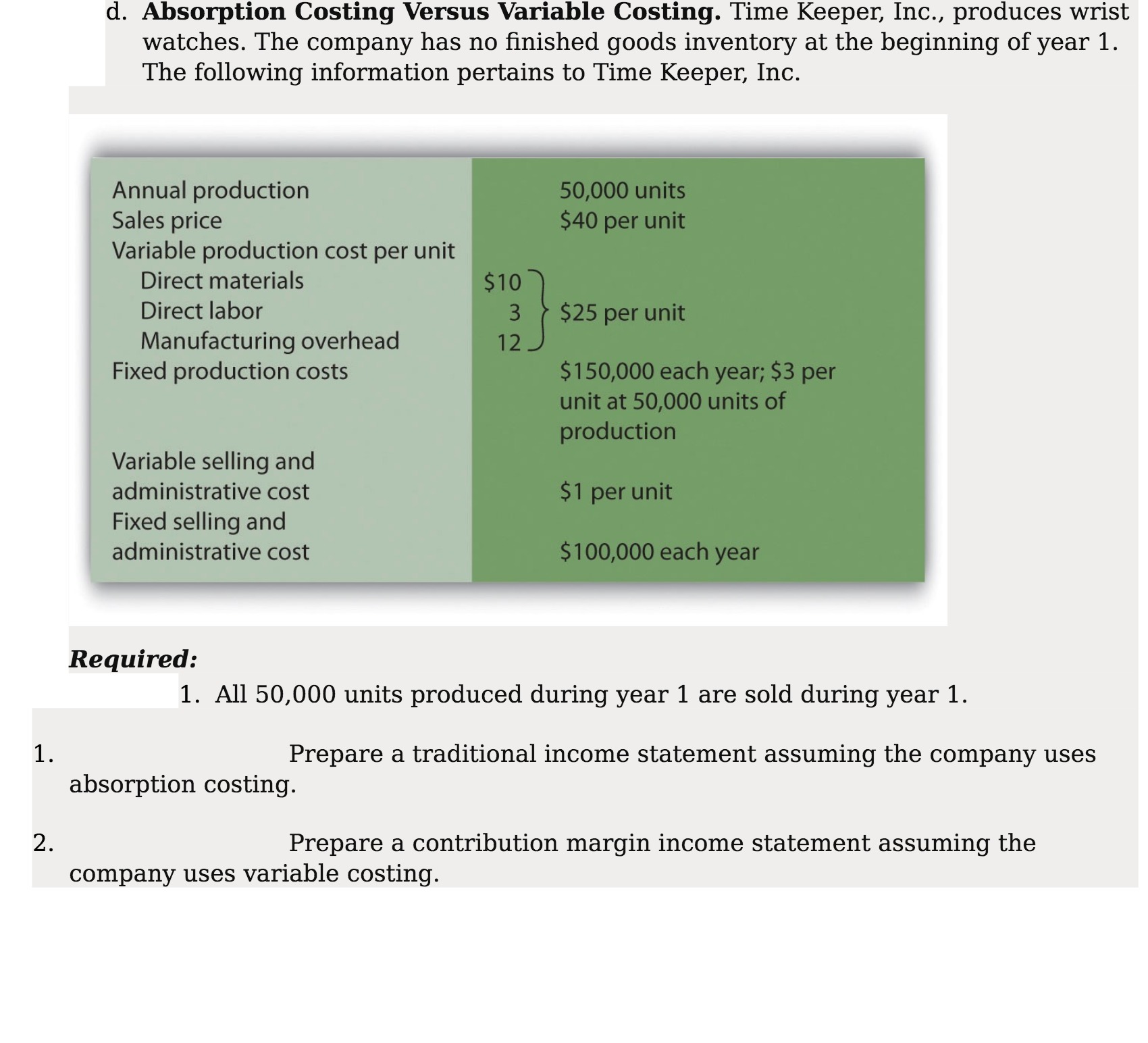

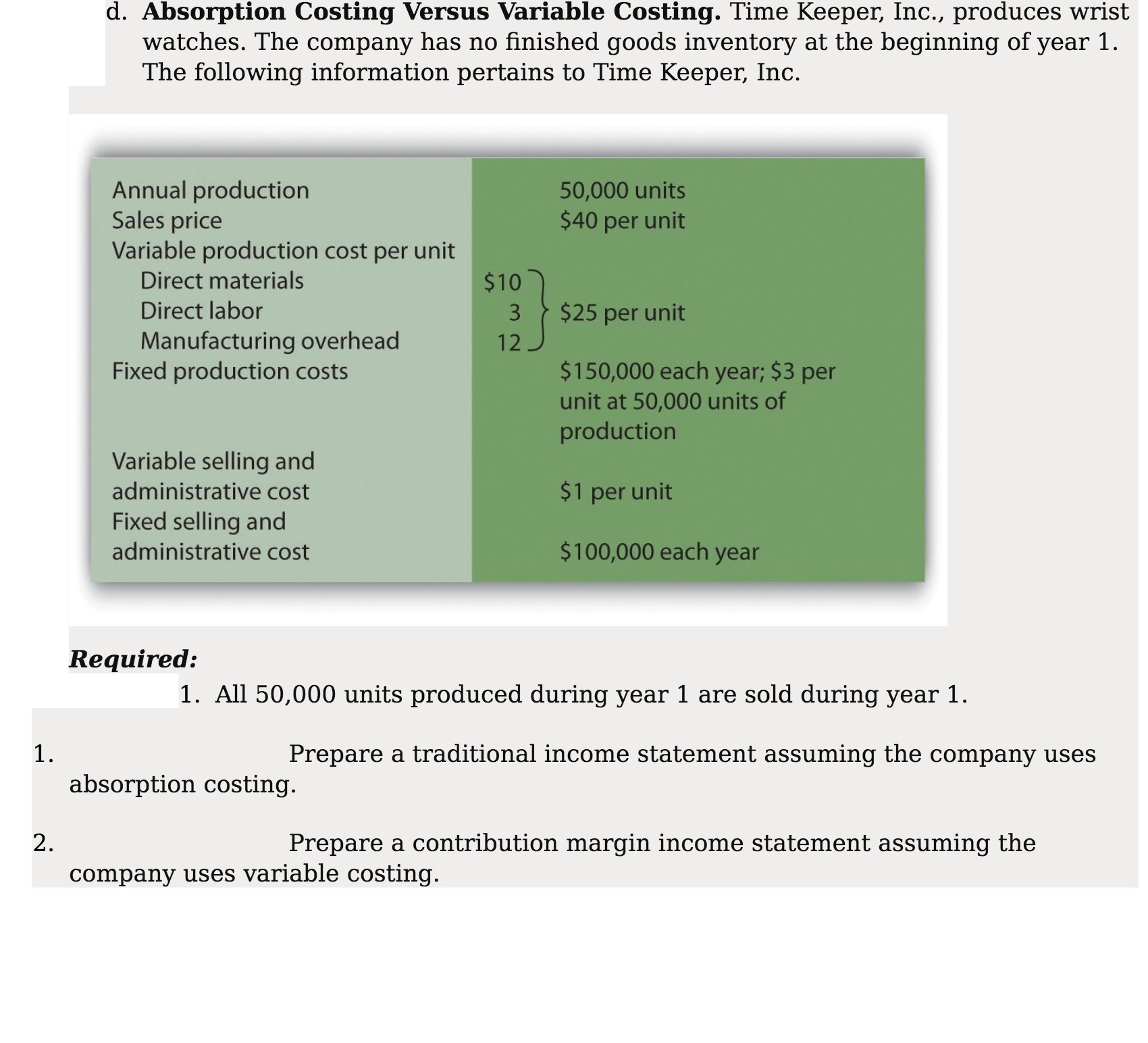

Question: d. Absorption Costing Versus Variable Costing. Time Keeper, Inc., produces wrist watches. The company has no finished goods inventory at the beginning of year 1.

d. Absorption Costing Versus Variable Costing. Time Keeper, Inc., produces wrist watches. The company has no finished goods inventory at the beginning of year 1. The following information pertains to Time Keeper, Inc. Annual production 50,000 units Sales price $40 per unit Variable production cost per unit Direct materials $10 ) Direct labor 13 $25 per unit Manufacturing overhead 12 Fixed production costs $150,000 each year; $3 per unit at 50,000 units of production Variable selling and administrative cost $1 per unit Fixed selling and administrative cost $100,000 each year Required: 1. All 50,000 units produced during year 1 are sold during year 1. 1. Prepare a traditional income statement assuming the company uses absorption costing. 2. Prepare a contribution margin income statement assuming the company uses variable costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts