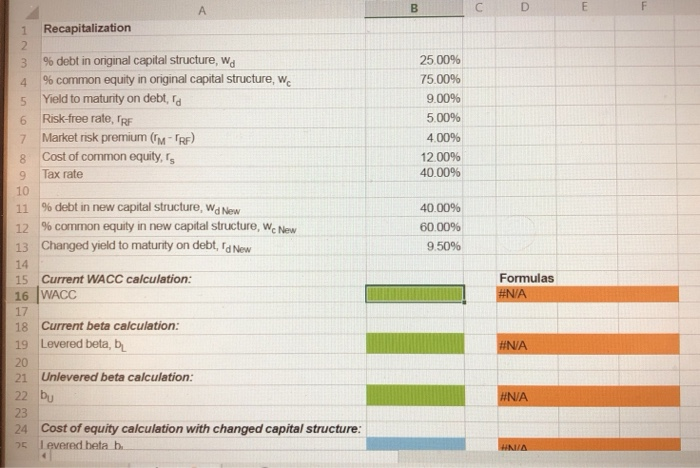

Question: D 1 Recapitalization 3 4 5 6 7 % debt in original capital structure, Wd % common equity in original capital structure, w Yield to

D 1 Recapitalization 3 4 5 6 7 % debt in original capital structure, Wd % common equity in original capital structure, w Yield to maturity on debt, d Risk-free rate, TRE Market risk premium (M RF) Cost of common equity.rs Tax rate 25.00% 75.00% 9.00% 5.00% 4.00% 12.00% 40.00% 10 11 % debt in new capital structure, Wd New 12 % common equity in new capital structure, W. New Changed yield to maturity on debt, Id New 14 15 Current WACC calculation: 16 WACC 40.00% 60.00% 9.50% 13 Formulas #N/A 18 Current beta calculation: 19 Levered beta, bu #NA 21 Unlevered beta calculation: 22 bu #NA Cost of equity calculation with changed capital structure 75 levered beta bu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts