Question: D (20 points) A U.S.-based, digital advertising firm is considering a new venture in Brno, Czech Republic to serve as its 2 European hub. The

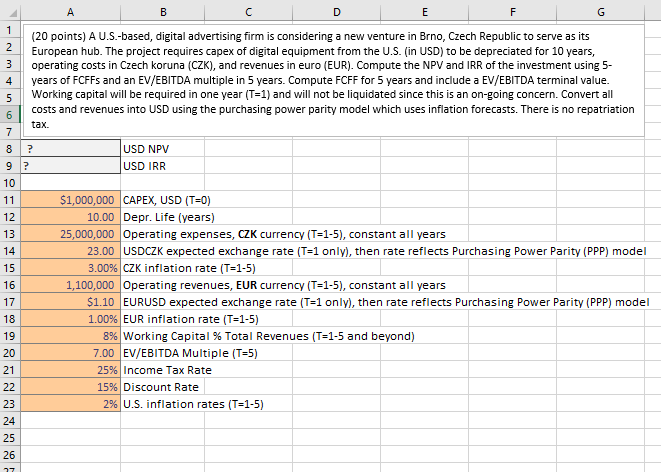

D (20 points) A U.S.-based, digital advertising firm is considering a new venture in Brno, Czech Republic to serve as its 2 European hub. The project requires capex of digital equipment from the U.S. (in USD) to be depreciated for 10 years, operating costs in Czech koruna (CZK), and revenues in euro (EUR). Compute the NPV and IRR of the investment using 5- years of FCFFS and an EV/EBITDA multiple in 5 years. Compute FCFF for 5 years and include a EV/EBITDA terminal value. Working capital will be required in one year (T=1) and will not be liquidated since this is an on-going concern. Convert all costs and revenues into USD using the purchasing power parity model which uses inflation forecasts. There is no repatriation 6. tax. USD NPV USD IRR 10 $1,000,000 CAPEX, USD (T=0) 10.00 Depr. Life (years) 25,000,000 Operating expenses, CZK currency (T=1-5), constant all years 23.00 USDCZK expected exchange rate (T=1 only), then rate reflects Purchasing Power Parity (PPP) model 3.00% CZK inflation rate (T=1-5) 11 12 13 14 15 1,100,000 Operating revenues, EUR currency (T=1-5), constant all years $1.10 EURUSD expected exchange rate (T=1 only), then rate reflects Purchasing Power Parity (PPP) model 16 17 1.00% EUR inflation rate (T=1-5) 18 8% Working Capital % Total Revenues (T=1-5 and beyond) 7.00 EV/EBITDA Multiple (T=5) 19 20 25% Income Tax Rate 21 15% Discount Rate 22 2% U.S. inflation rates (T=1-5) 23 24 25 26 D (20 points) A U.S.-based, digital advertising firm is considering a new venture in Brno, Czech Republic to serve as its 2 European hub. The project requires capex of digital equipment from the U.S. (in USD) to be depreciated for 10 years, operating costs in Czech koruna (CZK), and revenues in euro (EUR). Compute the NPV and IRR of the investment using 5- years of FCFFS and an EV/EBITDA multiple in 5 years. Compute FCFF for 5 years and include a EV/EBITDA terminal value. Working capital will be required in one year (T=1) and will not be liquidated since this is an on-going concern. Convert all costs and revenues into USD using the purchasing power parity model which uses inflation forecasts. There is no repatriation 6. tax. USD NPV USD IRR 10 $1,000,000 CAPEX, USD (T=0) 10.00 Depr. Life (years) 25,000,000 Operating expenses, CZK currency (T=1-5), constant all years 23.00 USDCZK expected exchange rate (T=1 only), then rate reflects Purchasing Power Parity (PPP) model 3.00% CZK inflation rate (T=1-5) 11 12 13 14 15 1,100,000 Operating revenues, EUR currency (T=1-5), constant all years $1.10 EURUSD expected exchange rate (T=1 only), then rate reflects Purchasing Power Parity (PPP) model 16 17 1.00% EUR inflation rate (T=1-5) 18 8% Working Capital % Total Revenues (T=1-5 and beyond) 7.00 EV/EBITDA Multiple (T=5) 19 20 25% Income Tax Rate 21 15% Discount Rate 22 2% U.S. inflation rates (T=1-5) 23 24 25 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts