Question: d) 0.7920 E)0.9024 For a stock, you are given: 1) The current stock price is 50 ii) At the end of three months the stock

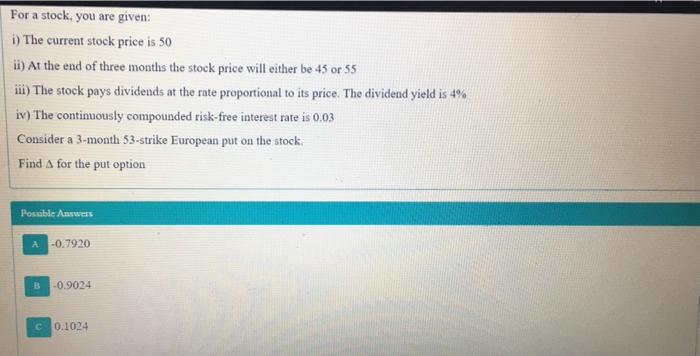

For a stock, you are given: 1) The current stock price is 50 ii) At the end of three months the stock price will either be 45 or 55 iii) The stock pays dividends at the rate proportional to its price. The dividend yield is 4% iv) The continuously compounded risk-free interest rate is 0.03 Consider a 3-month 53-strike European put on the stock Find A for the put option Posuble Answers A-0.7920 -0.9024 C 0.1024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts