Question: D 3 5 000 8 9 H 1 Excel Problem 2 Show All Excel Work (32 points) 2 Chesapeake Shipyards is considering replacing an sbc-year-old

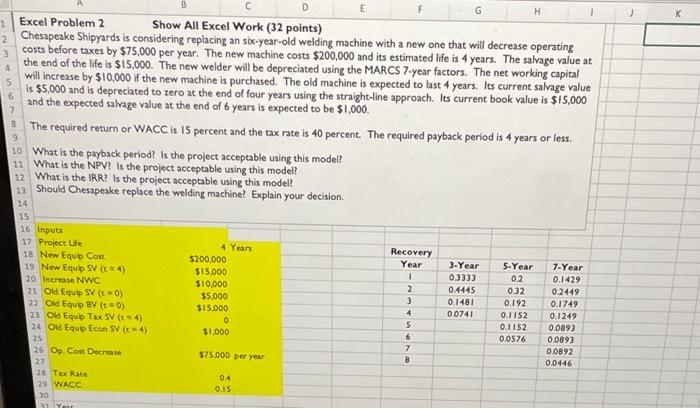

D 3 5 000 8 9 H 1 Excel Problem 2 Show All Excel Work (32 points) 2 Chesapeake Shipyards is considering replacing an sbc-year-old welding machine with a new one that will decrease operating costs before taxes by $75,000 per year. The new machine costs $200,000 and its estimated life is 4 years. The salvage value at the end of the life is $15.000. The new welder will be depreciated using the MARCS 7-year factors. The net working capital will increase by $10,000 if the new machine is purchased. The old machine is expected to last 4 years. Its current salvage value is $5.000 and is deprecated to zero at the end of four years using the straight-line approach. Its current book value is $15,000 and the expected salvage value at the end of 6 years is expected to be $1,000 The required return or WACC is 15 percent and the tax rate is 40 percent. The required payback period is 4 years or less. 10 What is the payback period? Is the project acceptable using this model? 11 What is the NPV? Is the project acceptable using this model? 12 What is the IRR? Is the project acceptable using this model? 13 Should Chesapeake replace the welding machine? Explain your decision 14 15 16 Inputs 17 Projecte 4 Years 18 New Equip Cost $200,000 19 New Equio SV (t = 4) $15.000 20 Increase NWC $10,000 21 Old Equip SV (t = 0) $5,000 22 Old Equip BV (0) $15.000 23 Old Equip Tax SV (t = 1) 0 24 Old Equip Econ SV (= 4) 31.000 25 26 Op Cost Decrease $75.000 per year 27 28 Tax Rate 29 WACC 30 Recovery Year 1 2 3 4 5 6 7 8 3-Year 0.3333 0.4445 0.1481 0.0741 5-Year 0.2 0.32 0.192 0.1152 0.1152 0.0576 7-Year 0.1429 0.2449 0.1749 0.1249 0.0893 0.089) 0.0892 0.0446 04 0.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts