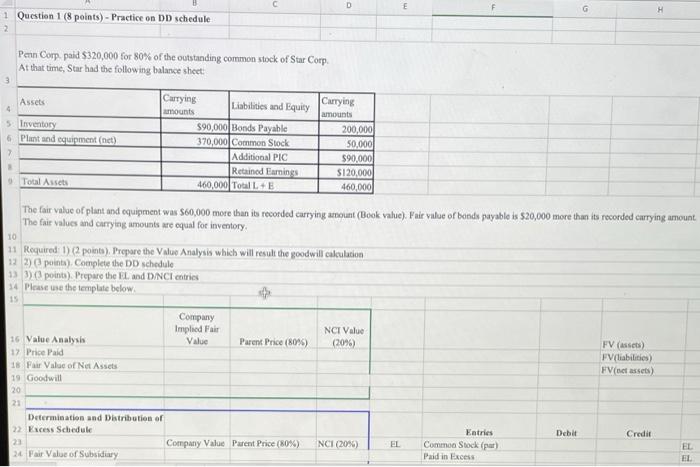

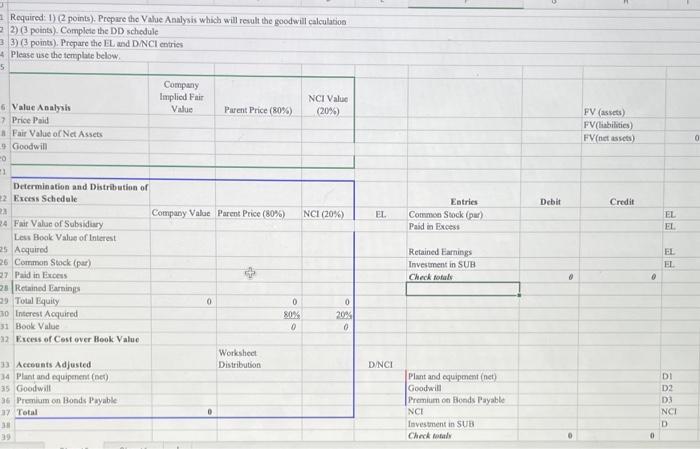

Question: D 1 Question 1 (8 points) - Practice on DD schedule 2 Penn Corp. paid $320,000 for 80% of the outstanding common stock of Star

D 1 Question 1 (8 points) - Practice on DD schedule 2 Penn Corp. paid $320,000 for 80% of the outstanding common stock of Star Corp At that time, Star had the following balance sheet 3 Assets 5. Inventory 6 Plant and equipment (net) Carrying Liabilities and Equity amounts $90,000 Bonds Payable 370,000 Common Stock Additional PIC Retained Earnings 460,000 Total L E Carrying amounts 200,000 50,000 $90,000 $120,000 460,000 Total Assets The fair value of plant and oquipment was $60,000 more than is recorded carrying amount (Book value). Fair value or bonds payable is $20,000 more than its recorded currying amount The fair values and carrying amounts are equal for inventory 10 11 Required: 1) (2 points). Prepare the Value Analysis which will result the goodwill calculation 122) points). Complete the DD schedule 13 3 points). Prepare the land DINCI entries 4 Please use the template below 15 Company Implied Fair Value Parent Price (80%) NCI Value (20%) FV (assets) FVliabilities FV (act assets) 16 Value Analysis 12 Price Paid 18 Pair Value of Net Assets 19 Goodwill 20 21 Determination and Distribution of 22 Excess Schedule Debit Credit Company Value Parent Price (80%) NCI (20%) EL Entries Common Stock (par) Paid in Excess 24 Fair Value of Subsidiary FL EL FV (sets) FViabilities) FV (niet assets) 0 Debit Credit EL Required: 1) (2 points). Prepare the Value Analysis which will result the goodwill calculation 2) points). Complete the DD schedule 33) (3 points). Prepare the Land DINCI entries Please use the template below 5 Company Implied Fair NCI Value 6 Value Analysis Value Parent Price (80%) (20%) Price Paid Fair Value of Net Assets Goodwill 0 1 Determination and Distribution of 2 Excess Schedule 23 Company Value Parent Price (80%) NCI (20%) 24 Pair Value of Subsidiary Less Book Value of Interest 5 Acquired 26 Common Stock (par) 27 Paid in Excess 2 Retained Earnings 29 Total Equity 0 0 0 30 Interest Acquired 80% 20% 31 Book Value 0 0 12 Excess of Cost over Hook Value Worksheet 33 Accounts Adjusted Distribution 34 Plant and equipment (net) 35 Goodwill 36 Premium on Bonds Payable 37 Total 0 3 39 Entries Common Stock (par) Paid in Excess FL FL Retained Earnings Investment in SUH Check fotos BL EL 0 D/NCI Plant and equipment (net) Goodwill Premium on Bonds Payable NCI Investment in SUB Check to DI D2 D3 NCI D 0 D 1 Question 1 (8 points) - Practice on DD schedule 2 Penn Corp. paid $320,000 for 80% of the outstanding common stock of Star Corp At that time, Star had the following balance sheet 3 Assets 5. Inventory 6 Plant and equipment (net) Carrying Liabilities and Equity amounts $90,000 Bonds Payable 370,000 Common Stock Additional PIC Retained Earnings 460,000 Total L E Carrying amounts 200,000 50,000 $90,000 $120,000 460,000 Total Assets The fair value of plant and oquipment was $60,000 more than is recorded carrying amount (Book value). Fair value or bonds payable is $20,000 more than its recorded currying amount The fair values and carrying amounts are equal for inventory 10 11 Required: 1) (2 points). Prepare the Value Analysis which will result the goodwill calculation 122) points). Complete the DD schedule 13 3 points). Prepare the land DINCI entries 4 Please use the template below 15 Company Implied Fair Value Parent Price (80%) NCI Value (20%) FV (assets) FVliabilities FV (act assets) 16 Value Analysis 12 Price Paid 18 Pair Value of Net Assets 19 Goodwill 20 21 Determination and Distribution of 22 Excess Schedule Debit Credit Company Value Parent Price (80%) NCI (20%) EL Entries Common Stock (par) Paid in Excess 24 Fair Value of Subsidiary FL EL FV (sets) FViabilities) FV (niet assets) 0 Debit Credit EL Required: 1) (2 points). Prepare the Value Analysis which will result the goodwill calculation 2) points). Complete the DD schedule 33) (3 points). Prepare the Land DINCI entries Please use the template below 5 Company Implied Fair NCI Value 6 Value Analysis Value Parent Price (80%) (20%) Price Paid Fair Value of Net Assets Goodwill 0 1 Determination and Distribution of 2 Excess Schedule 23 Company Value Parent Price (80%) NCI (20%) 24 Pair Value of Subsidiary Less Book Value of Interest 5 Acquired 26 Common Stock (par) 27 Paid in Excess 2 Retained Earnings 29 Total Equity 0 0 0 30 Interest Acquired 80% 20% 31 Book Value 0 0 12 Excess of Cost over Hook Value Worksheet 33 Accounts Adjusted Distribution 34 Plant and equipment (net) 35 Goodwill 36 Premium on Bonds Payable 37 Total 0 3 39 Entries Common Stock (par) Paid in Excess FL FL Retained Earnings Investment in SUH Check fotos BL EL 0 D/NCI Plant and equipment (net) Goodwill Premium on Bonds Payable NCI Investment in SUB Check to DI D2 D3 NCI D 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts