Question: d. Assume instead that Smith has the option to require Miller to buy back the equipment after one year for $58,850 (an amount greater than

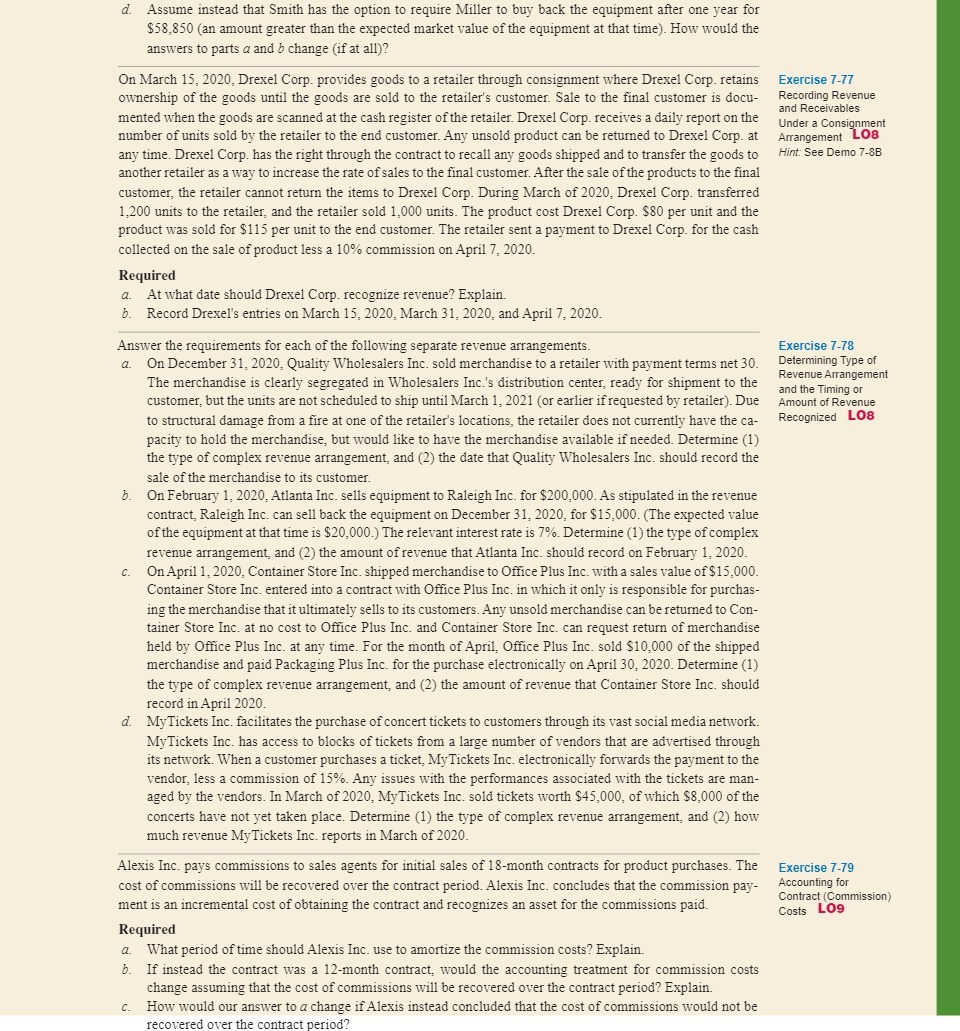

d. Assume instead that Smith has the option to require Miller to buy back the equipment after one year for $58,850 (an amount greater than the expected market value of the equipment at that time). How would the answers to parts a and b change (if at all)? On March 15, 2020, Drexel Corp. provides goods to a retailer through consignment where Drexel Corp. retains Exercise 7-77 ownership of the goods until the goods are sold to the retailer's customer. Sale to the final customer is docu- Recording Revenue mented when the goods are scanned at the cash register of the retailer. Drexel Corp. receives a daily report on the and Receivable Under a Consignment number of units sold by the retailer to the end customer. Any unsold product can be returned to Drexel Corp. at Arrangement LO8 any time. Drexel Corp. has the right through the contract to recall any goods shipped and to transfer the goods to Hint: See Demo 7-8B another retailer as a way to increase the rate of sales to the final customer. After the sale of the products to the final customer, the retailer cannot return the items to Drexel Corp. During March of 2020, Drexel Corp. transferred 1,200 units to the retailer, and the retailer sold 1,000 units. The product cost Drexel Corp. $80 per unit and the product was sold for $113 per unit to the end customer. The retailer sent a payment to Drexel Corp. for the cash collected on the sale of product less a 10% commission on April 7, 2020. Required a. At what date should Drexel Corp. recognize revenue? Explain. b. Record Drexel's entries on March 15, 2020, March 31, 2020, and April 7, 2020. Answer the requirements for each of the following separate revenue arrangements Exercise 7-78 a. On December 31, 2020, Quality Wholesalers Inc. sold merchandise to a retailer with payment terms net 30. Determining Type of The merchandise is clearly segregated in Wholesalers Inc.'s distribution center, ready for shipment to the Revenue Arrangement and the Timing or customer, but the units are not scheduled to ship until March 1, 2021 (or earlier if requested by retailer). Due Amount of Revenue to structural damage from a fire at one of the retailer's locations, the retailer does not currently have the ca- Recognized LO8 pacity to hold the merchandise, but would like to have the merchandise available if needed. Determine (1) the type of complex revenue arrangement, and (2) the date that Quality Wholesalers Inc. should record the sale of the merchandise to its customer. b. On February 1, 2020, Atlanta Inc. sells equipment to Raleigh Inc. for $200,000. As stipulated in the revenue contract, Raleigh Inc. can sell back the equipment on December 31, 2020, for $15,000. (The expected value of the equipment at that time is $20,000.) The relevant interest rate is 7%. Determine (1) the type of complex revenue arrangement, and (2) the amount of revenue that Atlanta Inc. should record on February 1, 2020. C. On April 1, 2020, Container Store Inc. shipped merchandise to Office Plus Inc. with a sales value of $15,000. Container Store Inc. entered into a contract with Office Plus Inc. in which it only is responsible for purchas- ing the merchandise that it ultimately sells to its customers. Any unsold merchandise can be returned to Con- tainer Store Inc. at no cost to Office Plus Inc. and Container Store Inc. can request return of merchandise held by Office Plus Inc. at any time. For the month of April, Office Plus Inc. sold $10,000 of the shipped merchandise and paid Packaging Plus Inc. for the purchase electronically on April 30, 2020. Determine (1) the type of complex revenue arrangement, and (2) the amount of revenue that Container Store Inc. should record in April 2020. d. My Tickets Inc. facilitates the purchase of concert tickets to customers through its vast social media network MyTickets Inc. has access to blocks of tickets from a large number of vendors that are advertised through its network. When a customer purchases a ticket, My Tickets Inc. electronically forwards the payment to the vendor, less a commission of 15%. Any issues with the performances associated with the tickets are man- aged by the vendors. In March of 2020, MyTickets Inc. sold tickets worth $45,000, of which $8,000 of the concerts have not yet taken place. Determine (1) the type of complex revenue arrangement, and (2) how much revenue My Tickets Inc. reports in March of 2020. Alexis Inc. pays commissions to sales agents for initial sales of 18-month contracts for product purchases. The Exercise 7-79 cost of commissions will be recovered over the contract period. Alexis Inc. concludes that the commission pay- Accounting for ment is an incremental cost of obtaining the contract and recognizes an asset for the commissions paid. Contract (Commission) Costs LO9 Required a. What period of time should Alexis Inc. use to amortize the commission costs? Explain. b. If instead the contract was a 12-month contract, would the accounting treatment for commission costs change assuming that the cost of commissions will be recovered over the contract period? Explain. C. How would our answer to a change if Alexis instead concluded that the cost of commissions would not be overed over the contract period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts