Question: d. 12% nominal rate, monthly compounding 2. You plan to invest an amount of money in five-year certificate of deposit (CD) at your bank. The

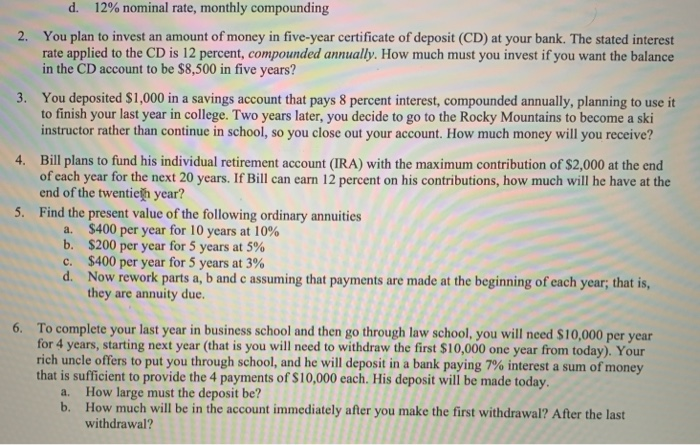

d. 12% nominal rate, monthly compounding 2. You plan to invest an amount of money in five-year certificate of deposit (CD) at your bank. The stated interest rate applied to the CD is 12 percent, compounded annually. How much must you invest if you want the balance in the CD account to be $8,500 in five years? 3. You deposited $1,000 in a savings account that pays 8 percent interest, compounded annually, planning to use it to finish your last year in college. Two years later, you decide to go to the Rocky Mountains to become a ski instructor rather than continue in school, so you close out your account. How much money will you receive? 4. Bill plans to fund his individual retirement account (IRA) with the maximum contribution of $2,000 at the end of each year for the next 20 years. If Bill can earn 12 percent on his contributions, how much will he have at the end of the twentieth year? 5. Find the present value of the following ordinary annuities a $400 per year for 10 years at 10% b. $200 per year for 5 years at 5% c. $400 per year for 5 years at 3% d. Now rework parts a, b and c assuming that payments are made at the beginning of each year, that is, they are annuity due. 6. To complete your last year in business school and then go through law school, you will need $10,000 per year for 4 years, starting next year (that is you will need to withdraw the first $10,000 one year from today). Your rich uncle offers to put you through school, and he will deposit in a bank paying 7% interest a sum of money that is sufficient to provide the 4 payments of $10,000 each. His deposit will be made today. a. How large must the deposit be? b. How much will be in the account immediately after you make the first withdrawal? After the last withdrawal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts