Question: D and E please! 3. Case 3: During a recent period, the fast-food chain Wendy's International purchased many treasury shares. This caused the number of

D and E please!

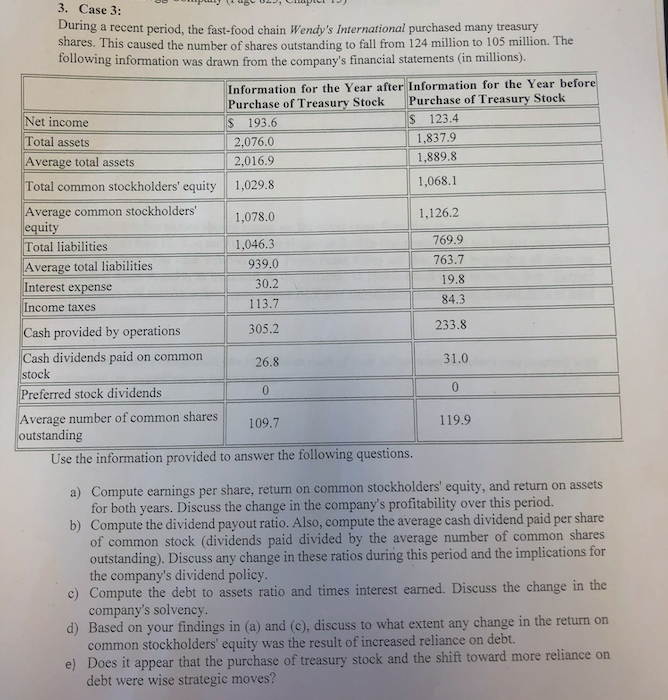

3. Case 3: During a recent period, the fast-food chain Wendy's International purchased many treasury shares. This caused the number of shares outstanding to fall from 124 million to 105 million. The following information was drawn from the company's financial statements (in millions). Information for the Year after Information for the Year Purchase of Treasury Stock Purchase of Treasury Stock S 193.6 S 123.4 et income Total assets Average total assets 1,837.9 1,889.8 1,068.1 2,076.0 2,016.9 Total common stockholders' equity 1,029.8 1,078.0 1,046.3 Average common stockholders equity Total liabilities Average total liabilities Interest expense Income taxes 1,126.2 939.0 30.2 113.7 305.2 769.9 763.7 19.8 84.3 233.8 Cash provided by operations Cash dividends paid on common stock 31.0 26.8 Preferred stock dividends Average number of common shares outstanding 109.7 119.9 Use the information provided to answer the following questions Compute earnings per share, return on common stockholders' equity, and return on assets for both years. Discuss the change in the company's profitability over this period Compute the dividend payout ratio. Also, compute the average cash dividend paid per share of common stock (dividends paid divided by the average number of common shares outstanding). Discuss any change in these ratios during this period and the implications for the company's dividend policy a) b) ) Compute the debt to assets ratio and times interest earned. Discuss the change in the d) Based on your findings in (a) and (e), discuss to what extent any change in the return on e) Does it appear that the purchase of treasury stock and the shift toward more reliance on company's solvency common stockholders' equity was the result of increased reliance on debt. debt were wise strategic moves

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts