Question: D) calculate the projects NPV, BCR and , IRR E) Based on your analysis, very briefly explain whether this project should be pursued and why?

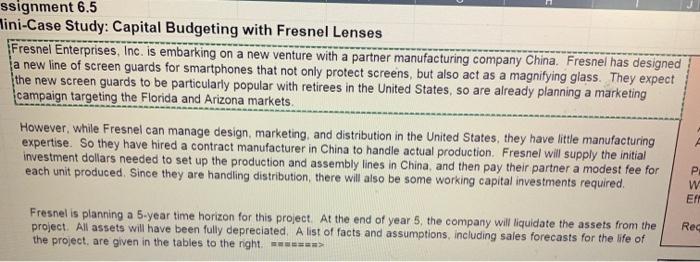

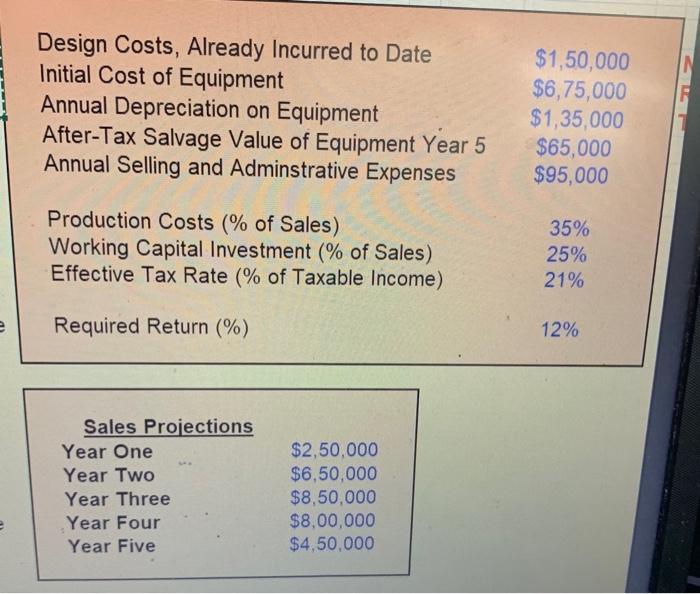

d) Caiculate the project's NPV, BCR, and IRR e) Based on your analysis very briefly explain whether this project should be pursued and why Create your Oripinal Solution Below - Be sure to show all calculations, to carefully complete all parts of the assignment, and to ch ni-Case Study: Capital Budgeting with Fresnel Lenses Fresnel Enterprises, Inc. is embarking on a new venture with a partner manufacturing company China. Fresnel has designed a new line of screen guards for smartphones that not only protect screens, but also act as a magnifying glass. They expect the new screen guards to be particularly popular with retirees in the United States, so are already planning a marketing campaign targeting the Florida and Arizona markets. However, while Fresnel can manage design, marketing, and distribution in the United States, they have little manufacturing expertise. So they have hired a contract manufacturer in China to handle actual production. Fresnel will supply the initial investment dollars needed to set up the production and assembly lines in China, and then pay their partner a modest fee for each unit produced. Since they are handling distribution, there will also be some working capital investments required. Fresnel is planning a 5-year time horizon for this project. At the end of year 5 , the company will liquidate the assets from the project. All assets will have been fully depreciated. A list of facts and assumptions, including sales forecasts for the life of the project. are given in the tables to the right. \\( m=m=m=m \\) ? Design Costs, Already Incurred to Date Initial Cost of Equipment Annual Depreciation on Equipment After-Tax Salvage Value of Equipment Year 5 Annual Selling and Adminstrative Expenses Production Costs (\\% of Sales) Working Capital Investment (\\% of Sales) Effective Tax Rate (\\% of Taxable Income) \\( \\$ 1,50,000 \\) \\( \\$ 6,75,000 \\) \\( \\$ 1,35,000 \\) \\( \\$ 65,000 \\) \\( \\$ 95,000 \\) Required Return (\\%) \35 \25 \21 \12 Sales Projections Year One Year Two Year Three Year Four Year Five \\( \\$ 2,50,000 \\) \\( \\$ 6,50,000 \\) \\( \\$ 8,50,000 \\) \\( \\$ 8,00,000 \\) \\( \\$ 4,50,000 \\)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts