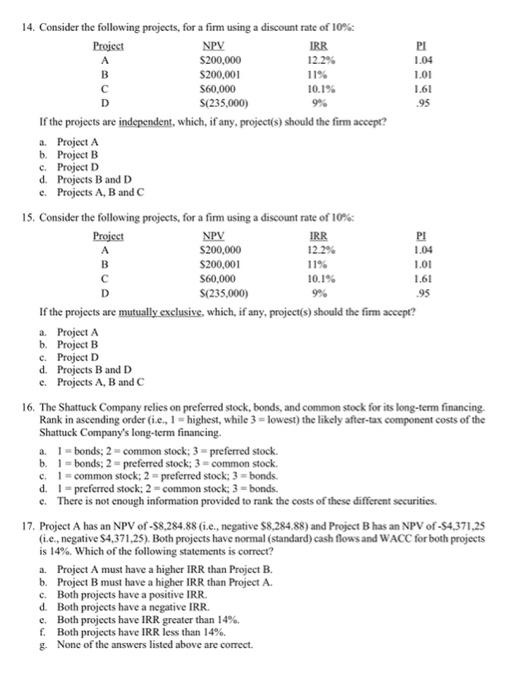

Question: D 14. Consider the following projects, for a fim using a discount rate of 10% Project NPV IRR PI $200,000 12.2% 1.04 B $200,001 11%

D 14. Consider the following projects, for a fim using a discount rate of 10% Project NPV IRR PI $200,000 12.2% 1.04 B $200,001 11% 1.01 S60,000 10.1% 1.61 S(235,000) 9% .95 If the projects are independent, which, if any, project(s) should the firm accept? a. Project A b. Project B c. Project D d. Projects B and D c. Projects A, B and C 15. Consider the following projects, for a fim using a discount rate of 10%: Project NPV IRR PI A $200,000 12.2% 1.04 B $200,001 1.01 $60,000 10.1% 1.61 D $(235,000) 9% 95 If the projects are mutually exclusive, which, if any, project(s) should the firm accept? a. Project A b. Project B c. Project D d. Projects B and D e. Projects A, B and C 16. The Shattuck Company relies on preferred stock, bonds, and common stock for its long-term financing Rank in ascending order (ie, 1 highest, while 3 = lowest) the likely after-tax component costs of the Shattuck Company's long-term financing. a 1 - bonds; 2 common stock: 3 = preferred stock. b. 1 - bonds; 2 = preferred stock: 3 common stock 1 common stock: 2 preferred stock: 3 = bonds. d. 1 - preferred stock: 2 - common stock: 3 - bonds. c. There is not enough information provided to rank the costs of these different securities, 17. Project A has an NPV of-S8.284.88 (i.e., negative $8,284,88) and Project Bhas an NPV of -S4,371,25 (.e negative $4,371.25). Both projects have normal (standard) cash flows and WACC for both projects is 14%. Which of the following statements is correct? a. Project A must have a higher IRR than Project B. b. Project B must have a higher IRR than Project A. c. Both projects have a positive IRR. d. Both projects have a negative IRR. c. Both projects have IRR greater than 14%. f. Both projects have IRR less than 14%. None of the answers listed above are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts