subsidiaries Loans Granted Loans Repaid Other Investing Cashflows Net Investing Cashflows Proceeds from Issues Proceeds from Borrowings Repayment of Borrowings Dividends Paid Other Financing Cashflows Net Financing Cashflows Net Increase in Cash Cash at Beginning of Period Exchange Rate Adj Other Cash Adjustments Cash at End of Period F G 06/19 06/18 $Movement %Movement 48,770,000,000.00 75,354,000,000.00 -26584000000 -35.28% -44,892,000,000.00 -69,836,000,000.00 24944000000 -35.72% 65,000,000.00 50,000,000.00 15000000 30.00% 27,000,000.00 15,000,000.00 12000000 80.00% -170,000,000.00 -195,000,000.00 25000000 -12.82% -1,082,000,000.00 -1,308,000,000.00 226000000 -17.28% 0.00 0 #DIV/0! 2,718,000,000.00 4,080,000,000.00 -1362000000 -33.38% -1,356,000,000.00 1,815,000,000.00 459000000 -25.29% 529,000,000.00 606,000,000.00 -77000000 -12.71% 0.00 0.00 0 #DIV/0! 231,000,000.00 17,000,000.00 214000000 1258.82% -17,000,000.00 0.00 -17000000 #DIV/0! 858,000,000.00 534,000,000.00 324000000 60.67% 0.00 0.00 0 #DIV/0! 0.00 0.00 0 #DIV/0! 0.00 0.00 0 #DIV/0! 245,000,000.00 -658,000,000.00 903000000 - 137.23% 0.00 0.00 0 #DIV/0! 2,000,000,000.00 688,000,000.00 1312000000 190.70% -1,164,000,000.00 1,905,000,000.00 741000000 -38.90% -3,628,000,000.00 2,528,000,000.00 -1100000000 43.51% -59,000,000.00 -7,000,000.00 -52000000 742.86% -2,851,000,000.00 -3,752,000,000.00 901000000 -24.01% 112,000,000.00 -330,000,000.00 442000000 -133.94% 683,000,000.00 1,013,000,000.00 -330000000 -32.58% 0.00 0.00 0 #DIV/0! 0.00 0.00 0 #DIV/0! 795,000,000.00 683,000,000.00 112000000 16.40% Profit Loss Balance Sheet Cash Flow Ratio Analysis + 06/19 ASX Code WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES WES Company Name Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Item Operating Revenue Other Revenue Total Revenue Excluding Interest Operating Expenses EBITDA Depreciation Amortisation Depreciation and Amortisation EBIT Interest Revenue Interest Expense Net Interest Expense PreTax Profit Tax Expense Net Profit after Tax Before Abnormals Abnormals Abnormals Tax Net Abnormals Reported NPAT After Abnormals Outside Equity Interests Shares Outstanding at Period End Weighted Average Number of Shares EPS Adjusted (cents/share) EPS After Abnormals (cents/share) 06/18 27,818,000,000.00 66,594,000,000.00 315,000,000.00 558,000,000.00 28,133,000,000.00 67,152,000,000.00 -24,648,000,000.00 -61,486,000,000.00 3,485,000,000.00 5,666,000,000.00 -424,000,000.00 -913,000,000.00 -113,000,000.00 -285,000,000.00 -537,000,000.00 -1,198,000,000.00 2,948,000,000.00 4,468,000,000.00 26,000,000.00 14,000,000.00 -175,000,000.00 -211,000,000.00 -149,000,000.00 197,000,000.00 2,799,000,000.00 4,271,000,000.00 -859,000,000.00 -1,246,000,000.00 1,940,000,000.00 3,025,000,000.00 0.00 -421,000,000.00 0.00 0.00 0.00 -421,000,000.00 5,510,000,000.00 1,197,000,000.00 0.00 0.00 1,133,840,000.00 1,133,840,242.00 1,131,000,000.00 1,131,000,000.00 171.38 266.99 486.75 105.65 $Movement -38,776,000,000 -243,000,000 -39,019,000,000 36,838,000,000 -2,181,000,000 489,000,000 172,000,000 661,000,000 -1,520,000,000 12,000,000 36,000,000 48,000,000 -1,472,000,000 387,000,000 -1,085,000,000 421,000,000 0 421,000,000 4,313,000,000 0 -242 0 -96 381 %Movement -58.23% -43.55% -58.11% -59.91% -38.49% -53.56% -60.35% -55.18% -34.02% 85.71% -17.06% -24.37% -34.46% -31.06% -35.87% -100.00% #DIV/0! -100.00% 360.32% #DIV/0! 0.00% 0.00% -35.81% 360.72% Profit Loss Balance Sheet Cash Flow Ratio Analysis + A Item 06/18 05/19 6.97 10.60 1100 12.53 19.46 11 25 40.48 4.54 6.71 7.14 8.51 13.29 9.59 2981 Movement 2.43 3.99 3.86 4.02 6.17 2.66 10.67 7.76 2.58 5.18 5.76 5.22 6.55 152 -15 2.32 7.17 5.01 -0.54 -4.53 -0.29 -0.04 -0.75 -0.49 0.15 3.77 119.02 0.22 12.26 1.52 250 40.03 1.84 30.39 22.40 19.79 1.22 -2.90 0.35 1.80 2.36 7.92 5.50 1.37 -1.27 -79.00 1.62 19.12 15.12 22.68 0.87 0.27 0.95 0.30 4.32 20.07 0.60 1.94 9.03 9.82 9739 50.30 0.40 1 ASX Code 2 WES 3 WES 4 WES 5 WES 6 WES 7 WES WES 9 WES 10 WES 11 WES 12 WES 13 WES 14 WES 15 WES 16 WES 17 WES 18 WES 19 WES 20 WES 21 WES 22 WES 23 WES 24 WES 25 WES 26 WES 27 WES 28 WES 29 WES 30 WES 31 WES 32 WES 33 WES 34 WES 35 WES 36 WES 37 WES 38 WES 39 WES 40 WES 41 WES 42 WES 43 WES 44 WES 45 WES 46 WES 47 WES 48 WES 49 WES 50 WES 51 WES 013 Company Name Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Wesfarmers Limited Movement 53 52% 57.97% 54.06% 47 24% 46.43% 30.97% 35.79% 49 81% .9 34% -40 86% -15.84% -1.60% -9.43% -8.91% 10.95% 296.85% - 150.67% 13 28% 67.66% 48.15% -12.76% 40.19% 50.07% 22.16% 7.99% 20.45% -56.18% 16.40% 67.01% 68 99% 32 48% 14 26% -37 83% 78 39% 69.10% 66.31% 32 49% -15.76% -41.47% -26.74% -26.74% -35.09% -27 23% 18.32% 10.30% 0.21 Net Profit Margin (%) EBIT Margin (9) EBITA Margin % EBITDA Margin (% ROE (9 ROA1% ROK 191 NOPLAT Margin (%) Invested Capital Turnover Inventory Turnover Asset Turnover LT Asset Turnover PPE Turnover Depreciation/PP&E % Depreciation/Revenue (% Wig Capital Revenue (9) Working Cap Turnover Financial Leverage Gross Gearing (D/E) (9) Net Gearing (%) Net Interest Cover Current Ratio Quick Ratio Gross Debt/CF Net Debt/CF NTA per Share ($) BV per Share ($) Cash per Share ($) Receivables/Op. Rev. (%) Inventory/Trading Rev. (%) Creditors/Op. Rev. (%) Funds from Ops./EBITDA%) Depreciation/Capex (%) Caped/Operating Rev. (9) Days Inventory Days Receivables Days Payables Gross CF per Share ($) Sales per Share ($) Year End Share Price Market Cap. Net Debt Enterprise Value EV/EBITDA EV/EBIT Market Cap./Rep NPAT Market Cap./Trading Rev. Price/Book Value Price/Gross Cash Flow 1 16 0.86 5.20 9.79 0.70 3.24 15.26 13.01 111.28 31.27 487 55.71 1182 47.50 2.30 24.57 36.16 0.06 0.83 -11 27 0.10 1 30 6.23 3.19 13.89 -19.03 2.14 22.77 4.74 11.65 2.73 32.95 7.09 35.85 2.73 41 98 49.36 -17.41 13.20 2,234,000,000.00 3.441.000.000.00 MMMMMMMMMMM 192 14.09% 12.41 14.67 7.44 147 4.11 15.77 21.10 10.43 13.30 46.76 0.84 2.46 12.94 1849 -3931 0.63 1.65 2.83 2.61 75.38% 67.18% 21 85% 14.13% Profit Loss Balance Sheet Cash Flow Ratio Analysis +. Question 3 (6 marks) You need to follow the "Assignment Presentation Guide - Company Analysis Guide" available under the "Assignment" tab. Select a company that is not a Bank/Financial institution from the Library database and download the required financial information. Please note: do not select a Bank or Financial institution as these companies have minimum liquidity ratios under law and are not as suitable for this activity. a) Using the downloaded data, complete a Horizontal Analysis of the Profit and Loss, Balance Sheet, Cash Flow and Ratios for 2018 and 2019. Set the $ movement to "no decimal places" and the % movement to "2 decimal places for the statements. When analysing the ratios please use 2 decimal places for both the $ and % movements. b) Write a brief report, using the horizontal analysis data, individually analysing the Profit and Loss, Balance Sheet and Cash Flow Statement. This is to be in your own words and not a report copied from a financial advisor on the internet. Marks will be significantly deducted if it is not in your own words and work. It is not acceptable to simply state one number is bigger than the other and therefore it is better. You need to explain the importance of the number and why it is better/worse. (200 words) Select a minimum of eight ratios, ensuring you include a range of liquidity, profitability and solvency ratios and analyse the company. Where possible use the ratios we have covered in class. As in part b above it is not acceptable to simply state one number is bigger than the other and therefore it is better. You need to explain the importance of the number and why it is better/worse. (200 words) Please note only refer to those ratios that are provided on the "ratios" tab, do not attempt to calculate them yourself. d) Ensure you include a screen copy of each of the four tabs with your horizontal analysis within your report. Where you include them is up to you based on your report presentation (could be in an appendix)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts